Abercrombie & Fitch 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2524

Ab e rcro mbi e &Fitch

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL

S TAT E M E N T S The preparation of financial statements in con-

formity with generally accepted accounting principles requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities as of the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Since actual results may

differ from those estimates, the Company revises its estimates and

assumptions as new information becomes available.

RECLASSIFICATIONS Certain amounts have been reclassified

to conform with current year presentation. The amounts reclas-

sified did not have an effect on the Company’s results of operations

or shareholders’ equity.

3. ISS U ANCES OF ACCOUNTING STA N DA R D S In June 2001, the

Financial Accounting Standards Board (“FA S B”) issued SFA S

No. 142, “Goodwill and Other Intangible Assets.” The standard

is effective starting with fiscal years beginning after December

15, 2001 (Fe b ru a ry 3, 2002 for the Company). SFAS No. 142

addresses how intangible assets that are acquired individually or

with a group of other assets should be accounted for in financial

statements upon their acquisition. It also addresses how goodwill

and other intangible assets should be accounted for after they

have been initially recognized in the financial statements.

Management anticipates that the adoption of SFAS No. 142 will

not have an impact on the Company’s results of operations or its

financial position.

S FAS No. 143, “Accounting for Asset Retirement Obligations,”

will be effective for fiscal years beginning after June 15, 2002

( Fe b ru a ry 2, 2003 for the Company). The standard requires enti-

ties to record the fair value of a liability for an asset retirement

obligation in the period in which it is a cost by increasing the car-

rying amount of the related long-lived asset. Over time, the

liability is accreted to its present value each period, and the cap-

italized cost is depreciated over the useful life of the related

obligation for its recorded amount or the entity incurs a gain or

loss upon settlement. Because costs associated with exiting

leased properties at the end of lease terms are minimal, man-

agement anticipates that the adoption of SFAS No. 143 will not

have a significant effect on the Company’s results of operations

or its financial position.

S FAS No.144, “Accounting for Impairment or Disposal of

Long-Lived Assets,” will be effective for fiscal years beginning aft e r

December 15, 2001 (February 3, 2002 for the Company), and

interim periods within those fiscal years. The standard addresses

financial accounting and reporting for the impairment or disposal

of long-lived assets. Management anticipates that the adoption

of SFAS No. 144 will not have an impact on the Company’ s

results of operations or its financial position.

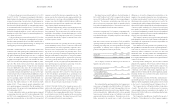

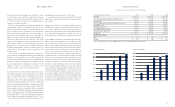

4. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2001 2000

Land $ 15,414 $ 14,007

Building 91,531 –

Furniture, fixtures and equipment 303,606 212,674

Beneficial leaseholds 7,349 7,349

Leasehold improvements 54,702 31,613

Construction in progress 28,721 118,553

Total $501,323 $384,196

Less: accumulated depreciation and amortization 136,211 105,411

Property and equipment, net $365,112 $278,785

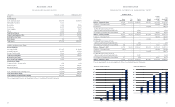

5. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount. Store

lease terms generally require additional payments covering taxes,

common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2001 2000 1999

Store rent:

Fixed minimum $83,608 $65,716 $51,086

Contingent 4,897 7,079 8,246

Total store rent $88,505 $72,795 $59,332

Buildings, equipment and other 1,566 2,777 2,574

Total rent expense $90,071 $75,572 $61,906

At Fe b ru a ry 2, 2002, the Company was committed to noncance-

lable leases with remaining terms of one to fourteen years. These

commitments include store leases with initial terms ranging pri-

marily from ten to fifteen years. A summary of minimum rent

commitments under noncancelable leases follows (thousands):

Ab e rcr o mbie&Fitch

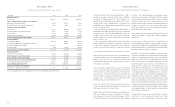

and liabilities are recognized based on the difference between the

financial statement carrying amounts of existing assets and lia-

bilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted

tax rates in effect in the years in which those temporary differ-

ences are expected to reverse. Under SFAS No. 109, the effect on

deferred taxes of a change in tax rates is recognized in income in

the period that includes the enactment date.

