Air New Zealand 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

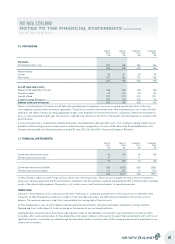

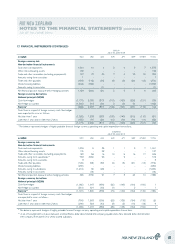

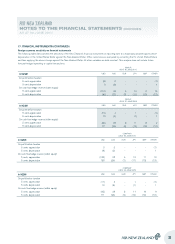

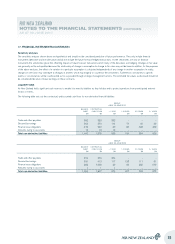

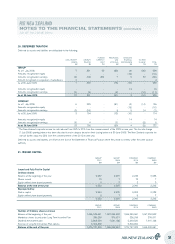

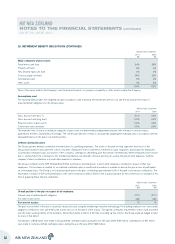

17. FINANCIAL INSTRUMENTS (CONTINUED)

COMPANY

AS AT 30 JUNE 2009

LOANS AND

RECEIVABLES

$M

NON-HEDGE

ACCOUNTED*

$M

AMORTISED

COST

$M

HEDGE

ACCOUNTED

$M

CARRYING

AMOUNT

$M

FAIR

VALUE

$M

Classification and fair values

Assets

Bank and short term deposits 1,566 - - - 1,566 1,566

Other interest-bearing assets 130 - - - 130 130

Trade and other receivables (excluding prepayments) 270 - - - 270 270

Derivative financial assets - 17 - 126 143 143

Amounts owing from subsidiaries 149 - - - 149 149

Amounts owing from associates 1 - - - 1 1

Total financial assets 2,116 17 - 126 2,259 2,259

Liabilities

Trade and other payables - - 332 - 332 332

Interest-bearing liabilities - - 252 - 252 254

Derivative financial liabilities - 163 - 144 307 307

Amounts owing to subsidiaries - - 1,261 - 1,261 1,261

Amounts owing to associates - - 1 - 1 1

Total financial liabilities - 163 1,846 144 2,153 2,155

* Classified as held for trading in accordance with NZ IFRS 7.

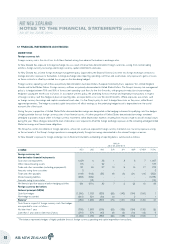

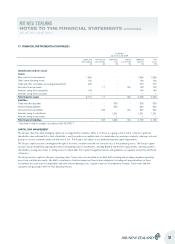

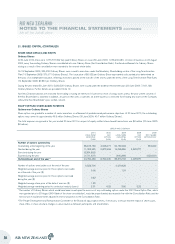

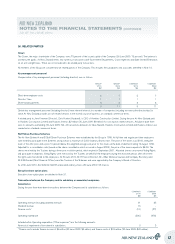

CAPITAL RISK MANAGEMENT

The Group’s objectives when managing capital are to safeguard the company’s ability to continue as a going concern and to continue to generate

shareholder value and benefits for other stakeholders, and to provide an acceptable return for shareholders by removing complexity, reducing costs and

pricing our services commensurately with the level of risk. The Group is not subject to any externally imposed capital requirements.

The Group’s capital structure is managed in the light of economic conditions and the risk characteristics of the underlying assets. The Group’s capital

structure may be modified by adjusting the amount of dividends paid to shareholders, initiating dividend reinvestment opportunities, returning capital to

shareholders, issuing new shares or selling assets to reduce debt. The capital management policies and guidelines are regularly reviewed by the Board

of Directors.

The Group monitors capital on the basis of gearing ratios. These ratios are calculated as net debt (both including and excluding capitalised operating

leases) over net debt plus equity. Net debt is calculated as total borrowings and finance lease obligations (including net open derivatives on these

instruments) less cash and cash equivalents and other interest-bearing assets. Capital comprises all components of equity. These ratios and their

calculation are disclosed in the Five Year Statistical Review.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

37