Costco 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 14, 2006

Dear Costco Shareholders,

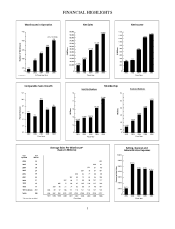

Fiscal 2006 was an outstanding year for our Company. Our sales during this 53-week fiscal year

increased 13.7% over the prior fiscal year to nearly $59 billion, driven by an increase in comparable

warehouse sales of 8% and the opening of 28 new warehouses (including 3 relocations). More

importantly, earnings increased to a record $1.1 billion or $2.30 per share. These results came on top

of a record year of sales and earnings in fiscal 2005.

Our members responded to our efforts and their satisfaction with Costco continued to improve. Key

measures of this success, in addition to our strong comparable sales increase, are reflected in our high

membership renewal rate of nearly 87%, our strong increase in new individual (Gold Star) and

Business member sign-ups, a large increase in member upgrades to our Executive Membership, and

our continuing top ranking in independent customer satisfaction surveys.

Key elements to our success continue to be high sales volumes per warehouse, leveraging our

efficient operating structure and making us the low cost operator in retail today. Costco sales volumes

per warehouse continue to lead the industry and are two to three times those of our nearest club

competitors. For the second time, one of our warehouses topped $300 million in sales in fiscal 2006. In

addition, forty-two of our locations had sales of more than $200 million, compared with only 25

warehouses in fiscal 2005, and several others are not far behind. Our average sales per warehouse

increased to $127 million. This top line sales success moved us from the ninth largest retailer in the

world to the seventh largest in 2006.

Our continued emphasis on cost controls and expense reduction was effective in 2006, although we

know there is still much work to do here. Our selling, general and administrative (SG&A) expenses as a

percent of sales declined from 9.76% in 2005 to 9.72% in 2006; and our shrink results continued to

improve and were the lowest in the Company’s history at less than .20% of net sales.

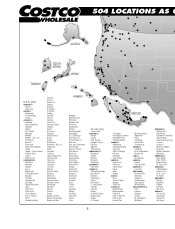

Our Company reached several important milestones in fiscal 2006 and the first quarter of fiscal 2007.

In July we celebrated the 30th anniversary of the opening of our first warehouse in 1976 in San Diego,

California, which marked the beginning of the warehouse club industry, now a retail segment

exceeding $100 billion annually. With the opening of our La Quinta, California warehouse just before

Thanksgiving this year, we reached 500 warehouses in operation; and with four more openings just

after Thanksgiving we now have 504 warehouses in operation around the world. In addition to being

named one of the most-admired companies in the U.S. by Fortune magazine, this year we also were

honored by our peers in being twice named Retailer of the Year—by both DSN Retailing Today and

Mass Market Retailers. We also received the J.D. Power Award from National Vision Retailers for

having the highest overall optical department customer satisfaction in the U.S.

With our strong bottom line performance and rapid inventory turnover we generated over $1.8 billion in

cash flow in fiscal 2006. With these funds, and our beginning-of-year cash balance of over $2 billion,

we were able to make some prudent expenditures in fiscal 2006: we paid out over $1.2 billion in capital

expenditures, primarily for new warehouse and depot construction; we retired $300 million in long-term

debt; we spent $1.5 billion to buy back 28.4 million shares of our stock; and we paid out more than

$230 million in dividends to our shareholders, increasing our dividend by 13% from $.115 to $.13 per

quarter.

This past year we began to implement more aggressive expansion plans, targeting both new and

existing markets in the United States and internationally. After opening sixteen new warehouses and

relocating five in fiscal 2005, we opened twenty-eight units in 2006, three of which were relocations to

larger and better-located facilities. We have found that our stronger markets can support increasing

numbers of our warehouses in closer proximity to each other. This infill strategy has been successful

and drives our market share and increases our sales volumes in these communities.

2