Cemex 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

delivering

2013 annual report

Table of contents

-

Page 1

delivering 2013 annual report -

Page 2

delivering innovative solutions for our CUSTOMERS We are staying closer than ever to our customers, tailoring our commercial offerings to suit their evolving needs. -

Page 3

delivering on our commitment to value creation for our INVESTORS We are proactively improving our operating performance, while optimizing our portfolio of assets to generate a higher return on capital employed. -

Page 4

delivering a better quality of life for our COMMUNITIES Since 1998, more than 2.3 million people in our communities have benefited from our company's inclusive businesses. -

Page 5

delivering opportunities for our EMPLOYEES We look to provide our employees with the most attractive opportunities for their personal and professional advancement. -

Page 6

... US$100 million in savings during the second half of 2013 through our cost-reduction initiatives in Mexico and Northern Europe alone. One of our most important continuing initiatives is the implementation of our value-before-volume pricing strategy. This has meant educating our sales force, as well... -

Page 7

... secured notes, demonstrating the strong support for CEMEX in the global capital markets. As a result of these offerings, the pro forma average life of our debt was 4.6 years at the end of the year; in the process, we also generated annual cash interest savings of approximately US$55 million. In... -

Page 8

... to a provider of comprehensive building solutions of value-added products and services for infrastructure and housing. I believe that is a roadmap for an increasingly profitable and valuable CEMEX. On behalf of the board and our management team, I thank all of you-as well as all of our other... -

Page 9

... year, which approximates a convenience translation of the Mexican peso results for 2013 and 2012 using the average exchange rates for the year of 12.85 MXN/US$ and 13.15 MXN/US$, respectively. For balance sheet accounts, US dollar figures result from translating the local currency amounts into US... -

Page 10

CEMEX is focused on delivering solutions to the increasingly complex and inter-connected demands of our society- improving the well-being of all of our stakeholders. -

Page 11

...40% During 2013, our specialty ready-mix concrete products accounted for approximately 40% of our total consolidated readymix concrete sales. Impercem® cement blocks the flow of water into concrete, reducing our customers' waterproofing costs and preventing damage to structural rebar and critical... -

Page 12

... of the Thames Water Lee Tunnel in Greater London. To meet the project's challenging material requirements, three cranes delivered 11,000 cubic meters of ready-mix concrete over 29 uninterrupted days, one of the longest continual slip form pours recorded in Europe. Time for first rehabilitation... -

Page 13

... for building on-site. We further work side-by-side with our customers to deliver an array of integrated services to fulfill their housing needs and aspirations. Our services include financing, planning and land management, urban development, design, materials supply, construction, and after sales... -

Page 14

...and services that, given our scale, we can buy at lower prices and share the savings with the network. These multiproduct offerings include prefabricated building products, hardware, and construction material and equipment. Today, six out of every 10 bags of cement we sell in Mexico and Colombia are... -

Page 15

... adapt our global operations network to meet current market dynamics. For example, in 2013, we achieved approximately US$100 million in savings during the second half of the year through our cost-reduction initiatives in Mexico and Northern Europe. These savings include capacity rationalization... -

Page 16

..., northern, and southern part of the country, including the capital city of Berlin. Third, the combination of the cement, ready-mix concrete, and aggregates operations of CEMEX and Holcim in Spain; CEMEX will have a 75% controlling interest of the combined assets-which will enable us to consolidate... -

Page 17

... in 2019. We used the net proceeds from this offering to pay in full the remaining US$55 million of debt under CEMEX's 2009 Financing Agreement, approximately â,¬183 million of our 2014 Eurobonds, and the remainder for general corporate purposes, including the repayment of other indebtedness. US... -

Page 18

... consumption of carbon-based fossil fuels, reduce our energy costs, and conserve valuable landfill space. In 2013, our utilization of alternative fuels grew to 28% of our total fuel mix, from 27% in 2012. We are also committed to securing alternative renewable sources of energy by either developing... -

Page 19

... evaluating investment opportunities in the development of new energy projects. In Mexico, we are in the process of developing a series of energy projects, beginning with the construction of the Ventika wind-powered energy park in the northern state of Nuevo Leon. With a minority equity stake... -

Page 20

... Enriching community well-being Since 1998, more than 2.3 million people in our communities have benefited from our company's inclusive businesses: Patrimonio Hoy, ConstruApoyo, and Productive Centers of Self-Employment. In 2013, we continued our efforts to improve access to quality housing among... -

Page 21

... behaviors to develop a culture of health and safety across our worldwide operations. Through this and related activities, we reduced our employee lost-time injury rate (per million hours worked) to 1.7, down 15% from 2012, underscoring our devotion to achieving our global goal of zero incidents. We... -

Page 22

... of our pricing strategy across our organization. To complement our onsite training efforts, we leverage our online learning management system-CEMEX Learning-to enable our employees to design their individual development plans. These plans guide and equip each of our people to deliver their best in... -

Page 23

... fundamentals; learn, practice, and apply specific new tools and frameworks in both a leadership and business context; and contribute tangible value through their work on breakthrough projects. Through ACHIEVE, participating top-tier managers and newly appointed directors develop their leadership... -

Page 24

... and implement effective action plans to improve employee commitment and build a high performance organization. Central to empowering managers is sharing the results of our employment engagement survey with local business leaders and human resources professionals, thereby preparing our organization... -

Page 25

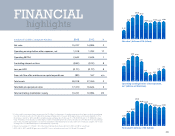

Selected consolidated financial information CEMEX, S.A.B. de C.V. and subsidiaries in millions of US dollars, except ADSs and per-ADS amounts Operating results Net sales Cost of sales1,2 Gross profit Operating expenses2 Operating earnings before other expenses, net Other expenses, net Financial ... -

