Aflac 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Once upon a time, John Amos, Aflac’s principal founder,

joined with his brothers, Paul and Bill, to make their

dream of starting an insurance company a reality. They

knew people were facing serious medical health events and

set out to establish a company focused on insurance products

that would help to ease the financial burden of getting sick or

injured. To many, such a venture may have seemed like a tall

tale or an impossible dream back in 1955. But their vision and

dedication laid the groundwork for an incredibly rewarding six

decades in which we’ve grown our business – and in doing

so, we’ve touched millions of lives. The privilege of enriching

the lives of policyholders, sales associates, employees and

shareholders remains our greatest priority and incorporates a

passion that we call The Aflac Way.

The story of Aflac continued in 2015 as we celebrated a

significant milestone: Aflac’s 60th anniversary. Our diamond

anniversary marked another year during which Aflac extended

its lengthy record of success, while pursuing more opportu-

nities. We made significant strides in advancing our vision of

offering high-quality voluntary products, solutions and service

through diverse distribution outlets, building upon our market-

leading position to drive long-term shareholder value.

2015 operating earnings* per diluted share, excluding the impact

of the yen, grew 7.5%. This metric is one of the principal financial

measures used to evaluate management’s performance, and

we believe it continues to be a key driver of shareholder value.

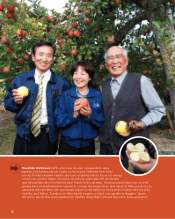

AFLAC JAPAN

In Japan, where we insure one in four households, 2015 was

a year of strengthening relationships with our sales channels

and enhancing our product line to ensure we’re continuing to

meet the needs of consumers. We saw phenomenal success

across all channels in sales of our third sector products,

particularly with the product we pioneered – cancer insurance.

These results helped generate a year in which we achieved

the highest annual growth rate for third sector products in the

past 10 years, helping us to maintain our status as the leading

provider of both medical and cancer insurance in Japan.

AFL AC U.S.

In the United States, Aflac again earned the distinction of being

the number one provider of voluntary insurance at the worksite**.

2015 was a year in which Aflac U.S. generated solid results, and

we’ve been encouraged that the changes we made to our career

and broker management infrastructure are laying the foundation

for expanded long-term sales growth opportunities. We closed

2015 strongly with our fourth quarter new annualized premium

sales hitting an all-time quarterly record in terms of premium

amount. Most notably, I am very proud of the new chapter we

marked in Aflac’s history with the introduction of One Day PaySM,

an industry-first initiative that allows us to process, approve and

pay eligible claims in just one day.

STRONG CAPITAL PROFILE SUPPORTS OUR PROMISE

Our strong capital position reinforces what I believe is the

most important promise an insurance company makes to

its policyholders – to protect them when they need us most

by paying claims fairly and promptly. We believe the financial

strength of our company is important to our business. Our

strong capital ratios demonstrate our commitment to our

policyholders, bondholders and shareholders. This financial

strength is reflected in the quality of our balance sheet. We are

very pleased by our solid capital levels, and we regularly assess

our capital adequacy using extreme economic scenarios to

ensure our financial strength, considering the economic uncer-

tainty in the world. Strong capital ratios serve to protect our

policyholders’ interests.

We’re also proud that the rating agencies continue to recognize

the strength of our balance sheet. Our financial strength ratings,

which reflect our ability to pay claims, are A+ (Superior) by

A.M. Best, Aa3 by Moody’s, A+ by S&P and AA- by Rating &

Investment Information Inc. (R&I).

While policyholders are always top of mind, we also strive to

enhance shareholder value through capital deployment. As

we’ve communicated, when it comes to deploying excess

capital, we still believe that growing the cash dividend and

repurchasing our shares represent the most attractive avenues,

particularly absent other compelling uses of that capital. In

2015, we repurchased 21.2 million of our shares at a cost of

$1.3 billion.

I am also pleased with the action by our board of directors in

2015 to increase the cash dividend to shareholders, marking

the 33rd consecutive year of dividend increases. Our objective is

to grow cash dividends at a rate generally in line with operating

earnings per diluted share before the impact of the yen.

We also take pride in generating an industry-leading return on

equity, or ROE. Excluding the yen impact, our operating ROE

for the full year was 20.2%, which was in line with our 2015

operating ROE target of 20% to 25%.

MESSAGE FROM MANAGEMENT

DANIEL P. AMOS, CHAIRMAN AND CEO

The Story of Aflac: 60 Years in the Making