Costco 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YEAR ENDED SEPTEMBER 3, 2006

Annual

Report

2006

2006

Annual

Report

2006

Table of contents

-

Page 1

Annual Report 2006 2006 YEAR ENDED SEPTEMBER 3, 2006 -

Page 2

...Letter to Shareholders ...Map of Warehouse Locations ...Business Overview ...Risk Factors ...Properties: Warehouse, Administration and Distribution Properties ...Market for Costco Common Stock, Dividend Policy and Stock Repurchase Program ...Five Year Operating and Financial Highlights ...Management... -

Page 3

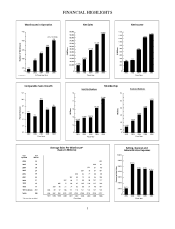

... 2005 2006 0 2002 2003 2004 Fiscal Year 2005 2006 2002 2003 2004 Fiscal Year 2005 2006 Excludes Mexico At Fiscal Year End Comparable Sales Growth Gold Star Members 12% 18 Membership Business Members 5.4 17.338 17 8% 5.2 5.214 10% 10% Percent Increase 8% 7% 6% 6% 5% 4% 16.233 Millions 16... -

Page 4

... (Gold Star) and Business member sign-ups, a large increase in member upgrades to our Executive Membership, and our continuing top ranking in independent customer satisfaction surveys. Key elements to our success continue to be high sales volumes per warehouse, leveraging our efficient operating... -

Page 5

...of the great benefits and services offered by our Executive Membership, at $100 a year, and enjoy the 2% reward (up to $500) they receive each year on their qualified purchases. We raised our membership fees for our Gold Star and Business Memberships by $5 in April (for member renewals in July). The... -

Page 6

... own computers. This year we expanded the online sporting goods and housewares categories and added a new business products program, as well as the ability to purchase "build-to-order" diamond rings. In its second year of operation in our important Canadian market, costco.ca had significant sales... -

Page 7

...Manager of Canada. We have assembled an outstanding team of warehouse managers, each of whom is directed to make their highest priority the training and developing of new managers and leaders for the Company as we prepare for expanded growth. It is very important to us that all of Costco's employees... -

Page 8

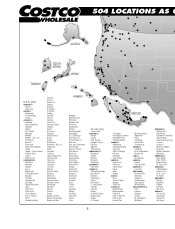

... - Costco Home Thomas Road Tucson N.W. Tucson CALIFORNIA (107...City Richmond Rohnert Park Roseville Sacramento Salinas San Bernardino San Diego S.E. San Diego San Francisco S. San Francisco San Jose San Juan Capistrano San Leandro San Luis Obispo San Marcos Sand City... Perimeter Town Center HAWAII (6) ... -

Page 9

... Salt Lake City Sandy Aurora Village Bellingham Burlington Clarkston Everett Federal Way Fife - Bus. Ctr. Issaquah Kennewick Kirkland Kirkland - Costco Home Lacey Lynnwood - Bus. Ctr. Ajax Ancaster Barrie Brampton Burlington Downsview Etobicoke Gloucester Kanata Kingston Kitchener London North... -

Page 10

... with new warehouse openings, our marketing teams personally contact businesses in the area that are potential wholesale members. These contacts are supported by direct mailings during the period immediately prior to opening. Potential Gold Star (individual) members are contacted by direct mail or... -

Page 11

... table indicates the number of ancillary businesses: 2006 2005 2004 Food Court and Hot Dog Stands ...One-Hour Photo Centers ...Optical Dispensing Centers ...Pharmacies ...Gas Stations ...Hearing Aid Centers ...Print Shops and Copy Centers ...Number of warehouses ... 452 450 442 401 250 196 9 458... -

Page 12

... Policy Our membership format is designed to reinforce customer loyalty and provide a continuing source of membership fee revenue, which allows us to offer low prices. Members can utilize their memberships at any Costco warehouse location. We have two primary types of members: Business, and Gold... -