Page 26

...of terms. 13. In 2010, 2011, 2012 and 2013, other financial obligations include the liability components associated with CEMEX's financial instruments convertible into CEMEX's CPOs, liablities secured with accounts receivable, as well as CEMEX's capital leases (see note 16B to the 2013 Annual Report... -

Page 27

..., we are strategically positioned in the Americas, Europe, Africa, the Middle East, and Asia. Our operations network produces, distributes, and markets cement, ready-mix concrete, aggregates, and related building materials to customers in over 50 countries, and we maintain trade relationships in... -

Page 28

... on more vertically integrated building solutions rather than separate products. providing us with the opportunity for significant organic growth over the medium and long term. By managing our cement, ready-mix concrete, and aggregates operations as one vertically integrated business, we not only... -

Page 29

... of operating diverse businesses throughout our industry's value chain in emerging and developed markets globally. With this in mind, we will continue to focus on recruiting, retaining, and developing motivated and knowledgeable professional managers. Vidalta Bridge, Mexico During 2013, CEMEX... -

Page 30

... began offering executives a new stock-ownership program in 2005. The plan moves our company's long-term incentives from stock option grants to restricted stock awards. As of December 31, 2013, our executives held 32,493,760 restricted CPOs, representing 0.3% of our total CPOs outstanding. Corporate... -

Page 31

...and Northern Europe operations. Operating EBITDA margin decreased 0.1 percentage points, from 17.5% in 2012 to 17.4% in 2013. Matilde School, Mexico 1,215 Consolidated results Net sales increased 2% to US$15.2 billion in 2013 compared with 2012. Higher sales in our U.S., South, Central America and... -

Page 32

... or in relation to compensation plans. Under International Financial Reporting Standards (IFRS), CEMEX is required to recognize all derivative financial instruments on the balance sheet as assets or liabilities at their estimated fair market value, with changes in such fair market values recorded in... -

Page 33

... the change in a pension plan in the Northern Europe region during the first quarter of 2012, operating EBITDA declined 1% during 2013. Our Northern European operations' domestic gray cement and ready-mix concrete volumes decreased 2% and 3%, respectively, while our aggregates volumes remained flat... -

Page 34

...Sales by region (percentage) 7 Cement plants (controlled) Cement plants (minority part.) 15 10 4 22 22 Ready-mix plants6 Aggregates quarries6 Land distribution centers Marine terminals as of December 31, 2013 27 l Mexico l United States Northern Europe l Mediterranean l South, Central America... -

Page 35

... 6% for the year. In Egypt, our operations' domestic gray cement volumes increased 7% in 2013. The main driver of cement consumption in the country remains the informal sector. The Our French operations' ready-mix concrete volumes decreased 6%, while our aggregates volumes increased 3% for the year... -

Page 36

... in the industry. Our trading operations help us to optimize our worldwide production capacity, deliver excess cement to where it is most needed, and explore new markets without the necessity of making immediate capital investments. Our worldwide network of strategically located marine terminals and... -

Page 37

... have benefited from PIAC, 110,000 people have been self-employed, and more than 915,000 m² of construction have been built. CEMEX included in UN Global Compact stock index On November 11, 2013, CEMEX announced that it was selected for inclusion in the United Nations Global Compact 100-a new global... -

Page 38

... "2016 Notes"), issued by CEMEX Finance LLC, and the remainder for general corporate purposes, including the purchase of â,¬220 million is composed of a representative group of Global Compact companies based on their adherence to the Global Compact's ten principles, as well as evidence of executive... -

Page 39

... and 17 ready-mix concrete plants. The Czech Republic is a market with a strong economy and solid prospects, and we expect that acquiring these assets should improve CEMEX's operations in the country and in Central Europe. CEMEX will divest its assets in the western part of Germany to Holcim, which... -

Page 40

...México, S.A. de C.V., New Sunward Holding B.V., CEMEX España, S.A., Cemex Asia B.V., CEMEX Corp., Cemex Egyptian Investments B.V., Cemex Egyptian Investments II B.V., CEMEX France Gestion (S.A.S.), Cemex Research Group AG, Cemex Shipping B.V., and CEMEX UK. The expansion will utilize state-of-the... -

Page 41

..., 2013 (the record date) received new shares as a result of the increase in the capital stock. The new ADSs issued were distributed on or about April 30, 2013. Each ADS represents 10 CPOs. As a result, the conversion rate of CEMEX's convertible subordinated notes due 2015, 2016, and 2018, as well as... -

Page 42

...' report 43 Consolidated statements of operations 44 Consolidated statements of comprehensive loss 45 Consolidated balance sheets 46 Consolidated statements of cash flows 47 Consolidated statements of changes in stockholders' equity 48 Notes to the consolidated financial statements 128... -

Page 43

...' report The Board of Directors and Stockholders CEMEX, S.A.B. de C.V.: We have audited the accompanying consolidated financial statements of CEMEX, S.A.B. de C.V. and subsidiaries ("the Company"), which comprise the consolidated balance sheets as at December 31, 2013 and 2012... -

Page 44

Consolidated statements of operations CEMEX, S.A.B. de C.V. and Subsidiaries (Millions of Mexican pesos, except for loss per share) Note 2013 Years ended December 31, 2012 2011 Net sales Cost of sales Gross profit Administrative and selling expenses Distribution expenses Operating ... -

Page 45

Consolidated statements of comprehensive loss CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Note 2013 Years ended December 31, 2012 2011 Consolidated net loss Items that will not be reclassified subsequently to profit or loss Actuarial losses Income tax recognized directly in ... -

