Abercrombie & Fitch 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2726

Ab e rcrombi e &Fitch

committed amount per annum. The Agreement contains limi-

tations on debt, liens, restricted payments (including dividends),

mergers and acquisitions, sale-leaseback transactions, invest-

ments, acquisitions, hedging transactions, and transactions with

affiliates. It also contains financial covenants requiring a minimum

ratio of EBITDAR to interest expense and minimum rent and a

maximum leverage ratio. No amounts were outstanding under the

Agreement at Fe b ru a ry 2, 2002 or Fe b ru a ry 3, 2001.

9. RELAT ED PA RTY TRA N S AC T I O N S Subsequent to the

Exchange Offer, A&F and T he Limited entered into various

s e r vice agreements for terms ranging from one to three years.

A&F hired associates with the appropriate expertise or con-

tracted with outside parties to replace those services which

expired in May 1999. Service agreements were also entered into

for the continued use by the Company of its distribution and

home office space and transportation and logistic services. The

agreement for use of distribution space terminated in April 2001.

The agreements for home office space and transportation and

logistics services expired in May 2001. The cost of these serv i c e s

generally was equal to The Limited’s cost in providing the rel-

evant services plus 5% of such costs.

Costs incurred to replace the services provided by The Limited

did not have a material adverse impact on the Company’s finan-

cial condition.

Shahid & Company, Inc. has provided advertising and design

s e rvices for the Company since 1995. Sam N. Shahid Jr., who

s e r ves on A&F’s Board of Directors, has been President and

Creative Director of Shahid & Company, Inc. since 1993. Fees paid

to Shahid & Company, Inc. for services provided during fiscal

years 2001, 2000 and 1999 were approximately $1.8 million, $1.7

million and $1.4 million, respectively.

On January 1, 2002, A&F loaned the amount of $4,953,833 to its

Chairman of the Board, a major shareholder of A&F, pursuant to

the terms of a replacement promissory note, which provides that

such amount is due and payable on December 31, 2002. If A&F

records net sales of at least $1,156,100,000 during the period from

Fe b r u a r y 3, 2002 through November 30, 2002, the outstanding prin-

cipal under the note will not bear interest. If A&F does not record

net sales exceeding that threshold, the outstanding principal under

the note will bear interest from January 1, 2002 at the rate of 4.5%

per annum. This note constitutes a replacement of, and substitute

f o r, the replacement promissory note dated as of May 18, 2001 in

the amount of $4,817,146, which has been cancelled. The replace-

ment promissory note dated May 18, 2001 constituted a

replacement of, and substitute for, the replacement promissory

note dated as of August 28, 2000 in the amount of $4.5 million. The

replacement promissory note dated August 28, 2000 constituted a

replacement of, and substitute for, the promissory note dated

March 1, 2000 and the replacement promissory note dated May 19,

2000 in the amounts of $1.5 million and $3.0 million, respectively.

The replacement promissory note dated May 19, 2000 constituted

a replacement of, and substitute for, the promissory note dated

November 17, 1999 in the amount $1.5 million.

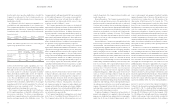

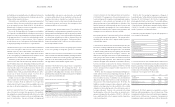

10. STOCK OPTIONS AND RESTRICTED SHARES Under A&F’s

stock plans, associates and non-associate directors may be

granted up to a total of 21.3 million restricted shares and options

to purchase A&F’s common stock at the market price on the date

of grant. In 2001, associates of the Company were granted

approximately 600,000 options, with vesting periods from four

to five years. A total of 84,000 options were granted to non-asso-

ciate directors in 2001, all of which vest over four years. All

options have a maximum term of ten years.

The Company adopted the disclosure requirements of SFA S

No. 123, “Accounting for Stock-Based Compensation,” in 1996,

but elected to continue to measure compensation expense in

accordance with Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees.” Ac c o r d i n g l y, no com-

pensation expense for stock options has been recognized. If

compensation expense had been determined based on the esti-

mated fair value of options granted in 2001, 2000 and 1999,

consistent with the methodology in SFAS No. 123, the pro forma

effect on net income and net income per diluted share would have

been a reduction of approximately $20.6 million or $.20 per share

in 2001, $20.0 million or $.20 per share in 2000 and $18.5 million

or $.17 per share in 1999. The weighted-average fair value of all

options granted during fiscal 2001, 2000 and 1999 was $14.96, $8.90

and $23.34, respectively. The fair value of each option was esti-

mated using the Black-Scholes option-pricing model with the

following weighted-average assumptions for 2001, 2000 and 1999:

