Airtran 2003 Annual Report Download - page 39

Download and view the complete annual report

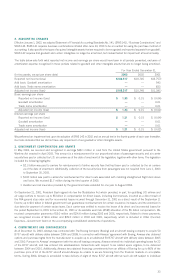

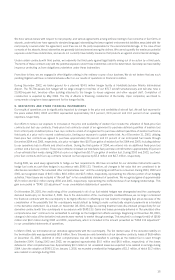

Please find page 39 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The notes are convertible into shares of Holdings’ common stock at a conversion rate of 89.9281 shares per $1,000 in principal

amount of the notes which equals an initial conversion price of approximately $11.12 per share. This conversion rate is subject to

adjustment in certain circumstances. Holders of the notes may convert their notes if after June 30, 2003, the price of Holdings’ common

stock exceeds 110 percent of the conversion price for at least 20 trading days in the 30 consecutive trading days ending on the last trading

day of the preceding quarter. During the third quarter of 2003, this condition was satisfied and, accordingly, the notes are convertible

into Holdings’ common stock. Holdings may redeem the notes, in whole or in part, beginning on July 5, 2010 at a redemption price

equal to the principal amount of the notes plus any accrued and unpaid interest. The holders of the notes may require Holdings to

repurchase the notes on July 1, 2010, 2013 and 2018 at a repurchase price of 100 percent plus any accrued and unpaid interest.

Holdings filed a shelf registration statement with the U.S. Securities and Exchange Commission covering the resale of the notes and

the underlying common stock which became effective in October 2003.

Holdings’ 7% Convertible Notes due 2023 contain provisions which allow the holders to redeem the notes at various dates beginning

on July 1, 2010. We may, at our option, elect to pay the repurchase price in cash, in shares of Holdings’ common stock or in any

combination of the two. Upon such a redemption, it is our intention to pay the repurchase price in cash.

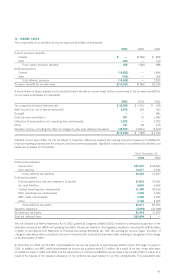

In June 2003, BCC exercised its remaining conversion rights related to Holdings’ 7.75% Series B Senior Convertible Notes. The

conversion resulted in a decrease of Holdings’ overall debt of $5.5 million. In connection with the conversion, Holdings issued

approximately 1.0 million shares of its common stock to BCC. In accordance with accounting principles generally accepted in the

United States, Holdings expensed $1.6 million of debt discount and $0.2 million of debt issuance costs that had not been amortized.

These amounts are shown on the accompanying consolidated statements of operations as “Other (Income) Expense—Deferred debt

discount/issuance cost amortization.”

In August 2003, we redeemed the remaining balance of $10.3 million of Holdings’ 13% Series A Senior Secured Notes. The terms of

the debt agreement required mandatory prepayments equal to 25 percent of Airways’ net income on a quarterly basis.

In October 2003, we redeemed the remaining balance of $70.3 million of Airways’ 11.27% Senior Secured Notes. In accordance with

accounting principles generally accepted in the United States, we expensed $7.0 million of debt discount and $3.5 million of debt

issuance costs that had not been amortized. These amounts are shown on the accompanying consolidated statements of operations

as “Other (Income) Expense—Deferred debt discount/issuance cost amortization.”

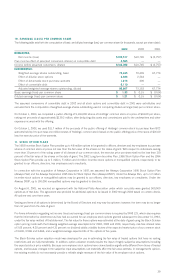

We completed a private placement of $178.9 million enhanced equipment trust certificates (EETCs) on November 3, 1999. The EETC

proceeds were used to replace loans for the purchase of the first 10 B717 aircraft delivered, and all 10 aircraft were pledged as

collateral for the EETCs. In March 2000, we sold and leased back two of the B717s in a leveraged lease transaction reducing the

outstanding principal amount of the EETCs by $35.9 million. Principal and interest payments on the EETCs are due semiannually

through April 2017.

During 2003 and 2002, we entered into capital lease agreements for various capital assets. See Note 8.

During 2002, we entered into a $15 million credit agreement with a term of one year which was extended to March 31, 2004. The

agreement allows us to obtain letters of credit and enter into hedge agreements with the bank. The agreement contains certain

covenant requirements including liquidity tests. The company is in compliance with these covenants. At December 31, 2003 and

2002, we had $13.3 million and $7.8 million, respectively, in letters of credit drawn against the credit agreement.

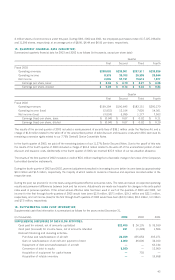

8. LEASES

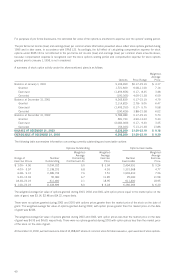

Total rental expense charged to operations for aircraft, facilities and office space for the years ended December 31, 2003, 2002 and

2001 was approximately $155.1 million, $96.6 million and $56.7 million, respectively.

We lease 63 B717s under leases with terms that expire through 2021. We have the option to renew the B717 leases for periods ranging

from one to four years. The B717 leases have purchase options at or near the end of the lease term at fair market value, and two have

purchase options based on a stated percentage of the lessor’s defined cost of the aircraft at the end of the 13th year of the lease term.

Forty-one of the B717 leases are the result of sale/leaseback transactions. Deferred gains from these transactions are being amortized

over the terms of the leases. At December 31, 2003 and 2002, unamortized deferred gains were $71.1 million and $73.7 million,

respectively. See Note 6. We also lease facilities from local airport authorities or other carriers, as well as office space under operating

leases with terms ranging from one month to 12 years. In addition, we lease ground equipment and certain rotables under capital leases.

37