Page 46

Consolidated balance sheets CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Assets Current assets Note 2013 December 31, 2012 Cash and cash equivalents Trade receivables less allowance for doubtful accounts Other accounts receivable Inventories, net Other current assets ... -

Page 47

...Notes 2013 Years ended December 31, 2012 2011 Consolidated net loss Non-cash items: Depreciation and amortization of assets Impairment losses Equity in gain (loss) of associates Other expenses (income), net Financial items, net Income taxes Changes in working capital, excluding... -

Page 48

Statements of changes in stockholders' equity CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Notes Common stock Additional paid-in capital Other equity reserves Retained earnings Total controlling interest Non-controlling interest Total stockholders' equity Balance at ... -

Page 49

... of the United Mexican States, or Mexico, is currently a holding company (parent) of entities whose main activities are oriented to the construction industry, through the production, marketing, distribution and sale of cement, ready-mix concrete, aggregates and other construction materials. CEMEX... -

Page 50

... unrealized foreign exchange effects, as well as the following transactions that did not represent sources or uses of cash In 2013, the increase in investments in associates for $712, related to CEMEX's joint venture Concrete Supply Co., LLC (note 13A). As part of the agreement CEMEX... -

Page 51

... line-by-line. The adoption of IFRS 11 did not represent any significant impact on CEMEX's consolidated financial statements. The equity method is discontinued when the carrying amount of the investment, including any long-term interest in the associate or joint venture, reaches zero, unless CEMEX... -

Page 52

...inflation rate over the last three years is approaching, or exceeds, 100%. In a hyperinflationary economy, the accounts of the subsidiary's statements of operations should be restated to constant amounts as of the reporting date, in which case, both the balance sheet accounts and... -

Page 53

... CEMEX maintains a residual interest in the trade accounts receivable sold in case of recovery failure, as well as continued involvement in such assets, do not qualify for derecognition and are maintained on the balance sheet. 2G) Inventories (note 11) Inventories are valued using the lower of cost... -

Page 54

... As of December 31, 2011, the main effects in the relevant line items of CEMEX's consolidated balance sheet were as follows: (Millions of pesos) As originally reported As restated Adjustment Other current assets Other investments and non-current accounts receivable Plant, machinery and equipment... -

Page 55

...cost to sell and its value in use, represented by the discounted amount of estimated future cash flows to be generated by such CGUs to which goodwill has been allocated. Other intangible assets of indefinite life may be tested at the CGU or group of CGUs level, depending on their allocation. CEMEX... -

Page 56

...balance sheet within "Other accounts payable and accrued expenses" against financial expense. During the reported periods, CEMEX did not have financial liabilities voluntarily recognized at fair value or associated to fair value hedge strategies with derivative financial instruments. Direct costs... -

Page 57

... standards or affect valuation practices outside financial reporting. Under IFRS 13, fair value represents an "Exit Value," which is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date... -

Page 58

... other production sites are left in acceptable condition at the end of their operation. Costs related to remediation of the environment (notes 17 and 24) Provisions associated with environmental damage represent the estimated future cost of remediation, which are recognized at their nominal value... -

Page 59

... 1, 2013, CEMEX restated its consolidated balance sheet as of December 31, 2012 and its consolidated statements of operations for the years ended December 31, 2012 and 2011. The effects were not significant. Termination benefits, not associated with a restructuring event, which mainly represent... -

Page 60

... consolidated financial statements Deferred tax assets are reviewed at each reporting date and are reduced to the extent that it is not considered probable that the related tax benefit will be realized. In conducting such assessment, CEMEX analyzes the aggregate amount of self-determined tax loss... -

Page 61

... financial asset; b) no predefined maturity date; and c) a unilateral option to defer interest payments or preferred dividends for indeterminate periods. 2Q) Revenue recognition (note 3) CEMEX's consolidated net sales represent the value, before tax on sales, of revenues originated by products... -

Page 62

... concentration within the countries in which CEMEX operates. As of and for the years ended December 31, 2013, 2012 and 2011, no single customer individually accounted for a significant amount of the reported amounts of sales or in the balances of trade receivables. In addition, there is no... -

Page 63

... involved in providing information technology solutions and services. Refers mainly to revenues generated by minor subsidiaries operating in different lines of business. Recognized to date 1 For the years ended December 31, 2013, 2012 and 2011, revenues and costs related to construction contracts... -

Page 64

..., distribution, marketing and sale of cement, ready-mix concrete, aggregates and other construction materials, the allocation of resources and the review of their performance and operating results. All regional presidents report directly to CEMEX's Chief Executive Officer. The country manager... -

Page 65

..., net net 2012 Net sales Operating EBITDA Financial expense Mexico United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America and the Caribbean Colombia Rest of SAC Asia Philippines Rest of... -

Page 66

...Net sales Operating EBITDA Financial expense Other financing items, net Mexico United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America and the Caribbean Colombia Rest of SAC Asia Philippines... -

Page 67

...371 9,022 Investments in associates Mexico United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America and the Caribbean Colombia Rest of South America and the Caribbean Asia Philippines Rest of... -

Page 68

... to the consolidated financial statements Net sales by product and geographic segment for the years ended December 31, 2013, 2012 and 2011 were as follows: 2013 Cement Concrete Aggregates Others Eliminations Net sales Mexico United States Northern Europe United Kingdom Germany France Rest of... -

Page 69

... consolidated financial statements 2011 Cement Concrete Aggregates Others Eliminations Net sales Mexico United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America and the Caribbean Colombia Rest... -

Page 70

... to $1,516 in 2013 and $2,280 in 2012. Therefore, the funded amount to CEMEX was $6,971 (US$534) in 2013 and $8,512 (US$662) in 2012, representing the amounts recognized within "Other financial obligations." The discount granted to the acquirers of the trade accounts receivable is recorded as... -

