Adidas 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Shareholder Information

Solid Development of adidas-Salomon Share

Despite a turbulent year on the stock markets, the adidas-

Salomon share price developed favorably in the second half

of 2000. At year-end the share price was c66.00, down 11%

from 1999 year-end, but up 32% from its first quarter low.

This performance was slightly lower than the German DAX-30

Index, which declined 8% over the same period, and clearly

behind the Standard & Poor’s SuperCap Footwear Index, a

composite of the Group’s major footwear competitors in

America, which increased 30% over the year as a result of the

rebounding sporting goods environment in the United States.

First quarter declines in the adidas-Salomon share price

were driven by company, industry and market factors. At

adidas-Salomon, Management changes and the c 38 million

Growth and Efficiency Program were announced. Profit warn-

ings were issued in the industry, which pushed share prices

down dramatically. In addition, interest rate increases and

mixed economic signals in the United States and the falling

euro raised overall market skepticism.

As the year progressed, however, confidence in the new Man-

agement’s plans increased, the athletic footwear retail

industry

consolidated and strengthened in the United States and

investor

insecurity

about the “new economy” drove increased interest

in our share and industry. Analyst sentiment also improved.

adidas-Salomon outperformed the DAX-30 after the first

quarter and showed consistent improvement, gaining strongest

momentum in the fourth quarter. In November, adidas-Salomon

was the top performer in the DAX-30. The adidas-Salomon

share price continued to appreciate in early 2001.

Dividend Sustained at g0.92

The adidas-Salomon Executive Board will propose paying a

dividend of c0.92 per share to the Annual General Meeting

of Shareholders on May 10, the same amount as in 1999.

This represents a total payout of approximately c42 million.

The decision to maintain a stable dividend level represents

Management’s confidence in its ability to achieve its 2001

financial targets, despite the net income decline in 2000.

The proposal represents a total payout ratio of 23%, which is

above the defined range of the Company’s dividend policy,

which recommends a payout ratio of between 15 and 20% of

consolidated net income. Management views 2000 as a year

of consolidation and restructuring and is increasing the payout

percentage to reward long-term shareholders. In 2001 and

beyond, adidas-Salomon will return to a dividend payout ratio

consistent with its established dividend policy.

Investor Relations Program Extends Offering

Open and consistent communication with shareholders, poten-

tial investors and other members of the financial community is

a high priority for adidas-Salomon. In addition, the transition of

new Management in 2000 brought a strong mandate to extend

and strengthen our relationship with each of these important

groups. It is our belief that this communication is critical to a

fair valuation of the adidas-Salomon share.

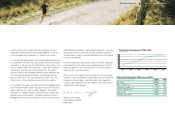

Dividend Payout Ratio

(in % of Net Income)

2000

1999

1998

1997

1996

0 5 10 15 20 25

*

Target range

* Before special effect

2000 Monthly Share Price Development

140

120

100

80

60

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

adidas-Salomon

DAX-30 Index

Standard & Poor’s SuperCap Footwear Index

2000 Quarterly DAX-30 Comparison

(in %)

10

0

–10

–20

Q1/00 Q2/00 Q3/00 Q4/00

adidas-Salomon

DAX