Page 13

... and home insurance, long-distance telephone service, check printing, and real estate and mortgage services. The services offered are generally provided by third-party providers and vary by state. In addition, Executive members may qualify for a 2% reward (which can be redeemed at Costco warehouses... -

Page 14

... upon the time of day. This is simply one part of the energy management system that operates in every warehouse, allowing us to better measure and control our energy usage. We also constantly review new lighting technologies for fixtures that give us greater illumination at lower cost. The exteriors... -

Page 15

... and insurance provided by four transit agencies), and offer employees subsidies to vanpool. We also subsidize employees who purchase monthly bus passes. Available Information We maintain an internet website at www.costco.com. We make available on our website, free of charge, our Annual Reports on... -

Page 16

... existing markets and enter new markets. Our opening of new warehouses, domestically and internationally, will depend on our ability to: identify and secure suitable locations; negotiate leases or real estate purchase agreements on acceptable terms; attract and train qualified employees; and manage... -

Page 17

... trends in operating expenses, including increased labor costs; cannibalizing existing locations with new warehouses; shifts in sales mix toward lower gross margin products; changes or uncertainties in economic conditions in our markets; and failing consistently to provide high quality products... -

Page 18

... stock reflects high market expectations for our future operating results. Any failure to meet these expectations for our comparable warehouse sales growth rates, earnings per share and new warehouse openings could cause the market price of our stock to drop. Cost related to natural disasters could... -

Page 19

... intended to provide absolute assurance that a misstatement of our financial statements would be prevented or detected. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect... -

Page 20

... Mexico. Administration and Distribution Properties Our executive offices are located in Issaquah, Washington and occupy approximately 395,000 square feet. We operated eight regional offices in the United States, two regional offices in Canada and four regional offices internationally at the end... -

Page 21

... years) and $2 billion authorized in July 2006 (expires after 3 years). Amounts remaining for repurchase relate to both authorizations. Equity Compensation Plans Information related to our equity compensation plans is incorporated herein by reference to the Proxy Statement filed with the Securities... -

Page 22

...sales: United States ...International ...Total ...BALANCE SHEET DATA Working capital ...Net property and equipment ...Total assets ...Short-term borrowings ...Long-term debt ...Stockholders' equity ...WAREHOUSE INFORMATION Warehouses in Operation(2) Beginning of year ...Opened(3) ...Closed(3) ...End... -

Page 23

... new member sign-ups at new warehouses opened during the fiscal year, increased penetration of the Executive Membership program, and continued strong member renewal rates; We increased annual membership fees by $5 for our U.S. and Canada Gold Star (individual), Business, and Business Add-on Members... -

Page 24

...at the 25 new warehouses opened in fiscal 2006, increased penetration of the Executive Membership program, and high overall member renewal rates consistent with recent years, currently 86.5%. In April 2006, we announced plans to increase annual membership fees by $5 for our U.S. and Canada Gold Star... -

Page 25

sign-ups at the 16 new warehouses opened in fiscal 2005, increased penetration of our Executive Membership program and a high overall member renewal rate of 86%. Gross Margin Fiscal 2006 Fiscal 2005 Fiscal 2004 Gross margin ...Gross margin increase ...Gross margin as a percent of net sales ...2006 ... -

Page 26

...and central operating costs positively impacted SG&A comparisons yearover-year by approximately ten basis points, primarily due to improved payroll utilization at the warehouse level, including increased leverage from increased comparable sales and cost control measures employed in employee benefits... -

Page 27

... includes costs related to impairment of long-lived assets, future lease obligations of warehouses that have been relocated to new facilities, and losses or gains resulting from the sale of real property. The provision for fiscal 2006 included charges of $3.8 million for warehouse closing expenses... -

Page 28

...from the settlement of a transfer pricing dispute between the United States and Canada (covering the years 1996-2003) and a net tax benefit on excess foreign tax credits on unremitted foreign earnings of $20.6 million. Excluding these benefits the effective income tax rate on earnings in fiscal 2005... -

