BT 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BT Group plc

Annual Report &

Form 20-F 2013

London 2012: The BT Tower

was used to celebrate British

medal winners in the Olympic

and Paralympic Games

Table of contents

-

Page 1

BT Group plc Annual Report & Form 20-F 2013 London 2012: The BT Tower was used to celebrate British medal winners in the Olympic and Paralympic Games -

Page 2

... the UK. It carried every ofï¬cial photograph and sports report and every visit to the London 2012 Games website and supported millions of calls, emails, text messages and tweets. A BT ï¬bre-based network delivered 5,000 hours of live TV coverage of the Games to the International Broadcast Centre... -

Page 3

... of BT Group plc 167 Subsidiary undertakings Additional information 170 Alternative performance measures 173 Selected ï¬nancial data 175 Financial and operational statistics 177 Information for shareholders 191 Cross reference to Form 20-F 195 Glossary of terms Online Annual Report www.bt.com... -

Page 4

.... During the year we also set ourselves three stretching Better Future goals to achieve by the end of 2020. By extending the reach of ï¬bre broadband, helping our customers reduce their carbon footprint and using our skills and technology to help generate money for good causes, we will make a major... -

Page 5

...lives of millions of people, helping them communicate, do business and be entertained and informed We are the leading provider of consumer voice and broadband services in the UK We provide managed networked IT services for many of the largest companies in the world In the UK we are delivering one... -

Page 6

... for UK SMEs BT Global Services - a global leader The wholesaler of choice The best network provider A responsible and sustainable business leader Read more on page 14 14 15 15 15 16 A better future Customer service delivery Read more on Customer service delivery on page Cost transformation Read... -

Page 7

... brand - Our networks - Our technology - Our ï¬nancial strength We enhance the things that set us apart Customer service delivery Cost transformation Investing for the future Delivering value Shareholders Customers The better we serve our customers, the less time and money we need to spend... -

Page 8

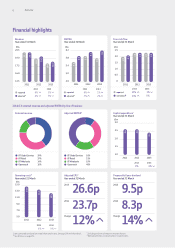

... 2012 2012 2013 6% 4% 5% 5% reported adjusteda 6% 3% 1% 2% 15% 11% 1% 0% 2012/13 external revenue and adjusted EBITDA by line of business External revenue Adjusted EBITDAa Capital expenditurec Year ended 31 March £bn 3.0 2.6 2.6 2.5 2.0 1.5 BT Global Services BT Retail BT Wholesale... -

Page 9

... converged ï¬xed and mobile services building on our investment in 4G spectrum to offer customers the best possible connection wherever they are. BT's retail broadband market share At 31 March % 40 35% 36% 37% 38% Proportion of BT Business revenue from IT servicesa Year ended 31 March % 22 20... -

Page 10

...year, helped by growth in managed network services. BT Wholesale order intake Year ended 31 March £m 900 We serve: 94% of the FTSE 100 companies 74% of the Fortune 500 companies 100% of Interbrand's top 50 annual ranking of the world's most valuable brands The world's top stock exchanges, leading... -

Page 11

... 20 0 2010 a 2011 2012 2013 Cumulative from 1 April 2009. We recruited around 1,600 engineers into the group to help accelerate our ï¬bre broadband rollout. We support the Comic Relief and Children in Need telethons, and operate the fee-free MyDonate platform for online donations. Overview -

Page 12

10 Strategy -

Page 13

... the principal risks our business faces and what we do to mitigate these. 12 Chief Executive's introduction 13 Our strategy 13 Customer service delivery 13 Cost transformation 14 Investing for the future BT SmartTalk is really convenient and saves me money too. Dan Hippey BT broadband customer... -

Page 14

...thank our people for making it happen. We have also invested in 4G mobile spectrum which will allow us to offer enhanced mobile broadband services to consumers and businesses - helping our customers to stay 'best connected' wherever they are. The spectrum allows us to build on our existing strength... -

Page 15

... local government organisations. We also sell wholesale telecoms services to communications providers (CPs) in the UK and internationally. Our strategy is built on Customer service delivery, Cost transformation and Investing for the future. These are the foundations for making BT a better business... -

Page 16

... over the world's largest in-country wi-ï¬ network and free BT Cloud storage. We offer our broadband service together with voice and TV in competitively-priced bundles. Bundling helps us keep existing customers and attract new ones. Fibre broadband lets people do even more. BT Inï¬nity sales have... -

Page 17

...customers tell us there are a number of things which make us stand out: our global assets, people and technology; industry experience and solutions; our consulting capability; our innovation; and our strength in the UK. Our future plans are to invest and build on these strengths. - We are supporting... -

Page 18

... of 10 people in the UK will have access to ï¬bre-based products and services 3:1 We will help customers reduce carbon emissions by at least three times the end-to-end carbon impact of our business £1bn To use our skills and technology to help generate more than £1bn for good causes Connected... -

Page 19

..., usually on contracts spanning several years. Contract durations with our wholesale customers range from just one month for regulated products, to ï¬ve years or more for major managed services deals. What sets us apart We have a unique combination of people, brand, networks and technology. And we... -

Page 20

... we spend less time and money putting things right. This reinforces our ï¬nancial strength and helps us to invest in the things that set us apart. A virtuous circle. That is why the three foundations of our strategy - Customer service delivery, Cost transformation and Investing for the future - are... -

Page 21

... of good people management. We track our performance in lots of different ways. But our sickness absence rate (SAR) is a key measure. In 2012/13 we missed our target to cut our SAR to 2.05% after some of our people experienced more strain caused in part by the bad weather. Our sick pay costs were... -

Page 22

... broadband satellite network as shown on the map on page 21. We are expanding our UK and global IP Exchange service (GIPX). We have more than 150 customers in the UK alone on this product and we have plans in place to add new features to support services such as HD voice and video calling. This year... -

Page 23

...Europe and the Middle East. They help us to maintain our view of global developments in new technologies, business propositions and market trends. This year we opened a new research laboratory with Tsinghua University in China. In 2012/13 we ï¬led patent applications for 69 inventions. We routinely... -

Page 24

... to invest in the business, repay debt, support the pension scheme and pay dividends. Our key free cash ï¬,ow measure changed from adjusted free cash ï¬,ow to normalised free cash ï¬,ow in 2012/13 following the £2.0bn lump sum pension deï¬cit payment made in March 2012. The £520m tax credit... -

