Air New Zealand 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

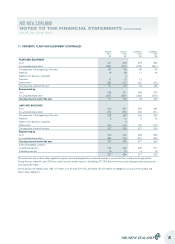

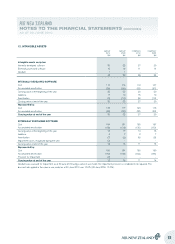

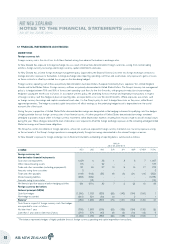

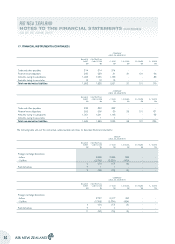

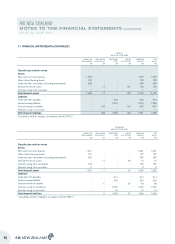

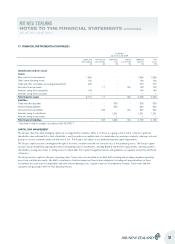

17. FINANCIAL INSTRUMENTS (CONTINUED)

MARKET RISK

Foreign currency risk

Foreign currency risk is the risk of loss to Air New Zealand arising from adverse fluctuations in exchange rates.

Air New Zealand has exposure to foreign exchange risk as a result of transactions denominated in foreign currencies, arising from normal trading

activities, foreign currency borrowings and foreign currency capital commitments and sales.

Air New Zealand has a formal foreign exchange management policy (approved by the Board of Directors) to enter into foreign exchange contracts to

manage economic exposure to fluctuations in foreign exchange rates impacting operating cash flows and asset values. Any exposure to gains or losses

on these contracts is offset by a related loss or gain on the item being hedged.

Foreign currency operating cash inflows are primarily denominated in Australian Dollars, European Community Euro, Japanese Yen, United Kingdom

Pounds and United States Dollars. Foreign currency outflows are primarily denominated in United States Dollars. The Group’s treasury risk management

policy is to hedge between 75% and 95% of forecast net operating cash flows for the first 6 months, with progressive reductions in percentages

hedged in subsequent months out to 2 years. In accordance with this policy, the underlying forecast revenue and expenditure transactions in respect

of foreign currency cash flow hedges in place at reporting date, are expected to occur over the next 24 months. Where exposures are certain, such

as foreign currency borrowings and capital commitments and sales, it is the Group’s policy to elect to hedge these risks as they arise, within Board

approved parameters. The hedge accounted capital transactions will affect earnings as the underlying hedged asset is depreciated over the useful

economic life of that asset.

During the year, a proportion of United States Dollar denominated borrowings was designated as the hedging instrument in qualifying cash flow hedges

of highly probable forecast foreign currency sales of non financial assets. A further proportion of United States denominated borrowings remained

unhedged to provide a natural offset to foreign currency movements within depreciation expense, resulting from revisions made to aircraft residual values

during the year. These changes reduced the level of derivative cover required to offset the foreign exchange exposure on the remaining unhedged United

States borrowings and finance lease obligations.

The Group has certain investments in foreign operations, whose net assets are exposed to foreign currency translation risk. Currency exposure arising

on the net assets of the Group’s foreign operations is managed primarily through borrowings denominated in the relevant foreign currencies.

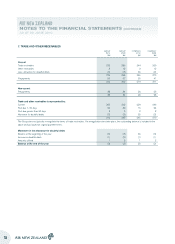

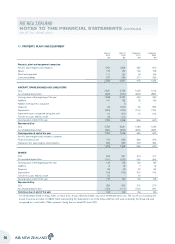

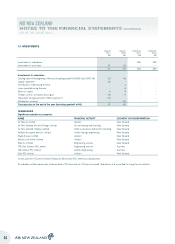

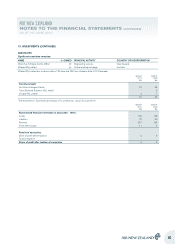

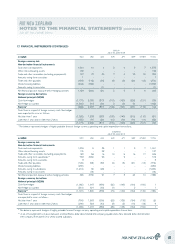

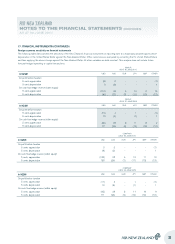

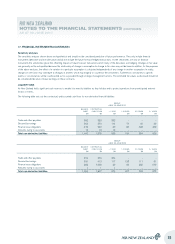

Air New Zealand’s exposure to foreign exchange risk on financial instruments outstanding at reporting date is summarised as follows:

GROUP

AS AT 30 JUNE 2010

In NZ$M NZD USD AUD EUR JPY GBP OTHER TOTAL

Foreign currency risk

Non-derivative financial instruments

Cash and cash equivalents 1,009 6 38 1 3 3 7 1,067

Other interest-bearing assets 115 - 22 - - - - 137

Trade and other receivables (excluding prepayments) 131 66 27 10 5 16 17 272

Amounts owing from associates 3 - - - - - - 3

Trade and other payables (144) (108) (55) (4) (6) (21) (14) (352)

Interest-bearing liabilities (453) (622) - - - - - (1,075)

Amounts owing to associates - (13) - - - - - (13)

Net financial position exposure before hedging activities 661 (671) 32 7 2 (2) 10 39

Foreign currency derivatives

Notional principal (NZ$M)

Cash flow hedges (1,050) 1,932 (339) (85) (143) (164) (150) 1

Non-hedge accounted (561) 621 (60) (1) - 2 - 1

Balance* (950) 1,882 (367) (79) (141) (164) (140) 41

Cash flows in respect of foreign currency cash flow hedges

are expected to occur as follows:

Not later than 1 year (759) 1,553 (296) (82) (138) (154) (132) (8)

Later than 1 year and not later than 2 years (291) 379 (43) (3) (5) (10) (18) 9

(1,050) 1,932 (339) (85) (143) (164) (150) 1

* The balance represents hedges of highly probable forecast foreign currency operating and capital expenditure transactions.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

28