Page 29

... to weekend sales immediately prior to the year-end close. The decrease in our most liquid assets of $627 million to $2.83 billion at September 3, 2006 was due primarily to the repurchase of our common stock, the acquisition of property and equipment related to warehouse expansion and the payment of... -

Page 30

...16 billion, offset by an increase of $217 million in additions to property and equipment related to warehouse expansion and remodel projects. The decrease in the net investment in short-term investments was due primarily to our stock repurchase activity. Net cash used in financing activities totaled... -

Page 31

... cash and cash equivalents and short-term investments. Plans for the United States and Canada during fiscal 2007 are to open approximately 33 to 35 new warehouses on a net basis, inclusive of one to two relocations. We expect to continue our review of expansion plans in our international operations... -

Page 32

... stock. The current Notes outstanding are convertible into a maximum of 2,925,057 shares of Costco common stock at an initial conversion price of $22.71. Derivatives We have limited involvement with derivative financial instruments and use them only to manage welldefined interest rate and foreign... -

Page 33

... 3, 2006. Purchases are made from time-to-time as conditions warrant in the open market or in block purchases, or pursuant to plans under SEC Rule 10b5-1. Repurchased shares are retired. Critical Accounting Policies The preparation of our financial statements requires that management make estimates... -

Page 34

..., whereby membership fee revenue is recognized ratably over one year. Our Executive members qualify for a 2% reward (which can be redeemed only at Costco warehouses), up to a maximum of $500 per year, on all qualified purchases made at Costco. We account for this 2% reward as a reduction in sales... -

Page 35

... a wholly-owned captive insurance entity and participation in a reinsurance pool, to provide for potential liabilities for workers' compensation, general liability, property damage, director and officers' liability, vehicle liability and employee health care benefits. Liabilities associated with the... -

Page 36

... our members, which under common trade practices are referred to as sales taxes, are and have been recorded on a net basis. We have no intention of modifying this accounting policy. Therefore, the adoption of EITF 06-03 will not have any effect on our financial position or results of operations. In... -

Page 37

... Secretary, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, WA 98027. Costco's Form 10-K for its fiscal year ended September 3, 2006, as filed with the Securities and Exchange Commission, includes the certifications of Costco's Chief Executive Officer and Chief Financial Officer required by... -

Page 38

...financial statements present our financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States. Disclosure Controls and Procedures Our management, including the Chief Executive Officer (principal executive officer) and Chief... -

Page 39

... when Quantifying Misstatements in the Current Year Financial Statements." We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Company's internal control over financial reporting as of September 3, 2006... -

Page 40

...the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of September 3, 2006 and August 28, 2005, and the related consolidated statements of income, stockholders' equity and comprehensive income, and cash flows for the 53 weeks ended September... -

Page 41

COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (dollars in thousands, except par value) September 3, 2006 August 28, 2005 ASSETS CURRENT ASSETS Cash and cash equivalents ...Short-term investments ...Receivables, net ...Merchandise inventories ...Deferred income taxes and other current ... -

Page 42

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share data) 53 weeks ended September 3, 2006 52 weeks ended August 28, 2005 52 weeks ended August 29, 2004 REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ... -

Page 43

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME (in thousands) Common Stock Shares Amount Additional Paid-In Capital...income tax benefits and other ...Conversion of convertible notes ...Stock repurchase ...Stock-based compensation ...Cash dividends... -

Page 44

... short-term borrowings, net ...Net proceeds from issuance of long-term debt ...Repayments of long-term debt ...Change in bank checks outstanding ...Cash dividend payments ...Change in minority interests ...Excess tax benefit from exercise of stock options ...Exercise of stock options ...Repurchases... -

Page 45

... financial statements include the accounts of Costco Wholesale Corporation, a Washington corporation, and its subsidiaries ("Costco" or the "Company"). All material inter-company transactions between the Company and its subsidiaries have been eliminated in consolidation. Costco operates membership... -

