Abercrombie & Fitch 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

expenses as a result of the decrease in comparable store sales. The

increase was also due to planned one-time expenses related to the

C o m p a n y’s move to a new home office and distribution center. The

increases were offset by tightly controlled headcount additions,

travel expenses, store payroll hours, outside services and compen-

sation expense related to management bonuses.

The general, administrative and store operating expenses rate

for the year was 21.0%, 20.7% and 20.2% in 2001, 2000 and

1999, respectively. The rate increases in 2001 and 2000 were pri-

marily due to the inability to leverage fixed expenses as a result

of the decrease in sales volume per average store. The increases

were partially offset by the Company’s continued focus on dis-

c r e t i o n a ry expense controls.

OPERATING INCOME The operating income rate (operating

income divided by net sales) was 27.6% and 19.9% for the fourth

quarter and fiscal year of 2001, respectively, compared to 28.2%

and 20.5% for the same periods in 2000. The decline in operat-

ing income rate in these periods was primarily due to lower

gross income percentages resulting from planned promotional

strategies executed in the fourth quarter. Lower general, admin-

istrative and store operating expenses, expressed as a percentage

of net sales, partially offset the lower gross income rate in the

fourth quarter. For the year, higher general, administrative and

store operating expenses, expressed as a percentage of net sales,

added to the decrease in operating income rate.

Operating income, expressed as a percentage of net sales, was

28.2% and 20.5% for the fourth quarter and fiscal year of 2000,

r e s p e c t i v e l y, compared to 34.5% and 23.5% for the same periods

in 1999. The decline in operating income as a percentage of net

sales in these periods was primarily a result of lower gross income

percentages. Higher general, administrative and store operating

expenses, expressed as a percentage of net sales, also added to the

decrease in the operating income percentage of net sales.

INTEREST INCOME/EXPENSE Net interest income was $1.2

million in the fourth quarter of 2001 and $5.1 million for the 2001

fiscal year compared with net interest income of $2.5 million and

$7.8 million for the corresponding periods last year. The decrease

in net interest income for both the quarter and the year was due

to the decline in interest rates. Net interest income in 2001 and

2000 was primarily from short-term investments.

Net interest income was $2.5 million in the fourth quarter of

2000 and $7.8 million for all of 2000 compared with net interest

income of $2.5 million and $7.3 million for the corresponding peri-

ods in 1999. The increase in net interest income for the year was

due to an increase in interest rates, which was partially offset by

lower cash and equivalents balances. Net interest income in 2000

and 1999 was primarily from short-term investments.

FINANCIAL CONDITION The Company's continuing growth

in net income affords it financial strength and flexibility. A

more detailed discussion of liquidity, capital resources and cap-

ital requirements follows.

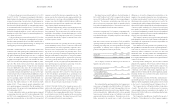

LIQUIDITY AND CAPITAL RESO U R C E S Cash provided by

operating activities provides the resources to support operations,

including projected growth, seasonal requirements and capital

expenditures. A summary of the Company's working capital

position and capitalization follows (thousands):

2001 2000 1999

Working capital $241,616 $146,939 $1 6 2 , 351

Capitalization:

Shareholders’ equity $595,434 $422,700 $311,094

The Company considers the following to be measures of

liquidity and capital resources:

2001 2000 1999

Current ratio (current assets divided

by current liabilities) 2.48 1.94 2.18

Cash flow to capital investment

(net cash provided by operating

activities divided by capital expenditures) 184% 99% 208%

Free cash flow (net cash provided by operating

activities less capital expenditures)

(in thousands) $106,687 ($2,292) $79,374

Net cash provided by operating activities, the Company’s pri-

m a ry resource of liquidity, totaled $233.2 million, $151.2 million

and $152.8 million for 2001, 2000 and 1999, respectively. Cash was

provided primarily by current year net income adjusted for depre-

ciation and amortization. Additionally in 2001, cash was provided

from increases in deferred income tax liabilities and accru e d

expenses and decreases in inventories. Deferred income tax lia-

bilities increased in the current year as a result of increasing

Ab e r cro mb i e&Fitch

14

For the year, the gross income rate decreased to 40.9% in 2001

from 41.2% in 2000. The decrease was primarily attributable to

higher buying and occupancy costs. Buying and occupancy costs

increased, as a percentage of net sales, due to the deleveraging cre-

ated by the decrease in comparable store sales. The decrease was

almost entirely offset by higher IMU as continued improvements

in sourcing merchandise have reduced costs. The other factors in

protecting gross income were tight control of inventory, which

resulted in disciplined markdown control, and lower inventory

shrinkage as a result of the Company’s continued emphasis on in-

store operational controls.