Page 71

...2,721 171 1,026 6,239 Non-trade accounts receivable are mainly attributable to the sale of assets. Includes $174 in 2013 and $171 in 2012, representing the short-term portion of a restricted investment related to coupon payments under CEMEX's perpetual debentures (note 20D... -

Page 72

...which: Book value at acquisition date Changes in stockholders' equity Cement Concrete Cement Cement Financing Cement Aggregates Aggregates Cement Cement Cement - Mexico United States Mexico Lithuania Mexico Trinidad and Tobago France France United States Panama French... -

Page 73

Notes to the consolidated financial statements Equity in net income (loss) of associates by geographic operating segment in 2013, 2012 and 2011 is detailed as follows: 2013 1 2012 2011 Mexico United States Northern Europe Mediterranean Corporate and Others (6) 91 111 16 17 229... -

Page 74

.... In 2011, includes sales of non-strategic fixed assets in the United Kingdom, Mexico and the United States for $424, $567 and $968, respectively. 4 In 2013, as described in note 13A, CEMEX contributed fixed assets to its associate Concrete Supply Co., LLC for approximately $445. In 2012, due... -

Page 75

...realizable value, in case of permanent shut down, and recognized impairment losses (note 2K) during 2013, 2012 and 2011 in the following countries and for the following amounts: 2013 2012 2011 Spain Puerto Rico United States Germany Mexico Latvia Ireland United Kingdom Colombia Other... -

Page 76

... financial statements Goodwill Changes in consolidated goodwill in 2013, 2012 and 2011 were as follows: 2013 2012 2011 Balance at beginning of period Business combinations Disposals and cancellations 1 Reclassification to assets held for sale 2 Impairment losses (note 15C) 3 Foreign... -

Page 77

... a global producer of building materials based in Switzerland, reached an agreement in principle, to conduct a series of related transactions by means of which: a) in the Czech Republic, CEMEX would acquire all of Holcim's assets, including a cement plant, four aggregates quarries and 17 ready-mix... -

Page 78

... balances allocated by operating segment were as follows: 2013 2012 United States Mexico Northern Europe United Kingdom France Czech Republic Mediterranean Spain United Arab Emirates Egypt SA&C Colombia Dominican Republic Rest of SA&C 1 Asia Philippines Others Other reporting units... -

Page 79

... the discounted cash flows in the group of CGUs with the main goodwill balances, were as follows: Groups of CGUs 2013 Discount rates 2012 2011 2013 Growth rates 2012 2011 United States Spain Mexico Colombia France United Arab Emirates United Kingdom Egypt Range of discount rates in... -

Page 80

... countries such as Mexico to fixed income securities in developed countries such as the United States. The market price of CEMEX's CPO has recovered significantly after CEMEX entering into the Facilities Agreement in September 2012. In dollar terms, CEMEX's market capitalization increased by... -

Page 81

...or alternate construction products, among other factors. CEMEX has also considered recent developments in its operations in the United States, such as the increases in ready-mix concrete volumes of approximately 8% in 2013, 20% in 2012 and 7% in 2011, and the increases in ready-mix concrete prices... -

Page 82

...,011 208,471 The most representative exchange rates for the financial debt are as follows: January 31, 2014 2013 2012 2011 Mexican pesos per dollar Euros per dollar 13.36 0.7377 13.05 0.7268 12.85 0.7576 13.96 0.7712 The maturities of consolidated long-term debt as of December 31... -

Page 83

... de México, S.A. de C.V., New Sunward Holding B.V., CEMEX España, Cemex Asia B.V., CEMEX Corp., Cemex Egyptian Investments B.V., Cemex Egyptian Investments II B.V., CEMEX France Gestion (S.A.S.), Cemex Research Group AG, Cemex Shipping B.V. and CEMEX UK. Fees and costs related to the issuance of... -

Page 84

... CEMEX Egyptian Investments II B.V., CEMEX France Gestion (S.A.S.), CEMEX Research Group AG, CEMEX Shipping B.V. and CEMEX UK. CEMEX used approximately US$596 of net proceeds from the offering for the repayment of US$55 of the remaining indebtedness under CEMEX's 2009 Financing Agreement, dated... -

Page 85

... well as by CEMEX Research Group AG, CEMEX Shipping B.V., CEMEX Asia B.V., CEMEX France Gestion (S.A.S.), CEMEX UK, and CEMEX Egyptian Investments B.V. ( jointly the "New Guarantors"), which also guarantee debt under the Facilities Agreement. The net proceeds from the offering... -

Page 86

... transactions, the application of the net proceeds obtained from the sale of assets, and an equity offering of CEMEX, S.A.B. de C.V. in 2009, the remaining debt balance under the Financing Agreement was approximately US$7,195 ($100,442). Considering certain prepayments by December 31, 2011 of debt... -

Page 87

... and acquisitions by CEMEX Latam and its subsidiaries, which capital expenditures, joint venture investments and acquisitions at any time then incurred are subject to a separate aggregate limit of US$350 (or its equivalent)). In the Facilities Agreement, and subject in each case to the permitted... -

Page 88

... and volatility in foreign exchange rates, as well as by overall conditions in the financial and capital markets. For the compliance periods ended as of December 31, 2013, 2012 and 2011, taking into account the Facilities Agreement and the amended Financing Agreement, as applicable, and based on... -

Page 89

... the calculation date. Funded debt equals debt, as reported in the balance sheet excluding finance leases, plus perpetual debentures and guarantees, plus or minus the fair value of derivative financial instruments, as applicable, among other adjustments Pro forma Operating EBITDA represents, all... -