Page 25

... teams to review. Audit & risk committees in each line of business, and our service unit, ensure this process is effective. Audit & Risk Committee Group Risk Panel The Group Risk Panel supports the Board and the Operating Committee. Every three months it reviews the Group Risk Register (which... -

Page 26

... legacy networks and the development of new technologies. The recoverability of these upfront costs may be impacted by delays or failure to meet milestones. Substantial performance risk exists in these contracts. Changes over the last year The difï¬cult economic and market conditions, particularly... -

Page 27

... centres on successfully executing our strategy. We believe that delivering this strategy, with its focus on Customer service delivery, Cost transformation and Investing for the future, as well as investing in our existing business and offering new services in adjacent markets, will together help... -

Page 28

... also lead to reputation and brand damage with investors, regulators and customers. Risk mitigation We have in place a number of controls to address risk in this area. These include a comprehensive anti-corruption and bribery programme, 'The Way We Work', which is our statement of business practice... -

Page 29

...ï¬cant harm to our business and the BT brand, as well as potentially impact our cost transformation and efï¬ciency plans. Changes over the last year Many suppliers continue to be impacted by the global economic downturn and as a result we have seen an increase in the number of suppliers suffering... -

Page 30

-

Page 31

...us. 30 Operating Committee 31 How we deliver our strategy 31 How we are organised 31 BT Global Services 32 BT Retail 34 BT Wholesale 34 Openreach 35 BT Technology, Service & Operations 36 Our customers and markets 36 UK consumers 37 UK SMEs 37 Large corporate and public sector customers 38 Wholesale... -

Page 32

...key management committee is the Operating Committee, which meets weekly and is chaired by the Chief Executive. Its members are set out below. The Operating Committee has responsibility for running our business and delivering our strategy. It monitors the group's ï¬nancial, operational and customer... -

Page 33

...Retail BT Wholesale Openreach BT Technology, Service & Operations BT Global Services We are a global leader in managed networked IT services. We work for around 7,000 large corporate and public sector customers in more than 170 countries worldwide. We focus on serving the following key industries... -

Page 34

... around the world provide consulting, integration and managed services to our customers. They help solve business problems. They have a range of specialisms, certiï¬cations and accreditations to make sure customers get the best out of our products and services. Industry-speciï¬c solutions As every... -

Page 35

..., cash machines and payment terminals, taxis and ï¬,eet management Public payphones and managed prison, card and private payphones More than ï¬ve million UK hotspots offering broadband on the move to consumers and small businesses and to wholesale customers like mobile network operators IT products... -

Page 36

... operational and future capital spending. We design, build, manage and transform networks for them, while our white-label managed services help them offer products like voice and broadband without the need to make large investments. Our solutions can be either dedicated to one customer or shared... -

Page 37

... & Design and BT Operate, our two internal service units, to form BT Technology, Service & Operations (BT TSO). There were around 17,000 people in BT TSO at 31 March 2013, supporting our customer-facing lines of business. We created it to simplify the way we work, help us further transform our cost... -

Page 38

... customers (including business customers). We are the UK's biggest broadband provider with a 31% share of the total broadband market at 31 March 2013. Excluding cable, we have a 38% share. As with ï¬xed calls and lines, Sky, Virgin Media and TalkTalk are the other big players. Mobile operator... -

Page 39

... market. Large corporate and public sector customers Large corporate and public sector customers are served by BT Global Services. They are our biggest segment by external revenue. Gartner, a leading information technology research and advisory company, estimates that the global business ICT market... -

Page 40

... the year. We also supply a range of services to other telecoms companies. BT Global Services 2012/13 revenue by sector Corporate customers Public sector (UK and overseas) Financial Institutions Transit Other global carriers 46% 26% 19% 6% 3% Outside the UK, we offer wholesale telecoms services to... -

Page 41

... WBC) - the Wholesale narrowband market (comprising calls and interconnection services). Where we are found to have SMP, Ofcom will carry out consultations on setting controls. These could change the prices we charge for these products. Ofcom has recently opened a compliance investigation following... -

Page 42

-

Page 43

...Group Finance Director's introduction 43 Group ï¬nancial performance 43 Group results 44 Overview 44 Outlook 44 Income statement 47 Cash ï¬,ow 48 Net debt 49 Taxation 50 Capital expenditure 50 Balance sheet 51 Pensions 52 Other information 53 Line of business performance 53 BT Global Services 55 BT... -

Page 44

... performances in BT Global Services, BT Retail's Business and Consumer divisions and in BT Wholesale. We reduced our underlying operating costs excluding transit by 6% in the year. Some of this reï¬,ects the decline in revenue, but the majority is the result of our cost transformation activities... -

Page 45

... We have made good progress in a number of areas and delivered strong ï¬nancial results for the year. The investments we have made will support our aim to drive proï¬table revenue growth. Group results Revenue Year ended 31 March £m 20,500 20,076 20,076 EBITDA Year ended 31 March £m 6,200... -

Page 46

...ï¬bre broadband network, TV or in 4G spectrum. These are long-term investments which will help in achieving our aim to generate proï¬table revenue growth in the future. Income statement Summarised income statement Year ended 31 March Before speciï¬c items Revenue Other operating income Operating... -

Page 47

... sales, marketing and transport costs, decreased by 11% (2011/12: 3%) due to the decline in revenue and the beneï¬t of our cost transformation programmes. 2012/13 cost basea Net labour costs POLOs Property & energy costs Network operating & IT costs Other 37% 21% 8% 5% 29% The table below provides... -

Page 48

... a number of years in the income statement. Year ended 31 March Net ï¬nance expense Timing differences: Derivative restructuring costs Annual coupon payment on maturing bonds Deferred income Impact of fair value accounting Net interest cash outï¬,ow 16 15 8 - 692 (4) - 8 - 685 (18) 73 38 6 944 2013... -

Page 49

... business has put us in a good liquidity and funding position. We generated normalised free cash ï¬,ow of £2,300m which was in line with our expectation for the year and level with the prior year. Growth in our proï¬ts and efï¬ciencies in our capital expenditure programmes helped generate strong... -

Page 50

... of dividends we pay to shareholders. We manage the capital structure based on economic conditions and the risk characteristics of the group. The Board reviews the capital structure regularly. No changes were made to our objectives and processes during 2012/13 or 2011/12. Our general funding policy... -

Page 51

... of overpayments made in prior years, following the tax deductible pension deï¬cit payment made in March 2012 and the use of capital allowances that we had not previously claimed. We paid non-UK corporate income taxes of £63m (2011/12: £47m, 2010/11: £34m). Tax strategy Our aim is to comply... -

