Airtran 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. ACCOUNTING CHANGES

Effective January 1, 2002, we adopted Statement of Financial Accounting Standards No. 141, (SFAS 141), “Business Combinations” and

SFAS 142. SFAS 141 requires business combinations initiated after June 30, 2001 to be accounted for using the purchase method of

accounting. It also specifies the types of acquired intangible assets that are required to be recognized and reported separate from goodwill.

SFAS 142 requires that goodwill and certain intangibles no longer be amortized, but instead tested for impairment at least annually.

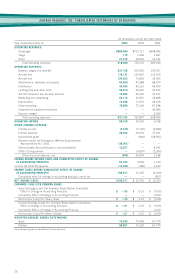

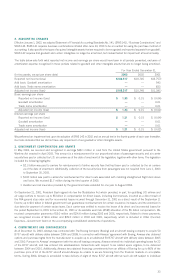

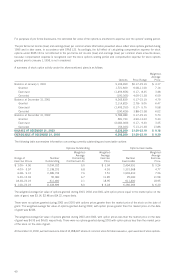

The table below sets forth what reported net income and earnings per share would have been in all periods presented, exclusive of

amortization expense recognized in those periods related to goodwill and other intangible assets that are no longer being amortized.

For Year Ended December 31,

(In thousands, except per share data) 2003 2002 2001

Reported net income (loss) $100,517 $10,745 $(2,757)

Add back: Goodwill amortization —— 543

Add back: Trade name amortization —— 833

Adjusted net income (loss) $100,517 $10,745 $(1,381)

Basic earnings per share

Reported net income (loss) $ 1.33 $ 0.15 $ (0.04)

Goodwill amortization —— 0.01

Trade name amortization —— 0.01

Adjusted net income (loss) $ 1.33 $ 0.15 $ (0.02)

Diluted earnings per share

Reported net income (loss) $ 1.21 $ 0.15 $ (0.04)

Goodwill amortization —— 0.01

Trade name amortization —— 0.01

Adjusted net income (loss) $ 1.21 $ 0.15 $ (0.02)

We performed an impairment test upon the adoption of SFAS 142 in 2002 and an annual test in the fourth quarter of each year thereafter.

Our tests indicated that we did not have any impairment of our goodwill or other intangible assets.

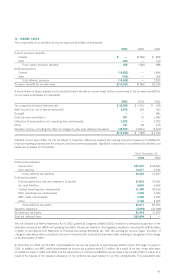

3. GOVERNMENT COMPENSATION AND GRANTS

In May 2003, we received and recognized in earnings $38.1 million in cash from the United States government pursuant to the

Wartime Act enacted in April 2003. This amount is a reimbursement for our proportional share of passenger security and air carrier

security fees paid or collected by U.S. air carriers as of the date of enactment of the legislation, together with other items. The legislation

included the following highlights:

•$2.3 billion was paid to carriers for reimbursement of airline security fees that had been paid or collected by the air carriers

as of the date of enactment. Additionally, collection of the security fees from passengers was not required from June 1, 2003

to September 30, 2003.

•$100 million was paid to carriers for reimbursement for direct costs associated with installing strengthened flight deck doors

and locks. We received $1.7 million during the third quarter of 2003.

•Aviation war risk insurance provided by the government was extended for one year to August 2004.

On September 21, 2001, President Bush signed into law the Stabilization Act which provided, in part, for qualifying U.S airlines and

air cargo carriers to receive: up to $5 billion in compensation for direct losses, including lost revenues, incurred as a direct result of

the FAA ground stop order and for incremental losses incurred through December 31, 2001 as a direct result of the September 11

Events; up to $10 billion in federal government loan guarantees; reimbursement for certain insurance increases; and the extension in

due dates for payment of certain excise taxes. Each carrier was entitled to receive the lesser of its direct and incremental losses for

the period September 11, 2001 to December 31, 2001 or its available seat mile (ASM) allocation of the $5 billion compensation. We

received compensation payments of $5.0 million and $24.6 million during 2002 and 2001, respectively. Related to these payments,

we recognized income of $0.6 million and $29.0 million in 2002 and 2001, respectively, which is included in Other (Income)

Expenses—Government Grant on the accompanying consolidated statements of operations.

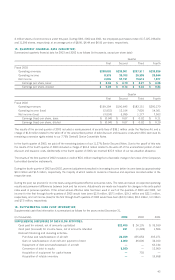

4. COMMITMENTS AND CONTINGENCIES

As of December 31, 2003, Airways has contracted with The Boeing Company (Boeing) and an aircraft leasing company to acquire 50

B737 aircraft with delivery dates between 2004 and 2008. In connection with Airways’ agreement with Boeing, Airways also obtained

options and purchase rights from the manufacturer to acquire up to an additional 50 B737 aircraft with delivery dates between 2005

and 2010. Pursuant to Airways’ arrangement with the aircraft leasing company, Airways entered into individual operating leases for 22

of the B737 aircraft, and has entered into sale/leaseback transactions with respect to six related spare engines, to be delivered

between 2004 and 2010. Additionally, Airways has obtained financing commitments from an affiliate of Boeing for up to 80% of the

purchase price of 16 of the B737 aircraft should Airways be unable to secure financing from the financial markets on acceptable

terms. During 2004, Airways is scheduled to take delivery of eight of these B737 aircraft with six such aircraft subject to individual

33