Page 90

...and 2012, other financial obligations in the consolidated balance sheet are detailed as follows: Short-term 2013 Long-term Total Short-term 2012 Long-term Total I. Convertible subordinated notes due 2018 $ I. Convertible subordinated notes due 2016 II. Convertible subordinated notes due 2015... -

Page 91

... conversion option generated a loss of $135 (US$10) in 2013. IV. Liabilities secured with accounts receivable As mentioned in note 9, as of December 31, 2013 and 2012, CEMEX maintained securitization programs for the sale of trade accounts receivable established in Mexico, the United States, France... -

Page 92

... balance sheets as of December 31, 2013 and 2012 are included in the following fair value hierarchy categories: 2013 Level 1 Level 2 Level 3 Total Assets measured at fair value Derivative instruments (notes 13B) Investments available-for-sale (note 13B) Investments held for trading... -

Page 93

... shown in the market as of the reporting date. These values should be analyzed in relation to the fair values of the underlying transactions and as part of CEMEX's overall exposure attributable to fluctuations in interest rates and foreign exchange rates. The notional amounts... -

Page 94

...to the consolidated financial statements IV. Options on CEMEX's own shares On March 15, 2011, in connection with the offering of the 2016 Convertible Notes and the 2018 Convertible Notes and to effectively increase the conversion price for CEMEX's CPOs under such notes, CEMEX, S.A.B. de... -

Page 95

... from consolidation, were generated in Mexico, 20% in the United States, 7% in the United Kingdom, 7% in Germany, 6% in France, 6% in the Rest of Northern Europe geographic segment, 2% in Spain, 3% in Egypt, 5% in the Rest of Mediterranean segment, 6% in Colombia, 7% in the Rest of South America... -

Page 96

... statements of operations as part of "Other financial income (expense), net." A significant decrease in the market price of CEMEX's CPOs and third party shares would negatively affect CEMEX's liquidity and financial position. As of December 31, 2013 and 2012, the potential change in the fair value... -

Page 97

... order to meet its liquidity needs, CEMEX also relies on cost-cutting and operating improvements to optimize capacity utilization and maximize profitability, as well as borrowing under credit facilities, proceeds of debt and equity offerings, and proceeds from asset sales. CEMEX's consolidated net... -

Page 98

... items related to tax contingencies. As of December 31, 2013 and 2012, includes approximately $20,530 and $12,526, respectively, of the non-current portion of taxes payable recognized since 2009 as a result of the changes to the tax consolidation regime in Mexico approved in 2009 and 2013 as... -

Page 99

...2013, 2012 and 2011 were approximately $572, $528 and $357, respectively. CEMEX contributes periodically the amounts offered by the pension plan to the employee's individual accounts, not retaining any remaining liability as of the balance sheet date. Defined benefit pension plans... -

Page 100

... the consolidated financial statements As of December 31, 2013 and 2012, plan assets were measured at their estimated fair value and consisted of: 2013 2012 Cash Investments in corporate bonds Investments in government bonds Total fixed-income securities Investment in marketable securities... -

Page 101

... these benefits in 2013 and 2012 for Mexico were 7.0%, for Puerto Rico 4.9%, the United States 4.6%, and for the United Kingdom were 6.6%. Significant events related to employees' pension benefits and other postretirement benefits Effective December 31, 2013, in connection with the closure in 2010... -

Page 102

... the consolidated financial statements During 2011, following the required notices to the plans' trustees, CEMEX settled its defined benefit pension plans in the Republic of Ireland. As a result, the available assets were used to provide beneficiaries' entitlements in accordance with the agreement... -

Page 103

... deferred income taxes during 2013, 2012 and 2011 were as follows: 2013 2012 2011 Deferred income tax (charged) credited to the statements of operations 1, 2 Deferred income tax (charged) credited to stockholders' equity Reclassification to other captions in the balance sheet Change in... -

Page 104

... For the years ended December 31, 2013, 2012 and 2011, CEMEX has reported pre-tax losses on a worldwide consolidated basis. Nonetheless, based on the same forecasts of future cash flows and operating results used by CEMEX's management to allocate resources and evaluate performance in the countries... -

Page 105

... differences between the statutory tax rate applicable in Mexico, and the effective tax rate presented in the consolidated statements of operations, which in 2013, 2012 and 2011 were as follows: 2013 % 2012 % 2011 % Consolidated statutory tax rate Non-taxable dividend income Expenses and other... -

Page 106

...during 2011 by the U.S. Internal Revenue Service ("IRS") for the years 2005 through 2009 proposing certain adjustments to CEMEX's subsidiaries tax returns in the United States, a resolution was reached with the IRS regarding the income tax audits for said years and also on tax losses applicable to... -

Page 107

... in the table below. Changes in the Parent Company's tax payable associated with the tax consolidation in Mexico in 2013, 2012 and 2011 were as follows: 2013 2012 2011 Balance at beginning of period Income tax received from subsidiaries Restatement for the period Payments during the period... -

Page 108

... were signed in connection with the years 2007 and 2008, respectively, representing the official conclusion of this proceeding. • 20) Stockholders' equity As of December 31, 2013 and 2012, stockholders' equity excludes investments in CPOs of CEMEX, S.A.B. de C.V. held by subsidiaries of... -

Page 109

...-in capital". This transfer represents a reclassification between line items within CEMEX's consolidated stockholders' equity that does not affect its consolidated amount. As of December 31, 2013 and 2012, the common stock of CEMEX, S.A.B. de C.V. was represented as follows: 2013 Shares 1 Series... -

Page 110

... the "Fixed program" (note 21) generated additional paid-in capital of approximately $11 in 2011 and increased the number of shares outstanding. In addition, in connection with the long-term executive stock-based compensation program (note 21) in 2013, 2012 and 2011, CEMEX issued... -