Page 52

... 600 300 0 2011/12 2012/13 Customer Fibre Network Broadband Support/Other Balance sheet Summarised balance sheet Our balance sheet primarily reï¬,ects the signiï¬cant investments in infrastructure that are the foundations of our business, and our capital management and funding strategy with which... -

Page 53

... Saving Scheme (BTRSS) is the current arrangement for UK employees who joined the group after 1 April 2001. It has around 22,000 active members. The BTPS and BTRSS are not controlled by the Board. The BTPS is managed by a separate and independent corporate trustee. The BTRSS is a contract-based... -

Page 54

... Operating lease obligations Capital commitments Programme rights commitments Pension deï¬cit obligations Total a Excludes fair value adjustments for hedged risks. b Includes £236m of accrued interest due within less than one year. At 31 March 2013, our cash, cash equivalents and current asset... -

Page 55

... co-operation with suppliers, and improve efï¬ciency; and BT Connect network services to link 160 locations globally Cloud-based contact centre services covering up to 1,800 agents to improve customer service at busiest times Managed solutions for payments processing and corporate services Caixa... -

Page 56

...to cut contract delivery costs. We are working with suppliers to leverage best practice and improve pricing across some of our major contracts. - Processes. We are transforming our end-to-end customer service processes. By moving contract management back-ofï¬ce functions into shared service centres... -

Page 57

... have cut costs. We have grown our broadband market share and our ï¬bre customer base. We have made good progress on TV, launching YouView from BT and securing great content for BT Sport. BT Business improved its revenue trend with good growth in IT services. Key facts Underlying revenue excluding... -

Page 58

... seen good growth in government and business contracts in the Republic of Ireland. We signed a wholesale deal to provide BSkyB with managed voice and broadband services to support their launch in the Republic of Ireland. We were also selected as the NI Direct strategic partner to develop and improve... -

Page 59

... with Dolby to develop new services using innovative technology that makes audio conference calls feel more like face-to-face meetings. In June 2012 we combined all our wi-ï¬ activities into one identity: BT Wi-ï¬. We have won a number of major deals, including contracts with Barclays bank... -

Page 60

... of managed service re-signs and growth in Ethernet and IP Exchange drove an improved trend in underlying revenue excluding transit during the year. Hard work on costs delivered an improved EBITDA trend as well. Key facts Revenue decreased by 2% (2011/12: 4%) with declines in calls and lines partly... -

Page 61

...- new management information and routing systems to support growth in international voice calls - a new online portal that will offer better tools for pricing, ordering and support. We also invested in our customer service operations, to help cut costs and make it easier for customers to do business... -

Page 62

...have now increased ï¬bre broadband coverage to more than 15m premises and achieved 873,000 net connections in the year. Our physical line base grew by 54,000. But our service performance was not good enough, affected by the poor weather conditions. Key facts Cost transformation Net operating costs... -

Page 63

... report at www.bt.com/betterfuture a CO e emissions ï¬gures restated based on 2012 DEFRA reporting guidelines. 2 Performance Employee engagement index - a measure of the success of our relationship with employees, through our annual employee attitude survey Maintain or improve the 2011/12 level... -

Page 64

62 Governance -

Page 65

... and Responsible Business Chairman's report 77 Report on Directors' Remuneration 93 Directors' information 94 General information 97 Shareholders and Annual General Meeting Find out more online at www.btwholesale.com EE is the ï¬rst mobile operator to bring 4G services to the UK. BT Wholesale... -

Page 66

... 9 May 2013 Our governance structure The Board has ultimate responsibility for the management of the group, and has structured its committees as set out below. BT Group plc Board Audit & Risk Committee Nominating & Governance Committee Remuneration Committee BT Pensions Committee Committee for... -

Page 67

...become European marketing director. Other appointments include Non-executive director of British Airways. Governance Governance Equality of Access Board Key to membership of Board committees Operating Audit & Risk Remuneration Nominating & Governance Sustainable and Responsible Business BT Pensions -

Page 68

... Friends Life Group, Business in the Community and Travelex. Also a trustee of Action Medical Research and BBC Children in Need. Karen Richardson Non-executive director Appointed to the Board in November 2011. A US national, age 50. Skills and experience With a 25 year career in the technology and... -

Page 69

... the group's performance, in addition to discharging certain legal responsibilities. It approves BT's: Our principal focus is on: Strategy Development Growing shareholder value Oversight and control Corporate governance 2006 2007 2008 2009 2010 2011 2012 2013 Calendar year The Board viewed... -

Page 70

... of information and BT's share dealing code. Role of the Chief Executive The Chief Executive is responsible for the performance and management of the group's business and success in achieving its goals and targets while managing the risks. His key responsibilities include: - proposing strategies... -

Page 71

... with the Chairman and non-executive directors. Separate reviews have taken place outside Board meetings with individual non-executive directors and management teams in key business areas such as TV, ï¬bre and customer service. Opportunities for the Board members to have greater visibility of... -

Page 72

... main Board committees; the powers delegated to those committees; corporate governance policies and procedures, including the powers reserved to our most senior executives; and the latest ï¬nancial information. We organise meetings with each of the executive and non-executive directors, members of... -

Page 73

...Board to assist in its review and approval of the results announcements and the Annual Report & Form 20-F. Governance Governance "Over the past year we have paid particular attention to increasing our understanding beyond group level risks. We have attended line of business audit & risk committees... -

Page 74

...You can ï¬nd details of the Board and our review of the group's systems of internal control and risk management on page 95. We received updates on security and resilience, cyber security, BT's networks, major contracts, BT's operations in Italy, customer data handling, litigation trends, as well as... -

Page 75

..., our whistleblowing procedures, and we have a code of ethics for the Chief Executive, Group Finance Director and senior ï¬nance managers as required by the Sarbanes-Oxley Act. We keep under review that the Board and its committees are appropriately receiving assurances on all major governance and... -

Page 76

... & Governance Committee on 30 October 2012 to facilitate the link with the Audit & Risk Committee - Gavin Neath joined the Committee for Sustainable and Responsible Business as an independent member on 1 November 2012. We reviewed our terms of reference and recommended some changes to the Board... -

Page 77

... 2013. We believe this investment strategy provides an appropriate balance of risk and return. "We are responsible to the Board for overseeing BT's relationship with the Trustee of the BT Pension Scheme, in the interests of pension scheme members themselves, as well as our shareholders, employees... -

