Air New Zealand 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

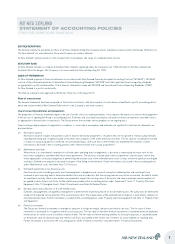

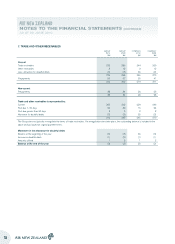

Hedge accounted financial instruments

Where financial instruments qualify for hedge accounting in accordance with NZ IAS 39: Financial Instruments: Recognition and Measurement,

recognition of any resultant gain or loss depends on the nature of the hedging relationship, as detailed below.

Cash flow hedges

Changes in the fair value of hedging instruments designated as cash flow hedges are recognised directly in the cash flow hedge reserve within equity to

the extent that the hedges are deemed effective in accordance with NZ IAS 39: Financial Instruments: Recognition and Measurement. To the extent that

the hedges are ineffective for accounting, changes in fair value are recognised in the Statement of Financial Performance.

If a hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, or the designation of the hedge

relationship is revoked or changed, then hedge accounting is discontinued. The cumulative gain or loss previously recognised in the cash flow hedge reserve

remains there until the forecast transaction occurs. If the underlying hedged transaction is no longer expected to occur, the cumulative, unrealised gain or

loss recognised in the cash flow hedge reserve with respect to the hedging instrument is recognised immediately in the Statement of Financial Performance.

Where the hedge relationship continues throughout its designated term, the amount recognised in the cash flow hedge reserve is transferred to the

Statement of Financial Performance in the same period that the hedged item is recorded in the Statement of Financial Performance, or, when the hedged

item is a non-financial asset, the amount recognised in the cash flow hedge reserve is transferred to the carrying amount of the asset when it is recognised.

Net investment hedge

Hedges of net investments in foreign operations are accounted for similarly to cash flow hedges. Any gain or loss on the hedging instrument relating to

the effective portion of the hedge is recognised in the foreign currency translation reserve within equity. The gain or loss relating to the ineffective portion

of the hedge is recognised immediately in the Statement of Financial Performance.

Fair value estimation

The fair value of derivative financial instruments is based on published market prices for similar assets or liabilities at balance date. This equates to “Level

2” of the fair value hierarchy defined within “Amendments to NZ IFRS 7: Financial Instruments: Disclosures”. The fair value of interest-bearing liabilities

for disclosure purposes is calculated based on the present value of future principal and interest cash flows, discounted at the market rate of interest for

similar liabilities at reporting date.

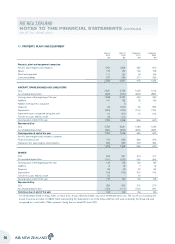

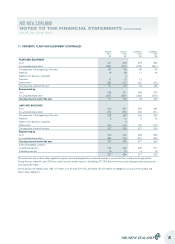

PROPERTY, PLANT AND EQUIPMENT

Owned assets

Items of property, plant and equipment are stated at cost or deemed cost less accumulated depreciation and accumulated impairment losses. Cost includes

expenditure that is directly attributable to the acquisition of the item and in bringing the asset to the location and working condition for its intended use. Cost

may also include transfers from equity of any gains or losses on qualifying cash flow hedges of foreign currency purchases of property, plant and equipment.

Where significant parts of an item of property, plant and equipment have different useful lives, they are accounted for separately.

A portion of the cost of an acquired aircraft is attributed to its service potential (reflecting the maintenance condition of its engines) and is depreciated

over the shorter of the period to the next major inspection event, overhaul, or the remaining life of the asset.

Leased assets

Leases under which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. All other leases are

classified as operating leases.

Upon initial recognition, assets held under finance leases are measured at amounts equal to the lower of their fair value and the present value of the

minimum lease payments at inception of the lease. A corresponding liability is also established.

Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to that asset.

Manufacturers’ credits

The Group receives credits from manufacturers in connection with the acquisition of certain aircraft and engines. These credits are recorded as a

reduction to the cost of the related aircraft and engines. When the aircraft are held under operating leases, the credits are deferred and deducted from

the operating lease rentals on a straight-line basis over the period of the related lease as deferred credits.

11

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2010