Air New Zealand 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

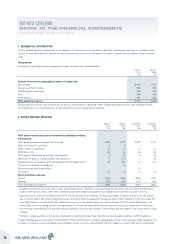

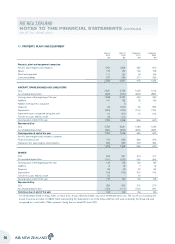

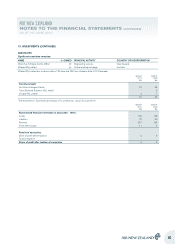

8. INVENTORIES

GROUP

2010

$M

GROUP

2009

$M

COMPANY

2010

$M

COMPANY

2009

$M

Engineering expendables 145 122 115 89

Consumable stores 17 21 17 21

162 143 132 110

Held at cost 144 119 114 88

Held at fair value less costs to sell 18 24 18 22

162 143 132 110

Movement in the provision for inventory obsolescence

Balance at the beginning of the year (24) (20) (22) (17)

Increase in provision (4) (7) (3) (7)

Decrease in provision 4 1 4 -

Amounts utilised 1 2 1 2

Balance at the end of the year (23) (24) (20) (22)

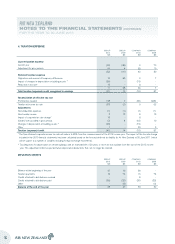

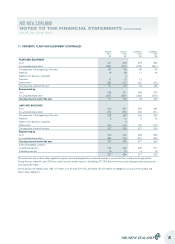

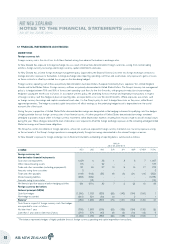

9. ASSETS HELD FOR RESALE

GROUP

2010

$M

GROUP

2009

$M

COMPANY

2010

$M

COMPANY

2009

$M

Current

Property, plant and equipment 8 3 2 -

8 3 2 -

Non-current

Property, plant and equipment 4 7 - -

4 7 - -

In anticipation of the exit of the Boeing 747-400 fleet, two engines and spares are being marketed for sale. During the 2009 financial year, the Group

reduced capacity on certain long haul routes, resulting in one Boeing 747-400 aircraft being componentised which is being disposed as parts. It is

expected that proceeds for parts will be received over a two year period. The carrying value of the assets as at 30 June 2010 reflects the lower of their

previous carrying value at the date of transfer or external market assessments of the fair value, less costs to sell.

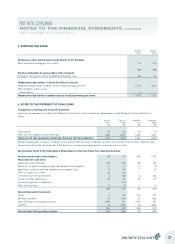

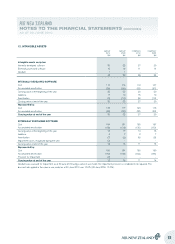

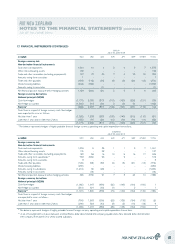

10. OTHER ASSETS

GROUP

2010

$M

GROUP

2009

$M

COMPANY

2010

$M

COMPANY

2009

$M

Current

Contract work in progress 45 40 28 22

Amounts owing from subsidiaries - - 169 149

Amounts owing from associates 3 1 3 1

Other assets (including defined benefit assets) 3 3 3 3

51 44 203 175

Non-current

Capital work in progress 64 39 52 37

Progress payments on aircraft, engines and simulators 308 110 308 104

Other interest-bearing assets 137 130 137 130

Other assets 14 12 8 7

523 291 505 278

Other non-current interest-bearing assets include registered transferable certificates of deposit (RTDs) that provide security over credit card obligations

accepted on behalf of Air New Zealand. The RTD’s bear floating rate interest, and mature after seven years.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

19