Page 78

... Better Future programme we oversee investment in projects which make a difference for the communities in which we operate, and for our environment. We focus on the use of technology and support the volunteering activities of employees. The investment by the group in 2012/13 was £27m (in time, cash... -

Page 79

... to executive directors in respect of their service in 2012/13. The committee continues to consider the pay and conditions of our employees when setting salary increases for our most senior executives. A comparison with UK employees is used, reï¬,ecting the fact that the majority of group employees... -

Page 80

... directors, are paid by reference to the market rate - performance for managers is measured and rewarded through a number of performance-related bonus schemes across the group - business unit performance measures are cascaded down through the organisation - BT offers employment conditions that... -

Page 81

... aligns remuneration metrics with results delivered by the group's underlying trading activities and key measures of performance in our reported results. The deï¬nition of normalised free cash ï¬,ow is set-out on page 22. Customer service is measured by rigorous and challenging 'Right First Time... -

Page 82

... that are similar to parts of BT's business or operate in comparable markets. The other 50% is based on a three-year cumulative reported free cash ï¬,ow measure. The TSR comparator group for the ISP 2010 comprised the following companies: Accenture AT & T Belgacom BSkyB BT Group Cap Gemini Centrica... -

Page 83

...for executive directors with BT performance against other major companies. Targets for free cash ï¬,ow reï¬,ect the importance to the group of investment in the business, repayment of debt, support to the pension scheme and payment of dividends. The revenue growth measures align with the group's aim... -

Page 84

... making changes to executive pay structure in 2014/15 subject to approval at the 2014 AGM. The annual bonus structure for 2013/14 is set out below. Chief Executive and Group Finance Director % Weighting Adjusted earnings per share Normalised free cash ï¬,ow Revenue growtha Customer service Personal... -

Page 85

... to be awarded. An estimate of the number of shares awarded calculated using the average closing market share price for the 3 month period 1 February to 30 April 2013 of £2.77. 2013/14 Remuneration Scenarios The committee has considered the level of total remuneration that would be payable under... -

Page 86

...Variable remuneration Long term incentives For a number of years we have generally used treasury shares to satisfy the exercise of share options and the vesting of share awards under our employee share plans. We intend to use both treasury shares and shares purchased by the BT Group Employee Share... -

Page 87

... Board. This policy is not mandatory. Current shareholdings are shown on page 87. No element of non-executive remuneration is performance-related. Non-executive directors do not participate in BT's bonus or employee share plans and are not members of any of the company pension schemes. Governance... -

Page 88

... years in June 2012. Letters of appointment are for an initial period of three years. Commencement date 26 September 2007 1 June 2008 1 December 2008 1 June 2008 The agreement is terminable by the company on 12 months' notice and by the director on six months' notice. Expiry date of current service... -

Page 89

... equates to 10 BT Group plc ordinary shares. The directors, as a group, beneï¬cially own less than 1% of the company's shares. Voting at the 2012 Annual General Meeting The votes cast in respect of the Directors' Remuneration Report at the Annual General Meeting held on 11 July 2012 were: Votes... -

Page 90

... includes a monthly cash allowance in lieu of a company car or part of such allowance which has not been used for a company car. e Includes an additional fee for regular travel to Board and Board committee meetings. f Eric Daniels retired as a director on 12 June 2012. family, special life cover... -

Page 91

... be transferred to participants at the end of the three-year deferred period if those participants are still employed by BT Group. Total number of award shares 31 March Lapsed 2013 1,016,608 770,089 689,420 - 292,493 246,635 232,633 - 307,888 263,531 236,793 Monetary Market value of price vested... -

Page 92

... 2012. award of shares is linked to TSR compared with a group of 25 companies and 50% is linked to a three-year cumulative free cash ï¬,ow measure. The market price at vesting is an estimate of the value using the average closing market share price for the 3 month period 1 February to 30 April 2013... -

Page 93

.... The market price of BT shares at 31 March 2013 was 278p (2012: 226.4p) and the range during the year was 200.7p - 281p (2012: 161.0p - 232.1p). Pensions The BT Pension Scheme (BTPS) closed to new entrants on 31 March 2001. None of the executive directors participate in future service accrual in... -

Page 94

... Plan (ESIP) at 31 March 2013 Total number of shares at 31 March 2013 I Livingston T Chanmugam G Patterson 363 679 247 During the year no awards were made under the ESIP. All UK employees may participate in the ESIP. The awards are not subject to any performance conditions. Former directors... -

Page 95

... statements include information on the group's investments, cash and cash equivalents, borrowings, derivatives, ï¬nancial risk management objectives, hedging policies and exposures to interest, foreign exchange, credit, liquidity and market risks. Alongside the factors noted above, the directors... -

Page 96

...independent directors and with written terms of reference which, in addition to identifying individuals qualiï¬ed to become board members, develops and recommends to the Board a set of corporate governance principles applicable to the company. We have a Nominating & Governance Committee whose terms... -

Page 97

... and promote effective risk management in the lines of business and internal service unit operations - the Audit & Risk Committee, on behalf of the Board, considers the effectiveness of the operation of internal control procedures in the group during the ï¬nancial year. It reviews reports from the... -

Page 98

... It has also approved the group's corporate governance framework, which sets out the high level principles by which BT is managed and the responsibilities and powers of the Operating Committee and the group's senior executives. As part of this framework, the development and implementation of certain... -

Page 99

... the Company Secretary notiï¬es directors of changes in the holdings of the principal shareholders. We have established procedures to ensure the timely release of inside information and the publication of ï¬nancial results and regulatory ï¬nancial statements. A committee of senior executives, the... -

Page 100

98 -

Page 101

...At the end of 2012, it was one of the ï¬rst communities to beneï¬t from the ï¬bre rollout programme in the region. Local businesses and residents are enjoying signiï¬cantly quicker internet and download speeds as a result. In fact, BT has invested more in ï¬bre broadband (without public support... -

Page 102

... the UK Corporate Governance Code speciï¬ed for our review; and - certain elements of the Report on Directors' Remuneration. Other matter We have reported separately on the parent company ï¬nancial statements of BT Group plc for the year ended 31 March 2013 and on the information in the Report on... -

Page 103

...Registered Public Accounting Firm to the Board of Directors and Shareholders of BT Group plc (the 'company') In our opinion, the accompanying Group income statements, Group statements of comprehensive income, Group balance sheets, Group statements of changes in equity and Group cash ï¬,ow statements... -

