Anthem Blue Cross 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

2012 Annual Report

Letter to Shareholders

Effective

Delivery System

Enhanced

Consumer Experience

Affordable

Health Care

29Strengthening our Foundation

Healthier

Communities

Continued

Financial Performance

To our shareholders,

When I assumed the role of WellPoint’s Interim President and CEO last August, I made three commit-

ments to our investors, our customers, our Board, and our associates: we would meet our financial

and operational objectives, close the Amerigroup transaction, and take the necessary steps to position

your company for success. I am pleased to say we delivered on each of these commitments, and I am

proud of what we’ve accomplished.

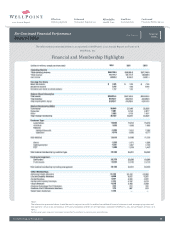

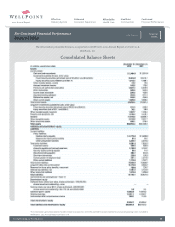

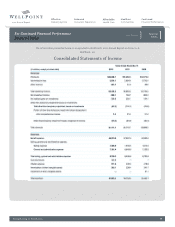

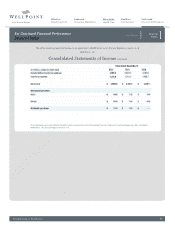

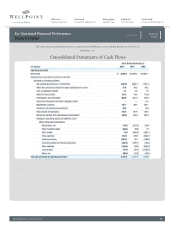

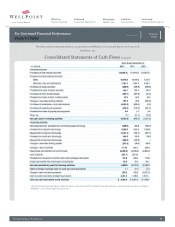

WellPoint’s financial performance improved over the course of 2012, driven by a combination of better

core operating performance and favorability in our capital management areas. Membership was up

5.5 percent, bringing our total medical membership to more than 36 million, and we continued to

manage our expenses responsibly while funding a diverse portfolio of strategic initiatives. Together,

these factors led to full year net income of $2.7 billion and adjusted net income of $7.56 per share, an

8.0 percent increase over 2011.

Outside of our financial performance, we took important steps in 2012 to position our company

for the opportunities ahead. We centered our strategy around four key growth areas: Medicare, the

Medicare-Medicaid dual eligibles, the emerging health insurance exchanges, and our specialty busi-

nesses, specifically vision and dental. We then matched the top talent from our company and our

recent acquisitions to create a best-in-class leadership team with deep market knowledge and specialized

operational expertise. By aligning our strategy and structure, we’ve empowered our leaders, enabling

them to better influence and more nimbly react to the factors that impact their businesses.

Near the end of 2012, we also successfully completed our acquisition of Amerigroup, a significant

accomplishment and testament to the leaders and workgroups on both sides of the transaction. We

now serve over 4.5 million Medicaid beneficiaries in 20 states, giving us the largest Medicaid footprint

in the industry. By retaining key operating talent and leveraging the proven care management models

of both Amerigroup and our CareMore subsidiary, we now have unmatched capabilities to manage

care for the nation’s growing high risk, high needs populations.