For the year, the gross income rate decreased to 41.2% in 2000

from 43.7% in 1999. The decrease was attributable to lower mer-

chandise margins, primarily due to lower IMU caused by both a

change in sales mix and the planned strategy of offering lower

opening price points in key product classifications.

G E N E RAL, ADMINISTRATIVE AND STORE OPERAT I N G

E X P E N S E S The fourth quarter general, administrative and store

operating expenses rate (general, administrative and store operat-

ing expenses divided by net sales) improved to 17.1% as compared

to 17.9% in the fourth quarter of 2000. The Company continues

to tightly control expenses in both the stores and the home office.

These cost controls include limiting headcount additions, reduc-

ing home office travel and store payroll hours, and decreasing

relocation and recruiting expenses. Savings were also recognized

in the new distribution center and in the e-commerce business.

During the fourth quarter, productivity in the distribution center,

as measured in units processed per labor hour, was over 50% high-

er than last year. In the e-commerce business, fulfillment costs per

order were down by over 10%. Last year’s general, administrative

and store operating expenses were unfavorably affected by one-

time expenses related to the move to the new distribution center

and home office and the inclusion of a 14th week in the fourth

quarter of 2000. These savings in general, administrative and

store operating expenses were partially offset by marketing costs

incurred as part of the promotional strategy implemented during

the fourth quarter of 2001.

General, administrative and store operating expenses, expressed

as a percentage of net sales, were 17.9% in the fourth quarter of 2000

and 16.4% in the comparable period in 1999. The increase in the

percentage was primarily due to the inability to leverage fixed

Ab e rcr ombi e &Fitch

differences in tax and book depreciation methods due to the

number of stores opened in the past few years. Ac c rued expenses,

including unredeemed gift card revenue and catalogue and

advertising costs, increased in the current year as a result of the

continued growth and development of the business. Inventories

decreased $12.1 million during 2001 due to the tight management

of inventory, which resulted in a 30% decrease in inventory per

gross square foot at year-end. Uses of cash were directly related

to store growth and primarily consisted of increases in capitalized

store supplies, construction allowance receivables and prepaid rent

related to stores (classified in other assets).

The Company’s operations are seasonal in nature and typically

peak during the back-to-school and Christmas selling periods.

Accordingly, cash requirements for inventory expenditures are

highest during these periods.

Cash outflows for investing activities were primarily for cap-

ital expenditures (see the discussion in the “Capital Expenditures”

section below) related to new stores (net of constru c t i o n

allowances) and the construction costs of the new office and

distribution center. Investing activities also included purchases

and maturities of marketable securities. As of Fe b ru a ry 2, 2002,

the Company held marketable securities with original maturities

of three to five months.

Financing activities during 2001, 2000 and 1999 consisted

primarily of the repurchase of 600,000 shares, 3,550,000 shares and

1,510,000 shares, respectively, of A&F’s Class A Common Stock

pursuant to previously authorized stock repurchase programs. As

of February 2, 2002, A&F is authorized to repurchase up to an

additional 1,850,000 shares under the current repurchase program.

Financing activities also consisted of stock option exercises and

restricted stock issuances.

The Company has available a $150 million syndicated unse-

cured credit agreement. No amounts are currently outstanding.

Additional details regarding the credit agreement can be found

in the Notes to Consolidated Financial Statements (Note 8).

The Company also has a $75 million facility for trade letters

of credit. The trade letters of credit are issued to numerous

overseas suppliers and serve as guarantees to the suppliers. As of

Fe b ru a ry 2, 2002, $39.7 million was outstanding under this trade

letter of credit facility.

The Company has standby letters of credit in the amount of

$8.5 million. The beneficiaries, two of the Company’s suppliers,