Page 46

... of three months to five years at the date of purchase. Investments with maturities beyond five years may be classified as short-term based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for current operations. Short-term... -

Page 47

... Company reviews previously reported goodwill for impairment on an annual basis, or more frequently if circumstances dictate. No impairment of goodwill has been incurred to date. Accounts Payable The Company's banking system provides for the daily replenishment of major bank accounts as checks are... -

Page 48

...a reinsurance pool, to provide for potential liabilities for workers' compensation, general liability, property damage, director and officers' liability, vehicle liability and employee health care benefits. Liabilities associated with the risks that are retained by the Company are not discounted and... -

Page 49

...'s Executive members qualify for a 2% reward (which can be redeemed at Costco warehouses), up to a maximum of $500 per year, on all qualified purchases made at Costco. The Company accounts for this 2% reward as a reduction in sales, with the related liability being classified within other current... -

Page 50

... as other operating costs incurred to support warehouse operations. Marketing and Promotional Expenses Costco's policy is generally to limit marketing and promotional expenses to new warehouse openings, occasional direct mail marketing to prospective new members and direct mail marketing programs to... -

Page 51

... than operating cash inflows. This amount is shown as excess tax benefit from exercise of stock options on the consolidated statements of cash flows. The following table presents the impact of the Company's adoption of SFAS 123R on selected line items from its consolidated financial statements for... -

Page 52

... value of the Company's financial instruments, including cash and cash equivalents, receivables and accounts payable approximate fair value due to their short-term nature or variable interest rates. Short-term investments classified as available-for-sale are recorded at market value with unrealized... -

Page 53

... units and convertible notes. Stock Repurchase Programs Share repurchases are not displayed separately as treasury stock on the consolidated balance sheets or consolidated statements of stockholders' equity in accordance with the Washington Business Corporation Act, which requires the retirement... -

Page 54

...consolidated financial statements. Note 2-Short-term Investments Short-term investments, which consist entirely of debt securities, at September 3, 2006 and August 28, 2005, were as follows: Fiscal 2006 Cost Basis Unrealized Gains Unrealized Losses Recorded Basis Available-for-sale securities Money... -

Page 55

... held greater than or equal to twelve months as of September 3, 2006, pertain to 211 and 247 fixed income securities, respectively, and were primarily attributable to changes in interest rates. The Company currently has the financial ability to hold short-term investments with an unrealized loss... -

Page 56

...owned United Kingdom subsidiary has a $113,900 bank revolving credit facility expiring in February 2007, and a $66,500 bank overdraft facility renewable on a yearly basis in March 2007. At September 3, 2006, $38,000 was outstanding under the revolving credit facility with an applicable interest rate... -

Page 57

...Short-term Borrowings Maximum Amount Outstanding During the Fiscal Year Average Amount Outstanding During the Fiscal Year Weighted Average Interest Rate During the Fiscal Year Fiscal year ended September 3, 2006 Bank borrowings: Canadian ...United Kingdom ...Japan ...Bank overdraft facility: United... -

Page 58

... outstanding are convertible into a maximum of 2,925,057 shares of Costco Common Stock shares at an initial conversion price of $22.71. Holders of the Notes may require the Company to purchase the Notes (at the discounted issue price plus accrued interest to date of purchase) in August 2007, or 2012... -

Page 59

... in the consolidated Statements of Income. Note 5-Stockholders' Equity Dividends In fiscal 2006, the Company paid quarterly cash dividends totaling $0.49 per share. In fiscal 2005, the Company paid quarterly cash dividends totaling $0.43 per share. The Company's current quarterly dividend rate is... -

Page 60

... to share repurchase plans under SEC Rule 10b5-1. Repurchased shares are retired. Comprehensive Income Comprehensive income includes net income, plus certain other items that are recorded directly to stockholders' equity. Accumulated other comprehensive income reported on the Company's consolidated... -