Page 104

102 Financial statements Group income statement Before speciï¬c items £m 18,253 ...Year ended 31 March 2012 Revenue Other operating income Operating costs Operating proï¬t (loss) Finance expense Finance income Net ï¬nance (expense) income Share of post tax proï¬t of associates and joint ventures... -

Page 105

... - - (329) (329) (2,323) 2,244 (79) - 42 (366) 239 (127) Year ended 31 March 2011 Revenue Other operating income Operating costs Operating proï¬t (loss) Finance expense Finance income Net ï¬nance expense Share of post tax proï¬t of associates and joint ventures Proï¬t on disposal of interest in... -

Page 106

104 Financial statements Group balance sheet At 31 March Non-current assets Intangible assets Property, plant and equipment Derivative ï¬nancial instruments Investments Associates and joint ventures Trade and other receivables Deferred tax assets Notes 13 14 26 22 16 10 2013 £m 3,258 14,153 1,... -

Page 107

... for the year Other comprehensive income (loss) - before tax Tax on other comprehensive income (loss) Transferred to the income statement Comprehensive income (loss) Dividends to shareholders Share-based payments Tax on share-based payments Net issuance of own shares At 31 March 2013 Share capitala... -

Page 108

... share capital Net cash used in ï¬nancing activities Net increase (decrease) in cash and cash equivalents Opening cash and cash equivalents Net increase (decrease) in cash and cash equivalents Effect of exchange rate changes Closing cash and cash equivalents a Includes pension deï¬cit payments... -

Page 109

...of BT Group plc, the parent company. Changes in accounting policies and standards adopted The group's policy for the recognition of government grants was changed from 1 April 2012. Under the new policy, which is set out on page 113, assets and operating costs are recognised net of government grants... -

Page 110

... life expectancy of the members, the salary progression of our current employees, the return that the pension fund assets will generate in the time before they are used to fund the pension payments, price inï¬,ation and the discount rate used to calculate the net present value of the future pension... -

Page 111

... non-current assets. These costs are then recognised in the income statement on a straight line basis over the remaining contract term, unless the pattern of service delivery indicates a different proï¬le is appropriate. These costs are directly attributable to speciï¬c contracts, relate to future... -

Page 112

... customer groups to which it provides communications products and services via its customer-facing lines of business: BT Global Services, BT Retail, BT Wholesale and Openreach. The customer-facing lines of business are supported by an internal service unit: BT Technology, Service & Operations (BT... -

Page 113

... available for use, on a straight line basis over the programming period, or the remaining licence term, as appropriate. The amortisation charge is recorded within operating costs in the income statement. Programmes produced internally are recognised within current assets at production cost, which... -

Page 114

... tax Current income tax is calculated on the basis of the tax laws enacted or substantively enacted at the balance sheet date in the countries where the company's subsidiaries, associates and joint ventures operate and generate taxable income. The group periodically evaluates positions taken in tax... -

Page 115

... payments The group operates a number of equity settled share-based payment arrangements, under which the group receives services from employees in consideration for equity instruments (share options and shares) of the group. Equity settled share-based payments are measured at fair value at the date... -

Page 116

... costs and then re-measured at subsequent reporting dates to fair value, with unrealised gains and losses (except for changes in exchange rates for monetary items, interest, dividends and impairment losses, which are recognised in the income statement) recognised in equity until the ï¬nancial asset... -

Page 117

... approximately £120m (2011/12: £100m). The service cost that will be recognised in the income statement in 2013/14 is estimated to be around £50m higher than the restated cost for 2012/13 mainly due to the change in discount rate and inï¬,ation assumptions. The net pension interest expense within... -

Page 118

116 Financial statements 4. Segment information The deï¬nition of the group's operating and reportable segments is provided on page 110. Information regarding the results of each reportable segment is provided below. Segment revenue and proï¬t Year ended 31 March 2013 Segment revenue Internal ... -

Page 119

... by transfer pricing levels. BT Global Services does not generate internal revenue from the other lines of business. The majority of internal trading relates to Openreach and arises on rentals, and any associated connection or migration charges, of the UK access lines and other network products to... -

Page 120

118 Financial statements 4. Segment information continued Capital expenditure Year ended 31 March 2013 Intangible assets Property, plant and equipment Capital expenditurea Purchases of telecommunications licences BT Global Services £m 153 372 525 - 525 a Before purchases of telecommunications ... -

Page 121

Financial statements 119 5. Other operating income Year ended 31 March Proï¬ts on disposal of property, plant and equipment Income from repayment works Other income Other operating income before speciï¬c items Speciï¬c items Other operating income 9 Note 2013 £m 132 83 177 392 7 399 2012 £m ... -

Page 122

... the proportion of other non-audit services to total services is considered the most suitable measure of the level of non-audit services provided. These represented 17% of the total fees in 2012/13 (2011/12: 17%, 2010/11: 18%). The BT Pension Scheme is an associated pension fund as deï¬ned in the... -

Page 123

... against revenue with an equal reduction in operating costs. b In 2011/12 a loss arose on the disposal of the group's 51% shareholding in its subsidiary Accel Frontline Limited. c The components of the restructuring charges recognised in 2012/13, 2011/12 and 2010/11 were: people and property charges... -

Page 124

122 Financial statements 10. Taxation Analysis of taxation (expense) credit for the year Year ended 31 March United Kingdom Corporation tax at 24% (2011/12: 26%, 2010/11: 28%) Adjustments in respect of prior periods Non-UK taxation Current Adjustments in respect of prior periods Total current tax ... -

Page 125

...521) Tax credit recognised directly in equity Year ended 31 March Tax credit relating to share-based payments 2013 £m 68 2012 £m 17 2011 £m 91 Deferred taxation Retirement Excess capital beneï¬t allowances obligationsa £m £m At 1 April 2011 (Credit) recognised in the income statement (Credit... -

Page 126

...Financial statements 10. Taxation continued Factors affecting future tax charges The rate of UK corporation tax changed from 24% to 23% on 1 April 2013. As deferred tax assets and liabilities are measured at the rates that are expected to apply in the periods of the reversal, deferred tax balances... -

Page 127

... of the current year pence per share 5.7 3.0 8.7 £m 449 235 684 pence per share 5.0 2.6 7.6 2012 £m 388 201 589 pence per share 4.6 2.4 7.0 2011 £m 357 186 543 The Board recommends that a ï¬nal dividend in respect of the year ended 31 March 2013 of 6.5p per share will be paid to shareholders on... -

