Airtran 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NEW PRODUCT

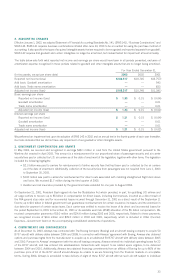

During 2003, we entered into a one-year charter agreement with a charter airline. Under this agreement, the charter airline provides

the aircraft, crew, maintenance on the aircraft and the hull and liability insurance in exchange for a fixed block hour rate for flights

operated on our behalf. During 2003, we paid this charter airline approximately $17.9 million. These payments are recorded on a net

basis as a reduction to passenger revenues.

RECENTLY ISSUED ACCOUNTING STANDARDS

Effective January 1, 2003, we adopted Statement of Financial Accounting Standards No. 146 (SFAS 146), “Accounting For Costs

Associated with Disposal or Exit Activities.” SFAS 146 nullifies Emerging Issues Task Force Issue No. 94-3, “Liability Recognition for

Certain Employee Termination Benefits and Other Costs to Exit an Activity.” SFAS 146 requires that a liability for a cost associated with

an exit or disposal activity be recognized and measured initially at fair value only when the liability is incurred. SFAS 146 is effective

for exit or disposal activities that are initiated after December 31, 2002. The adoption of SFAS 146 did not have a material impact on

our financial position, results of operations or cash flows.

We also adopted the Financial Accounting Standards Board (FASB) Interpretation 45 (FIN 45), “Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others.” FIN 45 requires a guarantor to

recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee. FIN 45

also expands the disclosures required to be made by a guarantor about its obligations under certain guarantees that it has issued.

Initial recognition and measurement provisions of FIN 45 are applicable on a prospective basis to guarantees issued or modified. This

interpretation applies to guarantees issued or modified after December 31, 2002 and has no impact on our consolidated results of

operations, consolidated balance sheet or consolidated cash flows. See Note 4.

Effective October 1, 2003, we adopted FASB Interpretation 46 (FIN 46), “Consolidation of Variable Interest Entities.” FIN 46 requires

the consolidation of certain types of entities in which a company absorbs a majority of another entity’s expected losses, receives a

majority of the other entity’s expected residual returns, or both, as a result of ownership, contractual or other financial interests in the

other entity. These entities are called “variable interest entities” or “VIEs.” The principal characteristics of VIEs are (1) an insufficient

amount of equity to absorb the entity’s expected losses, (2) equity owners as a group are not able to make decisions about the entity’s

activities or (3) equity that does not absorb the entity’s losses or receive the entity’s residual returns. “Variable interests” are contractual,

ownership or other monetary interests in an entity that change with fluctuations in the entity’s net asset value. As a result, VIEs can

arise from items such as lease agreements, loan arrangements, guarantees or service contracts.

If an entity is determined to be a VIE, the entity must be consolidated by the “primary beneficiary.” The primary beneficiary is the

holder of the variable interests that absorb a majority of the VIE’s expected losses or receive a majority of the entity’s residual returns

in the event no holder has a majority of the expected losses. There is no primary beneficiary in cases where no single holder absorbs

the majority of the expected losses or receives a majority of the residual returns. The determination of the primary beneficiary is based

on projected cash flows at the inception of the variable interest.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease aircraft

to us. These leasing entities meet the criteria of VIEs. We are generally not the primary beneficiary of the leasing entities if the lease

terms are consistent with market terms at the inception of the lease and do not include a residual value guarantee, fixed-price purchase

option or similar feature that obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft.

This is the case in the majority of our aircraft leases, however, we have two aircraft leases that contain fixed-price purchase option that

allow us to purchase the aircraft at predetermined prices on specified dates during the lease term. We have not consolidated the

related trusts because even taking into consideration these purchase options, we are still not the primary beneficiary based on our

cash flow analysis. Our maximum exposure under these leases is the remaining lease payments, which are reflected in future lease

commitments in Note 8 to the Consolidated Financial Statements.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK-SENSITIVE INSTRUMENTS AND POSITIONS

We are subject to certain market risks, including interest rates and commodity prices (i.e., aircraft fuel). The adverse effects of changes

in these markets pose a potential loss as discussed below. The sensitivity analyses do not consider the effects that such adverse

changes may have on overall economic activity, nor do they consider additional actions we may take to mitigate our exposure to such

changes. Actual results may differ. See the Notes to the Consolidated Financial Statements for a description of our financial policies

and additional information.

INTEREST RATES

As of December 31, 2003 and 2002, the fair value of our long-term debt was estimated to be $241.3 million and $210.2 million,

respectively, based upon discounted future cash flows using current incremental borrowing rates for similar types of instruments or

market prices. Market risk, estimated as the potential increase in fair value resulting from a hypothetical 100 basis point decrease in

interest rates, was approximately $6.0 million as of December 31, 2003, and approximately $9.6 million as of December 31, 2002.

Our long-term debt obligations bear fixed rates of interest and may be prepaid without penalty prior to their respective maturity dates

and, therefore, a change in market interest rates generally would not affect our financial position, results of operations or cash flows.

24