Airtran 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additionally, during 2003, AirTran Airways acquired 23 B717 aircraft in accordance with agreements with Boeing and BCC, bringing

our total B717 fleet to 73 aircraft. One aircraft was delivered through a sale/leaseback transaction with an affiliate of BCC and 22 aircraft

are subject to individual operating leases with affiliates of BCC. In July 2003, we cancelled our remaining six options to acquire six

B717 aircraft with Boeing and agreed to purchase 10 additional B717 aircraft during 2004 and 2005. These aircraft may be used or

new and shall either be subject to individual operating leases or sale/leaseback transactions with BCC or affiliates thereof. We also

obtained contingent options to acquire up to an additional four B717 aircraft under similar lease-financing arrangements.

During 2003, in connection with AirTran Airways’ agreements with Boeing, AirTran Airways was refunded $2.2 million in previously paid

aircraft deposits and paid $46.7 million in aircraft deposits under the new agreement with Boeing for the acquisition of B737 aircraft.

During 2002, we entered into a seven-year cancelable agreement with a regional jet contractor to provide regional jet service between

predetermined city pairs. We pay the contractor to operate the flights and we are entitled to all the revenues associated with these

flights. Under this agreement, we paid the contractor $35.7 million and $3.0 million for the years ended December 31, 2003 and

2002, respectively. These payments are recorded on a net basis as a reduction to passenger revenue. In March 2004, we announced

that we had reached an agreement to end this regional jet service. The move to end this service came after we performed an economic

analysis and determined that we could operate B717 aircraft more efficiently in short-haul markets. The phase-out of service will begin

in July 2004 and all regional jet service will end in August 2004.

At December 31, 2003, we had commitments to purchase aircraft fuel under fixed-price contracts for use during 2004 and 2005 of

approximately $63.2 million. Subsequent to year-end, we entered into an additional fixed-price contract for 2004 that increased our

commitments to purchase fuel to $73.3 million. These contracts, used to reduce our exposure to increases in fuel prices, cover

approximately 35% and 12% of our planned fuel requirements for 2004 and 2005, respectively.

During December 2002, we broke ground for a planned $14.5 million hangar facility at Hartsfield-Jackson Atlanta International Airport.

The 56,700-square-foot hangar will be large enough to hold two of our B717 aircraft, simultaneously, and will also have a

20,000-square-foot, two-story office building attached to the hangar to house engineers and other support staff. Completion of

construction is expected by May 2004. The City of Atlanta is financing construction of the facility. Upon completion, we intend to

consummate a long-term lease agreement for the hangar facility.

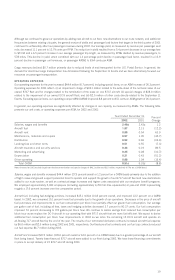

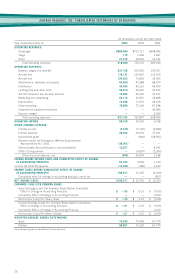

Our expected contractual obligations and commitments to be paid were the following as of December 31, 2003 (in millions):

Nature of commitment Total 2004 2005 2006 2007 2008 Thereafter

Operating lease payments

for aircraft and facility

obligations $4,946.4 $188.9 $218.4 $255.0 $292.8 $317.3 $3,674.0

Aircraft fuel purchases 63.2 44.4 18.8 ————

Long-term debt obligations(1) 246.9 5.0 9.6 9.9 11.1 5.4 205.9

Total contractual obligations

and Commitments $5,256.5 $238.3 $246.8 $264.9 $303.9 $322.7 $3,879.9

(1) Excludes related interest payments.

A variety of assumptions were necessary in order to derive the information described in the paragraph herein, including, but not limited

to: (i) the timing of aircraft delivery dates; (ii) estimated rental factors which are correlated to floating interest rates prior to delivery

and (iii) future fuel prices, including fuel refining, transportation and into-plane costs. Our actual results may differ from these estimates

under different assumptions or conditions.

OTHER INFORMATION

In May 2003, AirTran Holdings completed a private placement of $125.0 million in convertible notes due in 2023. The proceeds are

to be used to improve AirTran Holdings’ and AirTran Airways’ overall liquidity by providing working capital and for general corporate

purposes. The notes bear interest at 7% payable semi-annually on January 1 and July 1. The notes are unsecured senior obligations

ranking equally with AirTran Holdings’ existing unsecured senior indebtedness. The notes are unconditionally guaranteed by Airways

and rank equally with all unsecured obligations of AirTran Airways. The unsecured notes and the note guarantee are junior to any

secured obligations of AirTran Holdings or AirTran Airways to the extent of the collateral pledged and are also effectively subordinated

to all liabilities of our subsidiaries (other than Airways), including deposits and trade payables.

The notes are convertible into shares of AirTran Holdings’ common stock at a conversion rate of 89.9281 shares per $1,000 in principal

amount of the notes which equals an initial conversion price of approximately $11.12 per share. This conversion rate is subject to

adjustment in certain circumstances. Holders of the notes may convert their notes if after June 30, 2003, the price of AirTran Holdings’

common stock exceeds 110 percent of the conversion price for at least 20 trading days in the 30 consecutive trading days ending on

the last trading day of the preceding quarter. During the third quarter of 2003, this condition was satisfied and, accordingly, the notes

are currently convertible into AirTran Holdings’ common stock. AirTran Holdings may redeem the notes, in whole or in part, beginning

on July 5, 2010 at a redemption price equal to the principal amount of the notes plus any accrued and unpaid interest. The holders

22