no expected dividends; price volatility of 54% in 2001, 50% in 2000

and 45% in 1999; risk-free interest rates of 4.7%, 6.2% and 6.0%

in 2001, 2000 and 1999, respectively; assumed forfeiture rates of

Ab e rcr omb i e&Fitch

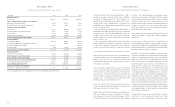

2002 $104,085 2005 102,533

2003 $105,953 2006 95,926

2004 $105,317 Thereafter 309,106

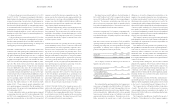

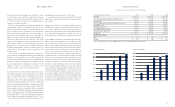

6. ACCRUED EXPENSES Ac c rued expenses consisted of the

following (thousands):

2001 2000

Accrual for construction in progress $ 25,338 $ 24,371

Unredeemed gift card revenue 17,031 11,636

Rent and landlord charges 16,247 15,634

Catalogue and advertising costs 11,178 7,818

Compensation and benefits 9,492 11,771

Taxes, other than income 3,552 5,102

Other 26,748 24,970

Total $109,586 $101,302

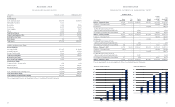

7. INCOME TAXES The provision for income taxes consisted of

(thousands):

2001 2000 1999

Currently payable:

Federal $ 80,126 $ 80,856 $ 84,335

State 14,567 18,403 20,251

$ 94,693 $ 99,259 $104,586

Deferred:

Federal 11,133 2,814 (3,885)

State 2,024 1,247 (971)

$13,157 $ (4,061)$(4,856)

Total provision $107,850 $103,320 $99,730

A reconciliation between the statutory Federal income tax rate

and the effective income tax rate follows:

2001 2000 1999

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 3.9% 4.1% 4.6%

Other items, net 0.1% 0.4% 0.4%

Total 39.0% 39.5% 40.0%

Income taxes payable included net current deferred tax assets

of $4.9 million and $12.6 million at February 2, 2002 and

February 3, 2001, respectively.

Subsequent to the Exchange Offer, the Company began filing

its tax returns on a separate basis and made tax payments direct-

ly to taxing authorities. Prior to the Exchange Offer, the

Company was included in the consolidated federal and certain

state income tax groups of The Limited for income tax purposes.

Under this arrangement, the Company was responsible for and

paid The Limited its proportionate share of income taxes, calcu-

lated upon its separate taxable income at the estimated annual

effective tax rate. Amounts paid to The Limited totaled $20

thousand, $829 thousand and $9.1 million in 2001, 2000 and

1999, respectively. Amounts paid directly to taxing authorities

were $94.3 million, $111.7 million and $81.1 million in 2001,

2000 and 1999, respectively.

The effect of temporary differences which gives rise to de-

ferred income tax assets (liabilities) was as follows (thousands):

2001 2000

Deferred tax assets:

Deferred compensation $ 8,833 $ 8,311

Rent 1,525 2,414

Accrued expenses 7,216 8,144

Inventory 1,747 2,767

Other, net 139 –

Total deferred tax assets 19,460 21,636

Deferred tax liabilities:

Store supplies (7,417) (2,061)

Property and equipment (8,307) (85)

Total deferred tax liabilities (15,724) (2,146)

Net deferred income tax assets $3,736 $19,490

No valuation allowance has been provided for deferred tax

assets because management believes that it is more likely than

not that the full amount of the net deferred tax assets will be

realized in the future.

8. LONG-TERM DEBT The Company entered into a $150 mil-

lion syndicated unsecured credit agreement (the “Agreement”) on

April 30, 1998. Borrowings outstanding under the Agreement are

due April 30, 2003. The Agreement has several borrowing options,

including interest rates that are based on the bank agent’s “A l t e r n a t e

Base Rate,” a LIBO Rate or a rate submitted under a bidding

process. Facility fees payable under the Agreement are based on

the Company’s ratio (the “leverage ratio”) of the sum of total

debt plus 800% of forward minimum rent commitments to trail-

ing four-quarters EBITDAR and currently accrues at .225% of the