Costco 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hedge the impact of fluctuations of foreign exchange on inventory purchases and typically have very

short terms. The aggregate notional amount, which approximates the fair value of foreign exchange

contracts outstanding at September 3, 2006 and August 28, 2005, was $63 million and $42 million,

respectively. The majority of the forward foreign exchange contracts were entered into by our wholly-

owned United Kingdom subsidiary, primarily to hedge U.S. dollar merchandise inventory purchases.

We also hold interest rate swaps to manage the interest rate risk associated with our borrowings and the

mix of fixed-rate and variable-rate debt. As of September 3, 2006 and August 28, 2005, we had

“fixed-to-floating” interest rate swaps with an aggregate notional amount of $300 million and an aggregate

fair value of $1 million and $8 million, respectively. These amounts were recorded in deferred income

taxes and other current assets as of September 3, 2006 and in other assets as of August 28, 2005, in our

consolidated balance sheets. These swaps were entered into effective March 25, 2002, and are

designated and qualify as fair value hedges of our $300 million 5

1

⁄

2

% Senior Notes. As the terms of the

swaps match those of the underlying hedged debt, the changes in the fair value of these swaps are offset

by corresponding changes in the carrying amount of the hedged debt and result in no net earnings impact.

We are exposed to market risk for changes in utility commodity pricing, which we partially mitigate

through the use of firm-price contracts with counterparties for approximately 19% of our locations in the

U.S. and Canada. The effects of these arrangements are not significant for any period presented.

Off-Balance Sheet Arrangements

With the exception of our operating leases, we have no off-balance sheet arrangements that have had,

or are reasonably likely to have, a material current or future effect on our financial condition or

consolidated financial statements.

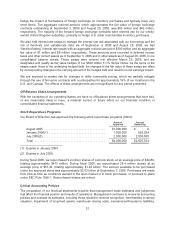

Stock Repurchase Programs

Our Board of Directors has approved the following stock repurchase programs (000’s):

Amount

Approved Amount

Remaining

August 2005 ....................................... $1,000,000 $ 0

January 2006(1) .................................... 1,000,000 625,534

July 2006(2) ....................................... 2,000,000 2,000,000

Total .............................................. $4,000,000 $2,625,534

(1) Expires in January 2009.

(2) Expires in July 2009.

During fiscal 2005, we repurchased 9.2 million shares of common stock, at an average price of $44.89,

totaling approximately $413 million. During fiscal 2006, we repurchased 28.4 million shares at an

average price of $51.44, totaling approximately $1.46 billion. The amount available to be purchased

under the approved plans was approximately $2.63 billion at September 3, 2006. Purchases are made

from time-to-time as conditions warrant in the open market or in block purchases, or pursuant to plans

under SEC Rule 10b5-1. Repurchased shares are retired.

Critical Accounting Policies

The preparation of our financial statements requires that management make estimates and judgments

that affect the financial position and results of operations. Management continues to review its accounting

policies and evaluate its estimates, including those related to revenue recognition, merchandise inventory

valuation, impairment of long-lived assets, warehouse closing costs, insurance/self-insurance liabilities,

31