Air New Zealand 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

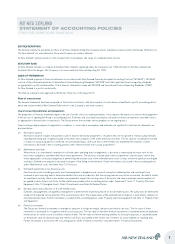

ENTITIES REPORTING

The financial statements presented are those of Air New Zealand Limited (the Company) and its subsidiaries and associates (the Group). References to

”Air New Zealand” are used where the Group and Company are similarly affected.

Air New Zealand’s primary business is the transportation of passengers and cargo on scheduled airline services.

STATUTORY BASE

Air New Zealand Limited is a company domiciled in New Zealand, registered under the Companies Act 1993 and listed on the New Zealand and

Australian Stock Exchanges. The Company is an issuer under the Financial Reporting Act 1993.

BASIS OF PREPARATION

Air New Zealand prepares its financial statements in accordance with New Zealand Generally Accepted Accounting Practice (“NZ GAAP”). NZ GAAP

consists of New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other applicable financial reporting standards

as appropriate to profit-oriented entities. These financial statements comply with NZ IFRS and International Financial Reporting Standards (“IFRS”).

Air New Zealand is a profit-oriented entity.

The financial statements were approved by the Board of Directors on 26 August 2010.

Basis of measurement

The financial statements have been prepared on the historical cost basis, with the exception of certain items as identified in specific accounting policies

below and are presented in New Zealand Dollars which is the Company’s functional currency.

Use of accounting estimates and judgements

The preparation of financial statements requires the use of certain critical accounting estimates. It also requires the directors to exercise their judgement

in the process of applying the Group’s accounting policies. Estimates and associated assumptions are based on historical experience and other factors,

as appropriate to the particular circumstances. The Group reviews the estimates and assumptions on an ongoing basis.

Areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements are

disclosed below:

(a) Revenue in advance

Revenue in advance includes transportation sales in advance and loyalty programmes. Unused tickets are recognised in revenue using estimates

regarding the timing and recognition based on the terms and conditions of the ticket and historical trends. The fair value of consideration received

in respect of loyalty programmes is deferred, net of estimated expiry, until such time as the member has redeemed their Airpoints. Further

information is disclosed in the accounting policies under “Airline revenue” and “Loyalty programmes”.

(b) Maintenance provisions

Where there is a commitment to maintain aircraft held under operating lease arrangements, a provision is made during the lease term for the

lease return obligations specified within those lease agreements. The provision is based upon historical experience, manufacturers’ advice and,

where appropriate, contractual obligations in determining the present value of the estimated future costs of major airframe inspections and engine

overhauls. Estimates are required to be made in respect of the timing of maintenance. Further information is disclosed in the accounting policies

under “Maintenance costs” and within Note 16 Provisions.

(c) Estimated impairment of non-financial assets

Non-financial assets (including property, plant and equipment, intangible assets, amounts owing from related parties and investments) are

reviewed at each reporting date to determine whether there are any indicators that the carrying amount may not be recoverable. Goodwill is tested

for impairment annually. Value in use models are prepared to support the carrying value of the assets and require estimates and assumptions to

be applied to derive future cash flows. Further details are provided in the accounting policies under “Impairment”, Note 11 Property, Plant and

Equipment, Note 12 Intangible Assets, Note 13 Investments and Note 26 Related Parties.

(d) Residual values and useful lives of aircraft related assets

Estimates and judgements are applied by management to determine the expected useful life of aircraft related assets. The useful lives are determined

based on the expected service potential of the asset and lease term. The residual value, at the expected date of disposal, is estimated by reference to

external projected values. Further information is provided in the accounting policies under “Property, plant and equipment” and Note 11 Property, Plant

and Equipment.

(e) Financial instruments

The Group uses financial instruments to manage its exposure to foreign exchange, fuel price and interest rate risks. The fair value of these

instruments is estimated for recognition and disclosure purposes. The fair value of derivative financial instruments is estimated based on published

market prices for similar assets or liabilities at balance date. The fair value of interest-bearing liabilities for disclosure purposes is calculated based

on the present value of future principal and interest cash flows, discounted at the market rate of interest for similar liabilities at reporting date.

Further information is disclosed in the accounting policies under “Financial instruments” and within Note 17 Financial Instruments.

7

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES

FOR THE YEAR TO 30 JUNE 2010