Page 111

... 22,224,000 new common shares offered in such private placement that were subject to a put option granted to the initial purchasers during the 30-day period following closing of the offering. CEMEX Latam's assets include substantially all of CEMEX's cement and ready-mix assets in Colombia, Panama... -

Page 112

... to the consolidated financial statements 21) Executive stock-based compensation CEMEX has long-term restricted stock-based compensation programs providing for the grant of CEMEX's CPOs to a group of executives, pursuant to which, new CPOs are issued under each annual program over a service period... -

Page 113

... on the program, increased annually at a 5.5% rate or at a 7% rate. C) Special program Until 2005, a subsidiary in the United States granted to a group of its employees a stock option program to purchase CEMEX ADSs. The options granted have a fixed exercise price denominated in dollars... -

Page 114

... of the reporting period. The number of shares resulting from the executives' stock option programs is determined under the inverse treasury method. 2 3 4 For 2013, 2012 and 2011, the effects on the denominator and numerator of potential dilutive shares generate antidilution; therefore... -

Page 115

... that CEMEX's plants in Mexico will acquire a portion of the energy generated by the wind farm for a period of at least 20 years, which began in February 2010, when EURUS reached the committed limit capacity. For the years ended December 31, 2013, 2012 and 2011, EURUS supplied (unaudited... -

Page 116

... processing services (back office) in finance, accounting and human resources; as well as IT infrastructure services, support and maintenance of IT applications in the countries in which CEMEX operates. In connection with the agreement in principle entered into by CEMEX and Holcim in August 2013... -

Page 117

... years 2013 3-5 years More than 5 years Total 2012 Total Long-term debt US$ 296 Capital lease obligations 1 58 Convertible notes 2 14 Total debt and other financial obligations 3 368 Operating leases 4 111 5 Interest payments on debt 1,037 Pension plans and other benefits... -

Page 118

... and another of CEMEX's indirect subsidiaries in Poland. The Protection Office alleged that there was an agreement between all cement producers in Poland regarding prices, market quotas and other sales conditions of cement, and that the producers exchanged confidential information, all of which... -

Page 119

... prices; b) any agreements designed to directly or indirectly fix prices; and c) any market sharing agreements between producers or between distributors. In connection with the 14 executives under investigation, including a former legal representative and the current President of CEMEX Colombia... -

Page 120

... financial condition. On June 21, 2012, one of CEMEX's subsidiaries in Israel was notified about an application for the approval of a class action suit against it. The application, filed by a homeowner who built his house with concrete supplied by CEMEX in October of 2010, claims that the concrete... -

Page 121

...consolidated financial statements • On January 20, 2012, the United Kingdom Competition Commission (the "UK Commission"), commenced a market investigation ("MIR") into the supply or acquisition of cement, ready-mix concrete and aggregates. The referral to the UK Commission was made by the Office... -

Page 122

... by CEMEX Colombia. An adverse resolution on this case would have a material adverse impact on CEMEX's results of operations, liquidity or financial condition. In October 2009, CEMEX Corp., one of CEMEX's subsidiaries in the United States, and other cement and concrete suppliers... -

Page 123

... have a significant adverse impact on CEMEX's results of operations, liquidity or financial condition. In November 2008, AMEC/Zachry, the general contractor for CEMEX's expansion project in Brooksville, Florida, filed a lawsuit against CEMEX Florida in Florida State Court in Orlando, for US$60... -

Page 124

...2012 final award, RMC Holdings B.V. pledged in favor of Strabag 496,355 shares (approximately a 33% stake) in its subsidiary Cemex Austria AG. On February 20, 2013, the Swiss Court rendered its judgment rejecting the annulment action brought by Strabag and ordered it to pay the Court costs for 100... -

Page 125

... consolidated financial statements • In August 2005, a lawsuit was filed against a subsidiary of CEMEX Colombia and other members of the Colombian Ready-mix Producers Association (Asociación Colombiana de Productores de Concreto or ASOCRETO), a union formed by all the ready-mix concrete producers... -

Page 126

... a member of the board of directors of IBM. As mentioned in note 23C, in the ordinary course of business, IBM provides CEMEX with business processes services and IT, including: data processing services (back office) in finance, accounting and human resources; as well as IT infrastructure services... -

Page 127

Notes to the consolidated financial statements • For the years ended December 31, 2013, 2012 and 2011, the aggregate amount of compensation of CEMEX, S.A.B. de C.V.'s board of directors, including alternate directors, and top management executives, was approximately US$39 ($504), US$37 ($490) and ... -

Page 128

...1 2 3 Mexico Spain United States Spain Costa Rica Nicaragua Egypt Colombia Panama Dominican Republic Puerto Rico France Philippines Philippines Thailand Malaysia United Kingdom Germany Austria Croatia Czech Republic Poland Hungary Ireland Israel Latvia United Arab Emirates... -

Page 129

ANNEX A Table of contents 129 Independent auditors' report 130 Statements of operations 131 Statements of comprehensive loss 132 Balance sheets 133 Statements of cash flows 134 Statements of changes in stockholders' equity 135 Notes to the financial statements [128] -

Page 130

...' report The board of directors and stockholders CEMEX, S.A.B. de C.V.: We have audited the accompanying separate financial statements of CEMEX, S.A.B. de C.V. ("the Company"), which comprise the separate balance sheets as at December 31, 2013 and 2012, the separate statements of operations... -

Page 131

...Notes 2013 Years ended December 31, 2012 2011 Dividend income Rental income License fees Total revenues Administrative expenses Operating earnings before other expenses, net Other expenses, net Operating earnings (loss) Financial expense Other financial (expense) income, net Foreign exchange... -