Page 61

... stock units (RSUs) generally vest over five years with an equal amount vesting on each anniversary of the grant date, the Company's plans allow for daily vesting of the pro-rata number of shares that would vest on the next anniversary of the grant date in the event of retirement or voluntary... -

Page 62

... expected dividend yield is based on the annual dividend rate at the time of grant. The Company recorded stock-based compensation expense related to stock options of $102,473, $67,937 and $36,508 in fiscal 2006, 2005, and 2004, respectively. The related total tax benefit was $32,665, $22,539 and $12... -

Page 63

...$4,924 in fiscal 2006. The related total tax benefit was $1,623 in fiscal 2006. The remaining unrecognized compensation cost related to non-vested restricted stock units at September 3, 2006, was $67,000 and the weightedaverage period of time over which this cost will be recognized is 4.8 years. 61 -

Page 64

... an annual contribution based on salary and years of service. California union employees participate in a defined benefit plan sponsored by their union. The Company makes contributions based upon its union agreement. For all the California union employees, the Company sponsored 401(k) plan currently... -

Page 65

... tax benefit resulting from the settlement of a transfer pricing dispute between the United States and Canada (covering the years 1996-2003) and a net tax benefit on unremitted foreign earnings of $20,592. The Company recognized a tax benefit of $30,602, resulting from excess foreign tax credits... -

Page 66

... actions on behalf of certain present and former Costco managers in California, in which plaintiffs principally allege that they have not been properly compensated for overtime work. Scott M. Williams v. Costco Wholesale Corp., United States District Court (San Diego), Case No. 02-CV-2003 NAJ (JFS... -

Page 67

... employees in California, in which the plaintiff principally alleges that Costco did not properly compensate and record time worked by employees during the security searches and routine closing procedures. Elizabeth Alvarado v. Costco Wholesale Corp., United States District Court (San Francisco... -

Page 68

... others, the Company's warehouse managers and buyers. None of the options in which the review identified imprecision in the grant process were issued to the Company's chief executive officer, chairman, or non-employee directors, except in April 1997 both the chief executive officer and the chairman... -

Page 69

... Income tax reserve for excess compensation Deposit accounting Deferred taxes Total Deferred income taxes and other current assets ...Other current liabilities ...Deferred income taxes and other liabilities ...Additional paid-in-capital ...Retained earnings ...Total ...Note 12-Segment Reporting... -

Page 70

...the equity method and its operations are not consolidated in the Company's financial statements. United States Operations Canadian Operations Other International Operations Total Year Ended September 3, 2006 Total revenue ...Operating income ...Depreciation and amortization ...Capital expenditures... -

Page 71

... fiscal 2006 and 2005. 53 Weeks Ended September 3, 2006 First Quarter 12 Weeks Second Quarter 12 Weeks Third Quarter 12 Weeks Fourth Quarter 17 Weeks Total 53 Weeks REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ...Selling, general and administrative... -

Page 72

...) that did not require rental payments during the period of construction. (b) Includes a $52,064 income tax benefit resulting primarily from the settlement of a transfer pricing dispute between the United States and Canada (covering the years 1996-2003). An additional benefit of $2,091 was booked in... -

Page 73

..., COO - Global Operations, Distribution and Construction, Costco Daniel J. Evans Chairman, Daniel J. Evans Associates; Former U.S. Senator and Governor of the State of Washington Richard A. Galanti Executive Vice President and Chief Financial Officer, Costco William H. Gates Co-Chair of the Bill and... -

Page 74

...Western Canada Region Gary Ojendyk GMM - Corporate Non-Foods Richard J. Olin Legal, General Counsel Mario Omoss Operations - Texas Region Steve Pappas Country Manager - United Kingdom Shawn Parks Operations - Los Angeles Region Mike Parrott Corporate Purchasing, Business Centers and Costco Home Mike... -

Page 75

...shareholder upon written request directed to Investor Relations, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, Washington 98027. Internet users can access recent sales and earnings releases, the annual report and SEC filings, as well as our Costco Online web site, at www.costco.com. E-mail... -

Page 76