Cemex 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

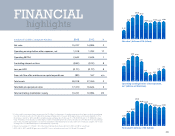

Over the course of the year, we took proactive steps

to strengthen our capital structure, improve our debt

maturity profile, and regain our financial flexibility. In the

process, we lowered our interest expense, reduced our

refinancing risk, and enhanced our liquidity.

We continued to successfully access the global capital mar-

kets—issuing US$3.1 billion in four separate transactions:

US$600 million of 5.875% senior secured notes

issued in March and maturing in 2019. We used the net

proceeds from this offering to pay in full the remaining

US$55 million of debt under CEMEX’s 2009 Financing

Agreement, approximately €183 million of our 2014

Eurobonds, and the remainder for general corporate pur-

poses, including the repayment of other indebtedness.

US$1billion of 6.50% senior secured notes issued in

August and maturing in 2019. We used the net proceeds

from this offering to pay US$925 million of our 9.50%

senior secured notes due 2016.

US$1billion of 7.25% senior secured notes issued in

September and maturing in 2021, and

US$500 million of floating rate senior secured

notes, bearing interest at three-month LIBOR plus 4.75%,

maturing in 2018. We used the net proceeds from these

offerings to pay the remaining US$825 million of our

9.50% senior secured notes due 2016 and €220 million

of our 9.625% senior secured notes due 2017. In addi-

tion, we created a cash reserve to pay the outstanding

balance of our 2014 Eurobonds at their maturity. The pro

forma average life of our debt reflecting the payment of

these Eurobonds is 4.6 years.

These strategic transactions are expected to result in

annual cash interest savings of approximately US$55 mil-

lion. Moreover, we bolstered our liquidity, and as of today,

we do not have any significant maturities until 2015.

Proactively managing our

financial position

Average life of debt

(as of December 31)

1 Pro forma

4.6

5.0

3.8

3.9

4.1

09 10 11 12 131

US$3.1 in senior secured notes

issued in four separate

transactions during 2013

billion

[16]