Page 132

Statements of comprehensive loss CEMEX, S.A.B. de C.V. (Parent company-only) (Millions of Mexican pesos) Note 2013 Years ended December 31, 2012 2011 Net loss Items that will not be reclassified subsequently to profit or loss Currency translation effects Income tax recognized directly in other... -

Page 133

... receivable Long-term accounts receivable from related parties Land and buildings, net Deferred income taxes Total non-current assets Total assets Liabilities and stockholders' equity Current liabilities Short-term debt including current maturities of long-term debt Other financial... -

Page 134

Statements of cash flows CEMEX, S.A.B. de C.V. (Parent company-only) (Millions of Mexican pesos) Operating activities Note 2013 Years ended December 31, 2012 2011 Net loss Non-cash items: Depreciation of buildings Financial items, net Income taxes Changes in working capital Net ... -

Page 135

... paid-in capital Other equity reserves Retained earnings Total stockholders' equity Balances at December 31, 2010 Total other items of comprehensive loss Capitalization of retained earnings Issuance of common stock for stock compensation programs Balance at December 31, 2011 Total other... -

Page 136

... the production, marketing, distribution and sale of cement, ready-mix concrete, aggregates and other construction materials. CEMEX is a public stock corporation with variable capital (S.A.B. de C.V.) organized under the laws of the United Mexican States, or Mexico. CEMEX, S.A.B. de... -

Page 137

... inflation and unrealized foreign exchange effects. The statements of cash flows exclude transactions that did not represent sources or uses of cash such as In 2013, 2012 and 2011, the increases in stockholders' equity associated with dividends in shares through the capitalization of retained... -

Page 138

...-denominated balances will generate foreign currency fluctuations through CEMEX, S.A.B. de C.V.'s statement of operations; c) non-monetary balances were translated into U.S. Dollars using the exchange rate at January 1, 2013, resulting in their new historical cost; and d) the conversion option... -

Page 139

... of future prices of CEMEX's products, the development of operating expenses, local and international economic trends in the construction industry, the long-term growth expectations in the different markets, as well as the discount rates and the growth rates in perpetuity applied. CEMEX, S.A.B. de... -

Page 140

... standards or affect valuation practices outside financial reporting. Under IFRS 13, fair value represents an "Exit Value," which is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date... -

Page 141

..., either directly or indirectly, and are used mainly to determine the fair value of securities, investments or loans that are not actively traded. Level 2 inputs included equity prices, certain interest rates and yield curves, implied volatility, credit spreads and other market corroborated... -

Page 142

... 1, 2010 according to IFRS 1; and d) when applicable, the restitution of retained earnings from other line item within stockholder´s equity. 2P) Revenue recognition CEMEX, S.A.B. de C.V.'s revenues represent the value, before tax on sales, of revenues originated by services sold to subsidiaries as... -

Page 143

Notes to the financial statements 2Q) Executive stock-based compensation Based on IFRS 2, Share-based payments ("IFRS 2"), stock awards based on shares of CEMEX granted to executives are defined as equity instruments, when services received from employees are settled delivering shares; or as ... -

Page 144

...non-current accounts receivable 7A) Investments in subsidiaries and associates As of December 31, 2013 and 2012, investment in shares of subsidiaries and associates, valued at cost, include the following: Activity Country % 2013 2012 CEMEX México, S.A. de C.V. CEMEX Trademarks Holding Ltd. CEMEX... -

Page 145

Notes to the financial statements 8) Land and buildings As of December 31, 2013 and 2012, land and buildings include the following: 2013 2012 Lands Buildings Accumulated depreciation $ $ 1,927 472 (335) 2,064 1,897 465 (326) 2,036 9) Other accounts payable and accrued ... -

Page 146

Notes to the financial statements 2013 Short-term Long-term 2012 Short-term Long-term Bank loans Loans in Mexico, 2014 to 2017 Loans in foreign countries, 2014 to 2018 Syndicated loans, 2014 to 2017 Notes payable Notes payable in Mexico, 2014 to 2017 Medium-term notes, 2014 to 2021 Other... -

Page 147

...de C.V., New Sunward Holding B.V., CEMEX España, Cemex Asia B.V., CEMEX Corp., Cemex Egyptian Investments B.V., Cemex Egyptian Investments II B.V., CEMEX France Gestion (S.A.S.), Cemex Research Group AG, Cemex Shipping B.V. and CEMEX UK. Fees and costs related to the issuance of the New Notes for... -

Page 148

... transactions, the application of the net proceeds obtained from the sale of assets, and an equity offering of CEMEX, S.A.B. de C.V. in 2009, the remaining debt balance under the Financing Agreement was approximately US$7,195 ($100,442). Considering certain prepayments by December 31, 2011 of debt... -

Page 149

... a) sell minority stakes in CEMEX's operations; b) sell selected assets in the United States; c) sell selected assets in Europe; and/or d) sale of other non-core assets. If during the Facilities Agreement term CEMEX pays down US$1,500 and US$2,000 of aggregate principal amount under the Facilities... -

Page 150

... and acquisitions by CEMEX Latam and its subsidiaries, which capital expenditures, joint venture investments and acquisitions at any time then incurred are subject to a separate aggregate limit of US$350 (or its equivalent)). In the Facilities Agreement, and subject in each case to the permitted... -

Page 151

... and volatility in foreign exchange rates, as well as by overall conditions in the financial and capital markets. For the compliance periods ended as of December 31, 2013, 2012 and 2011, taking into account the Facilities Agreement and the amended Financing Agreement, as applicable and based on... -

Page 152

... with its consolidated covenants under its Facilities Agreement, as it is expecting to benefit from cost savings programs implemented during 2013, 2012 and 2011, favorable market conditions in some of its key markets and decreasing costs for key inputs such as energy. Furthermore, CEMEX has an... -

