Airtran 2003 Annual Report Download - page 36

Download and view the complete annual report

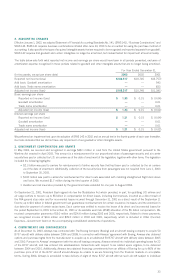

Please find page 36 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating leases mentioned above. There can be no assurance that sufficient financing will be available for all B737 aircraft and other

capital expenditures not covered by firm financing commitments.

Additionally, during 2003, Airways acquired 23 Boeing 717 (B717) aircraft in accordance with an agreement with Boeing and BCC,

bringing our total B717 fleet to 73 aircraft. One aircraft was delivered through a sale/leaseback transaction with an affiliate of BCC and

22 aircraft are subject to operating leases with affiliates of BCC. In July 2003, we cancelled our remaining six options to acquire six

B717 aircraft with Boeing and agreed to purchase 10 additional B717s during 2004 and 2005. These aircraft may be used or new

and shall either be subject to individual operating leases or sale/leaseback transactions with BCC or affiliates thereof.

During 2003, in connection with Airways’ agreements with Boeing, Airways was refunded $2.2 million in previously paid aircraft

deposits and paid $46.7 million in aircraft deposits under the new agreement with Boeing for the acquisition of B737 aircraft.

During 2002, we entered into a seven-year cancelable agreement with a regional jet contractor to provide regional jet service between

pre-determined city pairs. We pay the contractor to operate the flights and we are entitled to all the revenues associated with these

flights. Under this agreement, we paid the contractor $35.7 million and $3.0 million for the years ended December 31, 2003 and

2002, respectively. These payments are recorded on a net basis as a reduction to passenger revenue. In March 2004, we announced

that we had reached an agreement to end this regional jet service. The move to end this service came after we performed an economic

analysis and determined that we could operate B717 aircraft more efficiently in short-haul markets. The phase-out of service will begin

in July 2004 and all regional jet service will end in August 2004.

During 2003, we entered into a one-year charter agreement with a charter airline. Under this agreement, the charter airline provides

the aircraft, crew, maintenance on the aircraft and the hull and liability insurance in exchange for a fixed block hour rate for flights

operated on our behalf. During 2003, we paid this charter airline approximately $17.9 million. These payments are recorded on a net

basis as a reduction to passenger revenues.

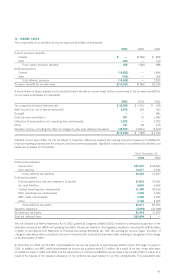

At December 31, 2003, we had commitments to purchase aircraft fuel under fixed-price contracts for use during 2004 and 2005 of

approximately $63.2 million. Subsequent to year-end, we entered into an additional fixed-price contract and a fuel cap contract for

2004 that increased our commitments to purchase fuel to $73.3 million. These contracts, used to reduce our exposure to increases

in fuel prices, cover approximately 35% and 12% of our planned fuel requirements for 2004 and 2005, respectively.

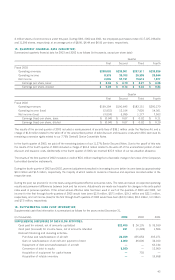

As of December 31, 2003, we had approximately 5,300 full-time equivalent employees. While there can be no assurance that our

generally good labor relations with our employees will continue, we have established as a significant component of our business

strategy the preservation of good relations with our employees, approximately 41 percent of whom are represented by unions.

Of those employees covered by collective bargaining agreements, approximately 60 percent presently have contracts under negotiations

or becoming amendable in 2004. The agreement with our mechanics and inspectors becomes amendable for pay rates only during

2004. We are currently in negotiations with our flight attendants whose contract became amendable in 2002. We continue to believe

that mutually acceptable agreements can be reached with these employees, although the ultimate outcome of the negotiations is

unknown at this time. Any labor disruptions which result in a prolonged significant reduction in flights could have a material adverse

impact on our results of operations and financial conditions.

We are party to many routine contracts under which we indemnify third parties for various risks. We have not accrued any liability for

any of these indemnities, as the likelihood of payment in each case is considered remote. These indemnities consist of the following:

Certain of Airways’ debt agreements related to certain aircraft-secured notes payable through 2014 and 2017 contain language

whereby we have agreed to indemnify certain holders of certificates evidencing the debt associated with such notes, as necessary, to

compensate them for any costs incurred by, or any reduction in receivables due to such certificate holders resulting from broadly

defined regulatory changes that impose or modify any reserve, special deposit or similar requirements relating to any extensions of

credit or other assets of, or any deposits with or other liabilities of such certificate holders. Additionally, if it becomes unlawful for such

certificate holders to make or maintain the investment or credit evidenced by the certificates, we have agreed to pay such certificate

holders an amount necessary to cause the interest rate with respect to the certificates to be a rate per annum equal to 4.88% over

the rate specified by such certificate holders as the cost to them of obtaining funds in dollars in the United States in an amount equal

to the pool balance of the certificates. The maximum potential payment under these indemnities cannot be determined.

Airways’ aircraft lease transaction documents contain customary indemnities concerning withholding taxes under which we are

responsible in some circumstances, should withholding taxes be imposed, for paying such amounts of additional rent as is necessary

to ensure that the lessor still receives, after taxes, the rent stipulated in the lease agreements. These provisions apply on leases expiring

through 2022. The maximum potential payment under these indemnities cannot be determined.

34