Prior to the Exchange Offer, the Company was included in

The Limited's consolidated federal and certain state income tax

groups for income tax reporting purposes and was responsible for

its proportionate share of income taxes calculated upon its fed-

eral taxable income at a current estimate of the Company’ s

annual effective tax rate. Subsequent to the Exchange Offer, the

Company began filing its tax returns on a separate basis.

SHAREHOLDERS’ EQUITY The Board of Directors declared a

two-for-one stock split on A&F’s Class A Common Stock, dis-

tributed on June 15, 1999 to shareholders of record at the close

of business on May 25, 1999. All share and per share amounts

in the accompanying consolidated financial statements for all

periods have been restated to reflect the stock split.

At February 2, 2002, there were 150 million shares of $.01 par

value Class A Common Stock authorized, of which 98.9 million

and 98.8 million shares were outstanding at Fe b ru a ry 2, 2002 and

Fe b ru a ry 3, 2001, respectively, and 106.4 million shares of $.01 par

value Class B Common Stock authorized, none of which were

outstanding at Fe b ru a ry 2, 2002 or Fe b ru a ry 3, 2001. In addition,

15 million shares of $.01 par value Preferred Stock were autho-

rized, none of which have been issued. See Note 13 for

information about Preferred Stock Purchase Rights.

Holders of Class A Common Stock generally have identical

rights to holders of Class B Common Stock, except that holders

of Class A Common Stock are entitled to one vote per share

while holders of Class B Common Stock are entitled to three votes

per share on all matters submitted to a vote of shareholders.

REVENUE RECOGNITION The Company recognizes retail

sales at the time the customer takes possession of the merchan-

dise and purchases are paid for, primarily with either cash or credit

card. Catalogue and e-commerce sales are recorded upon ship-

ment of merchandise. Amounts relating to shipping and

handling billed to customers in a sale transaction are classified

as revenue and the related costs are classified as cost of goods sold.

Employee discounts are classified as a reduction of revenue.

The Company reserves for sales returns through estimates based

on historical experience and various other assumptions that

management believes to be reasonable.

C ATALOGUE AND ADV E RTISING COSTS Costs related to the

A&F Quarterly, a catalogue/magazine, primarily consist of cata-

logue production and mailing costs and are expensed as incurred.

Advertising costs consist of in-store photographs and advertising

in selected national publications and are expensed when the

photographs or publications first appear. Catalogue and adver-

tising costs amounted to $30.7 million in 2001, $30.4 million in

2000 and $30.3 million in 1999.

STORE PREOPENING EXPENSES Preopening expenses related

to new store openings are charged to operations as incurred.

FAIR VA LUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receivables,

marketable securities and accounts payable, approximate fair

value due to the short maturity and because the average interest

rate approximates current market origination rates.

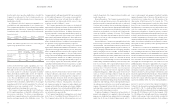

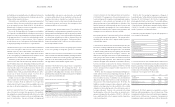

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net

income per basic share is computed based on the weighted aver-

age number of outstanding shares of common stock. Net income

per diluted share includes the weighted average effect of dilutive

stock options and restricted shares.

Weighted Average Shares Outstanding (thousands):

2001 2000 1999

Shares of common stock issued 103,300 103,300 103,300

Treasury shares (4,198) (3,239) (429)

Basic shares 99,102 100,061 102,871

Dilutive effect of options and

restricted shares 3,422 2,095 4,770

Diluted shares 102,524 102,156 107,641

Options to purchase 5,630,000, 9,100,000 and 5,600,000 shares of Class A Common

Stock were outstanding at year-end 2001, 2000 and 1999, respectively, but were not

included in the computation of net income per diluted share because the options’ exer-

cise prices were greater than the average market price of the underlying shares.