Air New Zealand 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

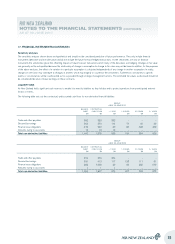

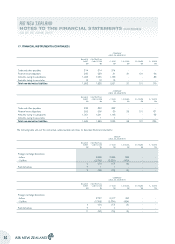

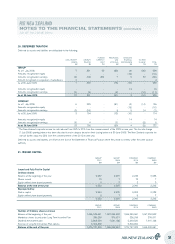

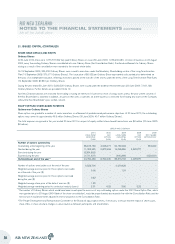

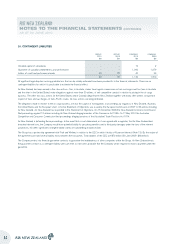

21. ISSUED CAPITAL (CONTINUED)

SHARE ISSUE DETAILS AND RIGHTS

Ordinary Shares

At 30 June 2010, there were 1,076,747,302 fully paid Ordinary Shares on issue (30 June 2009: 1,065,242,681). At close of business on 23 August

2004, every five existing Ordinary Shares consolidated into one Ordinary Share (the Consolidation Ratio). Fractional entitlements to Ordinary Shares

arising as a result of the consolidation were rounded to the nearest whole dollar.

On 18 September 2009, 336,299 Ordinary Shares were issued to executives under the Mandatory Shareholding section of the Long Term Incentive

Plan (19 September 2008: 376,671 Ordinary Shares). The issue price of $0.932 per Ordinary Share represented a discounted price determined on

the basis of an independent valuation, reflecting restrictions placed on the transfer of the shares under the terms of the Long Term Incentive Plan Rules

(19 September 2008: $0.851 per Ordinary Share).

During the year ended 30 June 2010, 5,863,520 Ordinary Shares were issued under the dividend reinvestment plan (30 June 2009: 7,641,188

Ordinary Shares). Further details are provided in Note 19.

Non New Zealand nationals are restricted from holding or having an interest in 10 percent or more of voting shares unless the prior written consent of

the Kiwi Shareholder is obtained. In addition, any person that owns or operates an airline business is restricted from holding any shares in the Company

without the Kiwi Shareholder’s prior written consent.

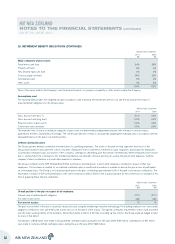

EQUITY-SETTLED SHARE-BASED PAYMENTS

Options over Ordinary Shares

Share options are granted to a number of senior executives on attainment of predetermined performance objectives. At 30 June 2010, the outstanding

options may convert to approximately 49.5 million Ordinary Shares (30 June 2009: 40.7 million Ordinary Shares).

The total expense recognised in the year ended 30 June 2010 in respect of equity-settled share-based transactions was $3 million (30 June 2009:

$3 million).

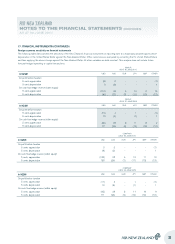

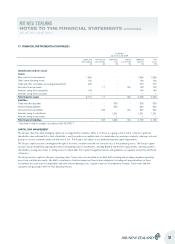

GROUP AND COMPANY

2010

LONG TERM

INCENTIVE

PLAN

2010

CEO

OPTION

PLAN

2009

LONG TERM

INCENTIVE

PLAN

2009

CEO

OPTION

PLAN

2009

2001 SHARE

OPTION PLAN*

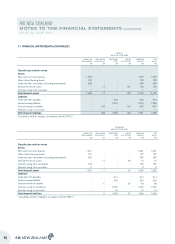

Number of options outstanding

Outstanding at the beginning of the year 35,815,153 4,923,077 20,160,094 - 650,000

Granted during the year 11,923,525 3,870,968 16,095,955 4,923,077 -

Exercised during the year (5,304,802) - - - -

Expired during the year (1,711,407) - (440,896) - (650,000)

Outstanding at end of the year** 40,722,469 8,794,045 35,815,153 4,923,077 -

Number of options exercisable as at the end of the year 6,558,704 - 6,279,622 - -

Weighted average exercise price for those options exercisable

as at the end of the year ($) 0.68 - 1.24 - -

Weighted average exercise price for those options exercised

during the year ($) 0.82 - - - -

Weighted average share price at the date of exercise ($) 1.20 - - - -

Weighted average remaining period to contractual maturity (years) 2.91 4.22 3.66 5.22 -

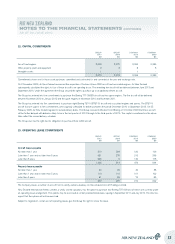

* The number of Ordinary Shares which would have been issued upon the exercise of any outstanding options under the 2001 Share Option Plan, which

were granted prior to 23 August 2004 (date of the share consolidation), would be proportionately decreased in line with the Consolidation Ratio and the

exercise price would have been adjusted in inverse proportion to the Consolidation Ratio.

** The People Development and Remuneration Committee of the Board will adjust option terms, if necessary, to ensure that the impact of share issues,

share offers or share structure changes is value neutral as between participants and shareholders.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

40