Airtran 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NON-OPERATING EXPENSES

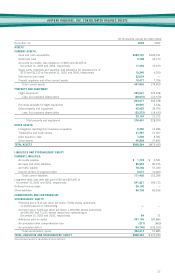

Other (income) expense, net increased by $15.0 million (266.8 percent) primarily due to reductions in interest expense, convertible

debt discount/issuance cost amortization, and interest income, as well as adjustments related to our fuel hedges in accordance with

Statement of Financial Accounting Standards No. 133 (SFAS 133), “Accounting for Derivative Instruments and Hedging Activities.”

Additionally, a Government grant credit of $0.6 million and $29.0 million were recorded as income in 2002 and 2001, respectively.

Interest expense decreased as a result of having reduced our outstanding debt obligations during the period. Convertible debt discount/

issuance cost amortization represents the exercise of conversion rights on approximately two-thirds of our 7.75% Series B Convertible

Notes during 2001. Upon conversion, we expensed $4.3 million of the debt discount associated with this financial instrument. Interest

income decreased due to lower interest rates earned on invested cash balances. SFAS 133 adjustment income represents changes in

the value of our now terminated fuel-related derivative contracts (see Note 5 to the Consolidated Financial Statements).

INCOME TAX EXPENSE (BENEFIT)

Income tax expense (benefit) was $(0.8) million and $3.2 million for 2002 and 2001, respectively. During 2002, we recorded income

tax benefit of $0.8 million due to a change in federal tax law as discussed below. During 2001, the differences between our effective

tax rates and statutory rates result from the expected utilization of a portion of our net operating loss (NOL) carryforwards, offset in

part by alternative minimum tax (AMT) and the application to goodwill of the tax benefit related to the realization of a portion of the

Airways Corporation, Inc. NOL carryforwards.

The Job Creation and Worker Assistance Act of 2002, passed by Congress in March 2002, resulted in a retroactive suspension of the

AMT NOL 90 percent limitation. This legislation resulted in a tax benefit of $0.8 million in 2002. In accordance with Statement of

Financial Accounting Standards No. 109, “Accounting for Income Taxes,” the effect of changes in tax laws or rates is included in

income in the period that includes the enactment date, resulting in recognition of the change in the first quarter of 2002.

LIQUIDITY AND CAPITAL RESOURCES

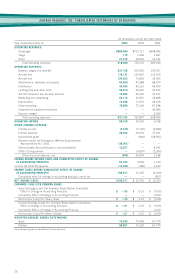

Our cash and cash equivalents, including restricted cash, totaled $348.5 million at December 31, 2003 compared to $138.3 million

at December 31, 2002.

Operating activities provided cash flows of $133.2 million in 2003 compared to $6.4 million in 2002. The primary components of our

2003 operating cash flows were net income improvements and air traffic liability growth. Our net income improved by $90.0 million

primarily due to a $38.1 million payment received from the government pursuant to the Wartime Act, the reversal of a $15.9 million

tax valuation allowance and to the growth of our business, as measured by passenger revenues. As our business has grown, so has

the level of our customers’ advance payments for future travel, commonly referred to as air traffic liability.

Investing activities used cash flows of $65.2 million in 2003 compared to cash flows provided of $7.6 million in 2002. Our property

and equipment purchases in both years primarily consisted of spare parts and equipment provisioning for the B717 aircraft as well as

improvements to our reservation systems and computer hardware and software. To a lesser extent our property and equipment purchases

consisted of capital expenditures on leasehold improvements and ground equipment to support our operations growth particularly for

the cities added to our route network during those years. Cash flows for aircraft purchase deposits relate to our agreement to acquire

B717 aircraft and B737 aircraft. During 2003, we committed to purchase up to 28 B737 aircraft and obtained options to purchase

an additional 50 B737 aircraft, which required us to pay advance deposits of approximately $46.7 million in 2003. During 2002, we

amended our B717 purchase agreement with the airframe manufacturer (see “Commitments” below). Pursuant to the amended B717

purchase agreement we were refunded deposits of approximately $2.2 million and $21.0 million in 2003 and 2002, respectively. Our

proceeds from the disposal of equipment were $0.6 million in 2002.

Financing activities provided $166.6 million of cash in 2003 and used $13.3 million of cash in 2002. During 2003, we issued new

convertible debt of $125 million and paid down existing debt of $90.5 million. Additionally, we issued 9.1 million shares of stock in a

secondary offering in October 2003, receiving net proceeds of $139.2 million. Financing activities for 2002 consisted primarily of

scheduled payments of debt obligations.

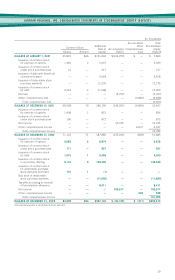

COMMITMENTS

As of December 31, 2003, AirTran Airways has contracted with The Boeing Company (Boeing) and an aircraft leasing company to

acquire 50 B737 aircraft with delivery dates between 2004 and 2008. In connection with AirTran Airways agreement with Boeing,

AirTran Airways also obtained options and purchase rights from Boeing to acquire up to an additional 50 B737 aircraft with delivery

dates between 2005 and 2010. Pursuant to AirTran Airways’ arrangement with the aircraft leasing company, AirTran Airways also

entered into individual operating leases for 22 of the B737 aircraft, and has entered into sale/leaseback transactions with respect to

six related spare engines, to be delivered between 2004 and 2010. Additionally, AirTran Airways has obtained financing commitments

from an affiliate of Boeing for up to 80% of the purchase price of 16 of the B737 aircraft should AirTran Airways be unable to secure

financing from the financial markets on acceptable terms. During 2004, AirTran Airways is scheduled to take delivery of eight of these B737

aircraft with six such aircraft subject to the individual operating leases as mentioned above. There can be no assurance that sufficient

financing will be available for all B737 aircraft and other capital expenditures not covered by firm financing commitments.

21