Airtran 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION AND BUSINESS

Our consolidated financial statements include the accounts of AirTran Holdings, Inc. (Holdings) and our wholly-owned subsidiaries,

including our principal subsidiary, AirTran Airways, Inc. (Airways). Significant intercompany accounts and transactions have been eliminated

in consolidation.

AirTran Airways, Inc. offers scheduled air transportation of passengers, serving short-haul markets primarily in the eastern United States.

USE OF ESTIMATES

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States

requires us to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and

accompanying notes. Actual results inevitably will differ from those estimates, and such differences may be material to the consolidated

financial statements.

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

We consider all highly liquid investments with maturities of three months or less when purchased to be cash equivalents. Restricted

cash primarily represents amounts escrowed relating to air traffic liability.

ACCOUNTS RECEIVABLE

Accounts receivable are due primarily from major credit card processors, travel agents and from municipalities related to guaranteed

revenue agreements. We provide an allowance for doubtful accounts equal to the estimated losses expected to be incurred in the

collection of accounts receivable based on historical credit card chargebacks and miscellaneous receivables greater than 90 days old.

Collateral is generally not required on accounts receivable.

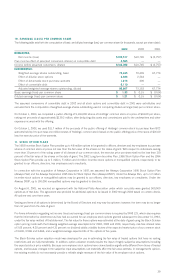

SPARE PARTS, MATERIALS AND SUPPLIES

Spare parts, materials and supplies are stated at the lower of cost or market using the first-in, first-out method (FIFO). These items

are charged to expense when used. Allowances for obsolescence are provided over the estimated useful life of the related aircraft and

engines for spare parts expected to be on hand at the date aircraft are retired from service.

PROPERTY AND EQUIPMENT

Property and equipment are stated on the basis of cost. Flight equipment is depreciated to its salvage values of 10%, using the straight-line

method. The estimated salvage values and depreciable lives are periodically reviewed for reasonableness, and revised if necessary.

The estimated useful lives for airframes, engines and aircraft parts are 30 years. Other property and equipment is depreciated over 3 to

10 years.

MEASUREMENT OF IMPAIRMENT

Effective January 1, 2002, we adopted Statement of Financial Accounting Standards No. 144 (SFAS 144), “Accounting for the

Impairment or Disposal of Long-Lived Assets.” SFAS 144 supercedes Statement of Financial Accounting Standards No. 121 (SFAS 121),

“Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of.” The adoption of SFAS 144 had no

effect on our results of operations. We record impairment losses on long-lived assets used in operations when events or circumstances

indicate that the assets may be impaired and the undiscounted cash flows estimated to be generated by those assets are less than

the net book value of those assets. See Note 13.

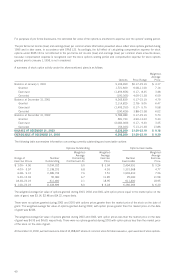

INTANGIBLES

The trade name and intangibles resulting from business acquisitions (goodwill) consist of cost in excess of net assets acquired. We

adopted Statement of Financial Accounting Standards No. 142 (SFAS 142), “Goodwill and Other Intangible Assets,” effective January 1,

2002. Pursuant to SFAS 142, goodwill and indefinite-lived intangibles, such as trade names, are no longer amortized but are subject

to periodic impairment reviews. We performed annual impairment tests in the fourth quarter of 2003 and 2002. Our tests indicated

that we did not have any impairment of our trade name or of our goodwill. See Note 2.

CAPITALIZED INTEREST

Interest attributable to funds used to finance the acquisition of new aircraft is capitalized as an additional cost of the related asset.

Interest is capitalized at our weighted-average interest rate on long-term debt or, where applicable, the interest rate related to specific

borrowings. Capitalization of interest ceases when the asset is placed in service. For the years ended December 31, 2003, 2002 and

2001, approximately $2.0 million, $4.8 million and $8.0 million of interest cost was capitalized, respectively.

AIRCRAFT AND ENGINE MAINTENANCE

Maintenance and repair costs for owned and leased flight equipment, including the overhaul of aircraft components, are charged to

expense as incurred, including engine overhaul costs covered by agreements where we pay monthly fees based on either the number

of flight hours flown or the number of landings made.

30

NOTES T O CO NSO LID ATE D FINANCIAL STATE MEN TS