Cemex 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

back-office services, as well as IT infrastructure, applica-

tion development, and maintenance services. When all of

these services are fully transferred to IBM, we anticipate

achieving steady-state savings of more than US$100

million per year. Moreover, this agreement will improve

the quality of services provided to our company, enhance

our business’ agility and scalability, maximize our internal

efficiency, and serve our customers with greater speed,

precision, and quality. In light of this positive relationship,

we will continue to explore ways to partner with world-

class companies like IBM to generate greater value for

our company and our stakeholders.

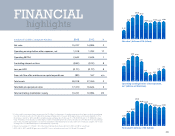

In addition to improving our operating performance, we

are focusing our efforts on optimizing our asset portfolio

to generate a higher return on capital employed. Among

our initiatives, we will continue to pursue strategic asset

swaps, through which we can capture synergies and

create more value for our investors without the necessi-

ty of making significant capital investments. We will also

only divest operating assets if they are accretive to our

company and our investors. We will further continue to

selectively divest non-operating assets, including equip-

ment and real estate. Indeed, over the past four years, we

have sold approximately US$700 million of non-operat-

ing assets—including approximately US$170 million this

year—which has significantly enhanced our balance sheet.

Consistent with these initiatives, in August, we announced

a series of three innovative transactions that will further

improve our return on capital employed. These transac-

tions include:

First, CEMEX’s acquisition of Holcim’s operations in the

Czech Republic; the Czech Republic is a market with a

strong economy and solid prospects, and we expect the

acquisition of these assets will considerably reinforce our

position in the country and in Central Europe.

Second, CEMEX’s divestiture of its assets in the western

part of Germany to Holcim; Germany is an attractive

market, and we will continue to maintain an important

presence in the eastern, northern, and southern part of

the country, including the capital city of Berlin.

Third, the combination of the cement, ready-mix con-

crete, and aggregates operations of CEMEX and Holcim in

Spain; CEMEX will have a 75% controlling interest of the

combined assets—which will enable us to consolidate this

operation and should translate into higher value creation

in this market.

Through these milestone transactions, which are subject

to regulatory approval and other conditions, we will opti-

mize our regional network of assets, increase our produc-

tivity, and extract synergies that will result in a recurring

improvement in our operating EBITDA of about US$20

million to US$30 million per year. In connection with

these transactions, we will also receive a cash payment of

approximately €70 million.

~US$700 of non-operating

assets sold over the

past four years

million

[15]