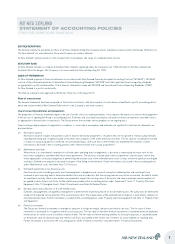

Air New Zealand 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WORK IN PROGRESS

Contract work in progress is stated at cost plus the profit recognised to date, using the percentage of completion method, less any amounts invoiced to

customers. Cost includes all expenses directly related to specific contracts and an allocation of direct production overhead expenses incurred.

Capital work in progress includes the cost of materials, services, labour and direct production overheads.

INVENTORIES

Inventories are measured at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO) cost method. Net realisable

value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses.

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction,

net of taxation, from the proceeds.

Where a member of the Group purchases the Company’s share capital, the consideration paid is deducted from equity under the treasury stock method,

until they are reissued or otherwise disposed of.

FINANCIAL GUARANTEE CONTRACTS

Where the Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within the Group, the Company

considers these to be insurance contracts (as defined by NZ IFRS 4: Insurance contracts) and accounts for them as such.

TAXATION

The income taxation expense for the period is the taxation payable on the current period’s taxable income at tax rates enacted or substantively enacted

at reporting date. This is adjusted by changes in deferred taxation assets and liabilities. Income taxation expense is recognised in the Statement of

Financial Performance except where it relates to items recognised directly in equity, in which case it is recognised in equity.

Deferred income taxation is provided in full, using the balance sheet liability method, on temporary differences arising between the tax bases of assets

and liabilities and their carrying amounts in the financial statements. Deferred income tax is determined using tax rates (and laws) that have been

enacted or substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the

deferred income tax liability is settled.

Deferred income tax assets and unused tax losses are only recognised to the extent that it is probable that future taxable amounts will be available

against which to utilise those temporary differences and losses.

EMPLOYEE BENEFITS

Pension obligations

Payments to defined contribution retirement plans are charged as an expense as they fall due. Payments made to multi-employer retirement benefit schemes

are treated in the same way as payments to defined contribution schemes where sufficient information is not available to use defined benefit accounting.

Air New Zealand’s net obligation in respect of defined benefit pension plans is calculated separately for each plan by an independent actuary, as being the present

value of the future obligations to the members less the fair value of the plan’s assets, adjusted for any unrecognised actuarial gains or losses and unrecognised

past service costs. The discount rate reflects the yield on government bonds that have maturity dates approximating the terms of Air New Zealand’s obligations.

When the calculation results in a benefit to Air New Zealand, the value of the asset recognised cannot exceed in aggregate the value of any unrecognised net

actuarial losses and past service cost, and the present value of any future refunds from the plan or reductions in future contributions to the plan.

Any actuarial gains or losses are amortised under the corridor method over the members’ expected average remaining working lives.

Share based compensation

All equity options are disclosed in the notes to the financial statements. The fair value (at grant date) of options granted to employees is recognised as

an expense, within the Statement of Financial Performance, over the vesting period of the options, with a corresponding entry to Issued Capital. The

amount recognised as an expense is adjusted at each reporting date to reflect the extent to which the vesting period has expired and management’s

best estimate of the number of share options that will ultimately vest.

Termination costs

Termination costs are recognised as an expense when the Group is demonstrably committed, without realistic possibility of withdrawal, to a formal

detailed plan to terminate employment before the normal retirement date.

PROVISIONS

A provision is recognised when the Group has a present legal or constructive obligation as a result of a past event, it is probable that an outflow of

economic benefits will be required to settle the obligation, and the provision can be reliably measured.

13

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2010