Page 153

... fair value of the conversion option generated a loss of $135 (US$10) in 2013. 10C) Fair value of financial instruments Financial assets and liabilities The carrying amounts of cash, other accounts receivable, short-term intercompany balances, other accounts payable and accrued expenses, as well as... -

Page 154

... 31, 2013 and 2012, the main exposure of CEMEX, S.A.B. de C.V., was related to changes in the prices of its CPOs. A significant decrease in the market price of CEMEX, S.A.B. de C.V. CPOs and third party shares would negatively affect CEMEX, S.A.B. de C.V., liquidity and financial position... -

Page 155

... fair value of this interest rate swap generated losses of approximately US$16 ($207) in 2013, US$2 ($35) in 2012 and US$12 ($150) in 2011, recognized in the statements of operations for each year. II. Derivative instruments on the price of CPO On March 15, 2011, in connection with the offering of... -

Page 156

... fund and certain of CEMEX's directors and current and former employees in April 2008, which fair value as of December 31, 2012, net of deposits in margin accounts, represented a liability of approximately US$58 ($740). Changes in fair value were recognized in the statements... -

Page 157

... affect its financing cost and increase its net loss. CEMEX, S.A.B. de C.V. manages its interest rate risk by balancing its exposure to fixed and variable rates while attempting to reduce the financial expense. As of December 31, 2013 and 2012, approximately 34% and 47% of the long-term debt of... -

Page 158

... such equity derivative instruments are recognized through the statements of operations as part of "Other financial income, net". As of December 31, 2013 and 2012, the potential change in the fair value of CEMEX's options (capped call) and the put option transaction based on the price of CEMEX... -

Page 159

... main accounts receivable and payable with related parties, are the following: Assets 2013 Short-term Long-term Liabilities Short-term Long-term CEMEX México, S.A. de C.V. CEMEX Research Group AG. CEMEX Latam Holdings, S.A. Construction Funding Corporation CEMEX Hungária, Kft CEMEX Central... -

Page 160

... new rules issued for the disconnection of the tax consolidation regime amounts to approximately $24,804. Changes in CEMEX, S.A.B. de C.V.'s tax payable in Mexico in 2013, 2012 and 2011 were as follows: 2013 2012 2011 Balance at the beginning of the year Income tax received from subsidiaries... -

Page 161

... these financial statements for the years ended December 31, 2013, 2012 and 2011 include the effect of this consolidation. On January 1, 2008, a new law became effective in Mexico, which was named the Minimum Corporate Tax law (Impuesto Empresarial Tasa Única or "IETU") and superseded the Business... -

Page 162

... changes during the period related to deferred tax assets originated by tax loss carryforwards. In 2013, this line item includes the effects associated with the termination of the tax consolidation regime in Mexico. 13) Stockholders' equity As of December 31, 2013 and 2012, there were 17,558... -

Page 163

... to the exercise of options under the "Fixed program" generated additional paid-in capital of approximately $11 in 2011 and increased the number of shares outstanding. In addition, in connection with the long-term executive stock-based compensation program in 2013, 2012 and 2011, CEMEX, S.A.B. de... -

Page 164

...pension fund and certain of CEMEX's directors and current and former employees (the "participating individuals"). The transaction was structured with two main components. Under the first component, the trust sold, for the benefit of CEMEX's Mexican pension fund, put options to Citibank in exchange... -

Page 165

...productive, commercial, marketing and administrative activities related to the sale of cement, ready-mix concrete, aggregates and other construction materials in Mexico. As part of this initiative, CEMEX, S.A.B. de C.V., will enter into lease agreements of property, plant and equipment, with CEMEX... -

Page 166

... process. Pozzolana is a fine, sandy volcanic ash. Ready-mix concrete is a mixture of cement, aggregates, and water. Slag is the by-product of smelting ore to purify metals. Financial terms American Depositary Shares (ADSs) are a means for nonU.S.-based corporations to list their ordinary equity... -

Page 167

...Morales (not a member of the board) Audit Committee Roberto Zambrano Villarreal President José Manuel Rincón Gallardo Rafael Rangel Sostmann Corporate Practices Committee Dionisio Garza Medina President Francisco Javier Fernández Carbajal Rafael Rangel Sostmann Finance Committee Rogelio Zambrano... -

Page 168

... management positions in the Strategic Planning area, he headed CEMEX operations in Egypt, Spain, and Western Europe. He is currently President of CEMEX Northern Europe, and is also responsible for the company's global Energy and Sustainability area. Ignacio graduated with a MSc in Civil Engineering... -

Page 169

...Strategic Planning, Business Development, Ready-Mix Concrete, Aggregates, and Human Resources. More recently, he headed CEMEX operations in Egypt. He is currently President of CEMEX Mediterranean, which includes operations in Spain, Egypt, Croatia, and the Middle East. He graduated with a Management... -

Page 170

...A shares and one B share) New York Stock Exchange (NYSE) United States Ticker symbol: CX Share series: ADS (representing 10 CPOs) Investor relations contact [email protected] From the US: 1 877 7CX NYSE From other countries : (212) 317-6000 Fax: (212) 317-6047 Web address www.cemex.com New York office... -

Page 171

... forward-looking statements. Readers should review future reports filed by us with the SEC and the BMV and/or CNBV. This annual report also includes statistical data regarding the production, distribution, marketing and sale of cement, ready-mix concrete, clinker and aggregates. We generated some of... -

Page 172

www.cemex.com Centro Roberto Garza Sada, Universidad de Monterrey, Mexico. Architect: Tadao Ando. design: signi.com.mx