Page 128

... differences At 1 April 2012 Charge for the year Disposals and adjustments Exchange differences At 31 March 2013 1,357 - - (7) (11) 1,339 - 33 - (8) 46 1,410 Customer relationships and brands £m 338 - - (13) - 325 - 28 - - 5 358 242 34 (6) - 270 18 - 3 291 Telecoms licences and other £m 288... -

Page 129

... by the Board covering a three-year period and a further two years approved by the line of business and group senior management team. They reï¬,ect management's expectations of revenue, EBITDA growth, capital expenditure, working capital and operating cash ï¬,ows, based on past experience and future... -

Page 130

128 Financial statements 14. Property, plant and equipment Land and buildingsa £m Cost At 1 April 2011 Additions Interest on qualifying assets Transfers Disposals and adjustments Exchange differences At 1 April 2012 Additionsc Acquisitions Transfers Disposals and adjustments Exchange differences ... -

Page 131

... related costs of £1m have been recognised in operating costs in the group income statement. 16. Trade and other receivables At 31 March Non-current Other assetsa leasing debtors of £98m (2011/12: £84m). 2013 £m 184 2012 £m 169 a Other assets includes costs relating to the initial set up... -

Page 132

...not past due At 31 March BT Global Services BT Retail BT Wholesale Openreach Other Total 2013 £m 564 316 64 21 2 967 2012 £m 609 212 90 27 9 947 Accrued income 2013 £m 399 68 135 75 6 683 2012 £m 396 93 176 59 6 730 Given the broad and varied nature of the group's customer base, the analysis of... -

Page 133

...) 17 (4) 456 112 - (211) (35) 322 2013 £m 120 510 630 a Amounts provided in relation to the BT Global Services restructuring programme and the contract and ï¬nancial reviews in 2008/09 as well as provisions relating to the group-wide b Property provisions mainly comprise onerous lease provisions... -

Page 134

... company or members. The income statement service cost in respect of deï¬ned beneï¬t plans represents the increase in the deï¬ned beneï¬t liability arising from pension beneï¬ts earned by active members in the current period. The company is exposed to investment and other experience risks and... -

Page 135

... below. Year ended 31 March Recognised in the income statement before speciï¬c items Current service cost: - deï¬ned beneï¬t plans - deï¬ned contribution plans Total operating expense Speciï¬c items (note 9) Interest expense on pension plan liabilities Expected return on pension plan assets Net... -

Page 136

... between actual investment performance in the year and the expected rate of return on assets assumed at the start of the year. Group balance sheet The net pension obligation in respect of deï¬ned beneï¬t plans reported in the group balance sheet is set out below. 2013 Present value of liabilities... -

Page 137

...by employer Included in the group cash ï¬,ow statement Contributions by employees Beneï¬ts paid Other movements Exchange differences Other movements At 1 April 2012 Current service cost Interest expense on pension plan liabilities Expected return on pension plan assetsa Included in the group income... -

Page 138

...return on assets at the end of the year is derived using the expected long-term rates of return for each category of asset weighted by the target asset allocation. The resulting percentage at 31 March 2012 has been used to calculate the expected return on plan assets reported in the income statement... -

Page 139

Financial statements 137 19. Retirement beneï¬t plans continued BTPS liabilities under IAS 19 Valuation methodology The liabilities of the BTPS are measured as the present value of the best estimate of future cash ï¬,ows to be paid out by the scheme using the projected unit credit method. The ... -

Page 140

...19 pension liability at 31 March 2013, and of the income statement charge for 2013/14, to changes in these assumptions. (Decrease) Decrease Decrease increase in (increase) in (increase) in net ï¬nance liability service cost income £bn £m £m 0.25 percentage point increase to: - discount rate - in... -

Page 141

... the funding deï¬cit in the period from 31 December 2008 to 30 June 2011 reï¬,ects an increase in scheme assets due to deï¬cit contribution payments totalling £1.6bn and strong investment performance of 10.1% per year. The liabilities increased due to a lower discount rate which was partly offset... -

Page 142

... the scheme. Shareholder distributions include dividends and the cost of share buybacks (excluding any possible buybacks associated with existing employee share plans) after deducting any proceeds from the issue of shares. BT will consult with the Trustee if it considers making a special dividend or... -

Page 143

... BT Group plc shares. The treasury shares and the shares in the Trust are being utilised to satisfy the group's obligations under its employee share plans. Further details on Employee Sharesave Plans and Executive share plans are provided in note 21. Financial statements a At 31 March 2013... -

Page 144

... This price is usually set at a 20% discount to the market price for ï¬veyear plans and 10% for three-year plans. The options must be exercised within six months of maturity of the savings contract, otherwise they lapse. Similar plans operate for BT's overseas employees. Incentive Share Plan Under... -

Page 145

...37 10 months 22 months 34 months 46 months 58 months Normal dates of vesting and exercise (based on calendar years) 2013 2014 2015 2016 2017 Total Exercise price per share 104p-185p 61p-175p 104p-189p 156p-168p 168p 490 26 months GSOP and GLOP (Legacy Executive Plans) During 2012/13 12m (2011/12... -

Page 146

... fair values and key assumptions used for valuing grants made under the Employee Sharesave plans and ISP in 2012/13, 2011/12 and 2010/11. 2013 Year ended 31 March Weighted average fair value Weighted average share price Weighted average exercise price Expected dividend yield Risk free rates Expected... -

Page 147

... right of set-off of the relevant cash and overdraft balances on bank accounts included within each scheme. The group's cash at bank included restricted cash of £91m (2011/12: £76m), of which £87m (2011/12: £68m) were held in countries in which prior approval is required to transfer funds... -

Page 148

146 Financial statements 24. Loans and other borrowings Capital management policy The objective of the group's capital management policy is to reduce net debt over time whilst investing in the business, supporting the pension scheme and paying progressive dividends. In order to meet this objective... -

Page 149

...) in US Dollars. The interest rates payable on loans and borrowings disclosed above reï¬,ect the coupons on the underlying issued loans and borrowings and not the interest rates achieved through applying associated cross-currency and interest rate swaps in hedge arrangements. Financial statements -

Page 150

... liabilities Listed bonds Finance leases Other loans and borrowings Total non-current liabilities Total 2013 £m 566 7 769 394 1,736 8,010 265 2 8,277 10,013 2012 £m 1,609 15 588 675 2,887 7,327 270 2 7,599 10,486 The carrying values disclosed in the above table reï¬,ect balances at amortised cost... -

Page 151

... 484 623 (338) 285 Less: future ï¬nance charges Total ï¬nance lease obligations (202) 272 Assets held under ï¬nance leases mainly consist of buildings and network assets. The group's obligations under ï¬nance leases are secured by the lessors' title to the leased assets. Financial statements -

Page 152

150 Financial statements 25. Finance expense and income Year ended 31 March Finance expense Interest on: - Financial liabilities at amortised cost - Finance leases - Derivatives Fair value movements: - Bonds designated as hedged items in fair value hedges - Derivatives designated as hedging ... -

Page 153

... exchange management services. Funding and deposit taking is usually provided in the functional currency of the relevant entity. The treasury operation is not a proï¬t centre and its objective is to manage ï¬nancial risk at optimum cost. Treasury policy Treasury policy is set by the Board. Group... -

Page 154

... Positive Rating BBB Baa2 2012 Outlook Stable Stable The group is targeting a BBB+/Baa1 credit rating over the medium term. Foreign exchange risk management Management policy The purpose of the group's foreign currency hedging activities is to protect the group from the risk that eventual future... -

Page 155

Financial statements 153 26. Financial instruments and risk management continued Hedging strategy A signiï¬cant proportion of the group's external revenue and costs arise within the UK and are denominated in Sterling. The group's non-UK operations generally trade and are funded in their ... -

Page 156

... payments not yet accrued Fair value adjustment for hedged risk Impact of discounting Carrying value on the balance sheeta applied at the relevant balance sheet date. - 78 - 10,231 a Foreign currency-related cash ï¬,ows were translated at closing rates as at the relevant reporting date. Future... -

Page 157

... reporting date. Future variable interest rate cash ï¬,ows were calculated using the most recent rate applied at the relevant balance sheet date. Credit risk management Management policy The group's exposure to credit risk arises from ï¬nancial instruments transacted by the treasury operation... -

Page 158

... of credit risk for trading balances of the group is provided in note 16, which analyses outstanding balances by line of business. The derivative ï¬nancial assets were held with 14 counterparties at 31 March 2013 (2011/12: nine counterparties). After applying the legal right of set-off under... -

Page 159

... swaps Interest rate swaps Forward foreign exchange contracts Total derivative ï¬nancial assets Total ï¬nancial assets Loans and receivables Notes £m 22 23 16 8 331 2,477 2,816 - - - - 2,816 Fair value Designated Designated through in a in a proï¬t cash ï¬,ow fair value and loss hedge hedge... -

Page 160

... the value of future cash ï¬,ows using approximate discount rates in effect at the balance sheet date where market prices of similar issues do not exist - the fair value of the group's outstanding swaps and foreign exchange contracts are estimated using discounted cash ï¬,ow models and market rates... -

Page 161

... exchange contracts and were estimated using discounted cash ï¬,ow models and market rates of interest and foreign exchange at the balance sheet date. All derivative ï¬nancial instruments are categorised at Level 2 of the fair value hierarchy. Investments Non-current investments analysed at Level... -

Page 162

160 Financial statements 26. Financial instruments and risk management continued The group had outstanding hedging arrangements at 31 March 2013 as follows: Remaining Derivative fair value Notional term principal Asset Liability of hedging Hedge type £m £m £m instruments Cash ï¬,ow Cash ï¬,ow ... -

Page 163

... in the new parent company, BT Group plc, and the aggregate of the share capital, share premium account and capital redemption reserve of the prior parent company, British Telecommunications plc. b The cash ï¬,ow reserve is used to record the effective portion of the cumulative net change in the... -

Page 164

162 Financial statements 28. Related party transactions Key management personnel comprise executive and non-executive directors and members of the Operating Committee. Compensation of key management personnel is disclosed in note 6. Amounts paid to the group's retirement beneï¬t plans are set out... -

Page 165

... statements of BT Group plc for the year ended 31 March 2013 which comprise the BT Group plc company balance sheet, the BT Group plc company reconciliation of movement in equity shareholders' funds, the BT Group plc accounting policies and related information. The ï¬nancial reporting framework... -

Page 166

... paid; ï¬nal dividends when authorised in general meetings by shareholders. Share capital Ordinary shares are classiï¬ed as equity. Repurchased shares of the company are recorded in the balance sheet as part of Own shares reserve and presented as a deduction from shareholders' equity at cost. Cash... -

Page 167

Financial statements 165 BT Group plc company balance sheet At 31 March Fixed assets Investments in subsidiary undertakingsa Total ï¬xed assets Current assets Cash at bank and in hand Total current assets Creditors: amounts falling due within one yearb Net current liabilities Total assets less ... -

Page 168

166 Financial statements BT Group plc company reconciliation of movement in equity shareholders' funds Share capitala £m At 1 April 2011 Loss for the ï¬nancial year Dividends paid Capital contribution in respect of share-based payment Net issuance of own shares At 1 April 2012 Proï¬t for the ... -

Page 169

...group did not have any signiï¬cant associates or joint ventures at 31 March 2013. Subsidiary undertakings British Telecommunications plc BT Americas Incd BT Australasia Pty Limited BT Business Direct Limited BT Communications do Brasil Limitadab Activity Communications related services and products... -

Page 170

-

Page 171

... measures Selected ï¬nancial data Financial and operational statistics Information for shareholders Cross reference to Form 20-F Glossary of terms This is one of the largest programmes of its kind ever undertaken by any company in Europe. Duncan Webb Commercial Director, BT Fleet WINNER Cost... -

Page 172

... or litigation claims, business restructuring programmes, asset impairment charges, property rationalisation programmes, net interest on pensions and the settlement of multiple tax years in a single payment. In 2008/09 BT Global Services contract and ï¬nancial review charges were disclosed as... -

Page 173

... at a corporate level independently of ongoing trading operations such as dividends, share buybacks, acquisitions and disposals and repayment of debt. Normalised free cash ï¬,ow is not a measure of the funds that are available for distribution to shareholders. Adjusted free cash ï¬,ow was a key... -

Page 174

... any discount over the term of the debt. For the purpose of this measure, current asset investments and cash and cash equivalents are measured at the lower of cost and net realisable value. Currency denominated balances within net debt are translated to Sterling at swap rates where hedged. This... -

Page 175

... ï¬nancial data Summary group income statement Year ended 31 March Revenue Adjusted Speciï¬c items Other operating income Adjusted Speciï¬c items Operating costs Adjusted Speciï¬c items Operating proï¬t Adjusted Speciï¬c items Net ï¬nance expense Adjusted Speciï¬c items Share of post tax pro... -

Page 176

174 Additional information Summary group balance sheet At 31 March Intangible assets Property, plant and equipment Other non-current assets Total non-current assets Current assets less current liabilities Total assets less current liabilities Non-current loans and other borrowings Retirement bene... -

Page 177

... on research and development Research and development operating expense Capitalised software development costs Total Capital expenditure Additions to property, plant and equipment comprised: Land and buildings Network infrastructure and other equipment Transmission equipment Exchange equipment Other... -

Page 178

...assets and investments. b Before speciï¬c items. c The number of times net ï¬nance expense is covered by operating proï¬t. d Before purchases of telecommunications licences. Operational statistics All values in thousands unless otherwise stated. Year ended 31 March BT Global Services 2013 2012... -

Page 179

...; our broadband service and strategy; our investment in BT Sport; the BT Pension Scheme recovery plan, operating charge, regular cash contributions and interest expense; capital expenditure; effective tax rate; shareholder returns including growing dividends and share buyback; growth opportunities... -

Page 180

... rate between Sterling and the US Dollar affect the US Dollar equivalent of the Sterling price of the company's ordinary shares on the London Stock Exchange and, as a result, are likely to affect the market price of the ADSs on the New York Stock Exchange. Background BT Group plc is a public... -

Page 181

... known to the company, the operation of which may at a subsequent date result in a change in control of the company. The company's major shareholders do not have different voting rights to those of other shareholders. At 3 May 2013, there were 8,151,227,029 ordinary shares outstanding, including 268... -

Page 182

... the tax treatment of dividends paid, see Taxation of dividends on page 187. Dividends have been translated from Sterling into US Dollars using exchange rates prevailing on the date the ordinary dividends were paid. Per ordinary share Financial years ended 31 March 2009 2010 2011 2012 2013 Interim... -

Page 183

Additional information 181 Dividend investment plan Under the Dividend investment plan, cash from participants' dividends is used to buy further BT shares in the market. Shareholders could elect to receive additional shares in lieu of a cash dividend for the following dividends: Date paid 2008/09 ... -

Page 184

... nine months 4th quarter and full year Annual Report 2014 published a Dates may be subject to change. Datea 25 July 2013 November 2013 February 2014 May 2014 May 2014 ShareGift The charity ShareGift specialises in accepting small numbers of shares as donations. Further information about ShareGift... -

Page 185

...paid on any class of shares on the dates stated for the payments of those dividends. The directors can offer ordinary shareholders the right to choose to receive new ordinary shares, which are credited as fully paid, instead of some or all of their cash dividend. Before they can do this, the company... -

Page 186

... remuneration referred to below, each director will be paid such fee for his services as the Board decide, not exceeding £65,000 a year and increasing by the percentage increase of the retail prices index (as deï¬ned by section 833(2) Income and Corporation Taxes Act 1988) for any 12-month... -

Page 187

... particular contract carried out in breach of those provisions. Directors' appointment and retirement Under BT's Articles there must be at least two directors, who manage the business of the company. The shareholders can vary this minimum and/or decide a maximum by ordinary resolution. The Board and... -

Page 188

... information Directors' borrowing powers To the extent that the legislation and the Articles allow, the Board can exercise all the powers of the company to borrow money, to mortgage or charge its business, property and assets (present and future) and to issue debentures and other securities... -

Page 189

... limitations applicable to foreign credits. There will be no right to any UK tax credit or to any payment from HMRC in respect of any tax credit on dividends paid on ordinary shares or ADSs. Certain US Holders (including individuals) are eligible for reduced rates of US federal income tax (currently... -

Page 190

... and other customers that require global communications connectivity, are insigniï¬cant to the group's ï¬nancial condition and results of operations. Under Section 219 of the Iran Threat Reduction and Syria Human Rights Act of 2012, which added Section 13 (r) to the Securities Exchange Act of... -

Page 191

....bt.com/betterfuture Document Summary ï¬nancial statement & notice of meeting Annual Report & Form 20-F Better Future: our annual sustainability report EAB Annual Report Quarterly results releases Current Cost Financial Statements The Way We Work, a statement of business practice Publication date... -

Page 192

...(General) or +1 651 453 2128 (From outside the US) or +1 800 428 4237 (Global Invest Direct) email: [email protected] www.equiniti.com General enquiries BT Group plc BT Centre 81 Newgate Street London EC1A 7AJ United Kingdom www.adr.com Tel: 020 7356 5000 Fax: 020 7356 5520 From outside... -

Page 193

... company History and development of the company Financial highlights Group ï¬nancial performance Group results Selected ï¬nancial data Information for shareholders Exchange rates Not applicable Not applicable 6 43 173 182 4B Business overview 4C Organisational structure 4D Property, plants... -

Page 194

... plans Share-based payments Board of Directors Reports of the Board Committees Report on Directors' Remuneration Our people Group ï¬nancial performance Income statement Operating costs Consolidated ï¬nancial statements Notes to the consolidated ï¬nancial statements Employees Reports of the Board... -

Page 195

...Share capital Memorandum and articles of association Material contracts Exchange controls Taxation Dividends and paying agents Statement by experts Documents on display Subsidiary information Quantitative and qualitative disclosures about market risk 178 Not applicable Information for shareholders... -

Page 196

... committee ï¬nancial expert 94 94 16B 16C Code of ethics Principal accountants' fees and services 120 71 180 16E 16F 16G Purchases of equity securities by the issuer and afï¬liated purchasers Change in registrant's reporting accountant Corporate Governance 94 17 18 Financial statements... -

Page 197

... which uses ï¬bre to provide high connection speeds for the whole route from the exchange to the customer FVA: Fibre Voice Access B BDUK: Broadband Delivery UK BTPS (BT Pension Scheme): the deï¬ned beneï¬t pension scheme which was closed to new members on 31 March 2001 BTRP (BT Retirement Plan... -

Page 198

...Additional information R 'Right First Time': the internal measure of whether we are keeping our promises to our customers and meeting or exceeding their expectations W WAN: wide area network WBC: wholesale broadband connect WLR: wholesale line rental - a product supplied by Openreach which is used... -

Page 199

-

Page 200

BT Group plc Registered ofï¬ce: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group www.bt.com PHME 67064 Printed in England by Pindar Scarborough Ltd Design by saslondon.com Typeset by RR Donnelley Printed on Amadeus 50 Silk which is made from 50% ...