Abercrombie & Fitch 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1918

Ab e rcr ombi e &Fitch

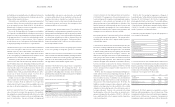

how goodwill and other intangible assets should be accounted

for after they have been initially recognized in the financial

statements. Management anticipates that the adoption of SFA S

No. 142 will not have an impact on the Company’s results of

operations or its financial position.

S FAS No. 143, “Accounting for Asset Retirement Obligations,”

will be effective for fiscal years beginning after June 15, 2002

( Fe b ru a ry 2, 2003 for the Company). The standard requires enti-

ties to record the fair value of a liability for an asset retirement

obligation in the period in which it is a cost by increasing the car-

rying amount of the related long-lived asset. Over time, the

liability is accreted to its present value each period, and the capi-

talized cost is depreciated over the useful life of the related

obligation for its recorded amount or the entity incurs a gain or loss

upon settlement. Because costs associated with exiting leased

properties at the end of lease terms are minimal, management

anticipates that the adoption of SFAS No. 143 will not have a sig-

nificant effect on the Company’s results of operations or its

financial position.

S FAS No.144, “Accounting for Impairment or Disposal of

Long-Lived Assets,” will be effective for fiscal years beginning aft e r

December 15, 2001 (Fe b ru a ry 3, 2002 for the Company), and

interim periods within those fiscal years. The standard addresses

financial accounting and reporting for the impairment or dis-

posal of long-lived assets. Management anticipates that the

adoption of SFAS No. 144 will not have an impact on the

C o m p a n y’s results of operations or its financial position.

R E L ATIONSHIP WITH THE LIMITED Effective May 19, 1998,

The Limited completed a tax-free exchange offer to establish

A&F as an independent company. Subsequent to the exchange

offer (see Note 1 of the Notes to Consolidated Fi n a n c i a l

Statements), A&F and The Limited entered into various serv i c e

agreements for terms ranging from one to three years. A&F hired

associates with the appropriate expertise or contracted with outside

parties to replace those services which expired in May 1999.

S e rvice agreements were also entered into for the continued use

by the Company of its distribution and home office space and trans-

portation and logistic services. The distribution space agreement

terminated in April 2001. The home office space and transporta-

tion and logistic services agreements expired in May 2001. The cost

of these services generally was equal to The Limited’s cost in

providing the relevant services plus 5% of such costs.

Costs incurred to replace the services provided by The Limited

did not have a material adverse impact on the Company’s finan-

cial condition.

I M PACT OF INFLAT I O N The Company's results of operations

and financial condition are presented based upon historical

cost. While it is difficult to accurately measure the impact of

inflation due to the imprecise nature of the estimates required,

the Company believes that the effects of inflation, if any, on its

results of operations and financial condition have been minor.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECU-

RITIES LITIGATION REFORM ACT OF 19 9 5 A&F cautions that

any forward-looking statements (as such term is defined in the

Private Securities Litigation Reform Act of 1995) contained in this

Report or made by management of A&F involve risks and uncer-

tainties and are subject to change based on various important

factors. The following factors, among others, in some cases

have affected and in the future could affect the Company’ s

financial performance and actual results and could cause actual

results for 2002 and beyond to differ materially from those

expressed or implied in any of the forward-looking statements

included in this Report or otherwise made by management:

changes in consumer spending patterns and consumer prefer-

ences; the effects of political and economic events and conditions

domestically and in foreign jurisdictions in which the Company

operates, including, but not limited to, acts of terrorism or war;

the impact of competition and pricing; changes in weather pat-

terns; political stability; currency and exchange risks and changes

in existing or potential duties, tariffs or quotas; availability of suit-

able store locations at appropriate terms; ability to develop new

merchandise; and ability to hire, train and retain associates.

Ab e rcr omb i e&Fitch

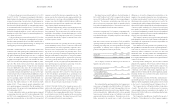

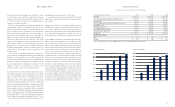

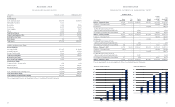

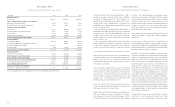

C O N SO L I DAT ED STAT E ME NTS OF INCOME

2001 2000 1999

$1,364,853 $1,237,604 $1,030,858

806,819 728,229 580,475

558,034 509,375 450,383

286,576 255,723 208,319

271,458 253,652 242,064

(5,064) (7,801) (7,270)

276,522 261,453 249,334

107,850 103,320 99,730

$ 168,672 $ 158,133 $ 149,604

$ 1.70 $ 1.58 $ 1 4 ,1.45

$ 1.65 $ 1.55 $ 1 4 ,1.39

(Thousands except per share amounts)

Net Sales

Cost of Goods Sold, Occupancy and Buying Costs

Gross Income

General, Administrative and Store Operating Expenses

Operating Income

Interest Income, Net

Income Before Income Taxes

Provision for Income Taxes

Net Income

Net Income Per Share:

Basic

Diluted

The accompanying Notes are an integral part of these Consolidated Financial Statements.

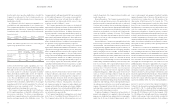

Net Sales ($ in Millions)

1997 1998 1999 2000 2001

$1,200

$1,400

$1,000

$800

$600

$400

$200

$513

$805

$1,031

$1,238

$1,365

Net Income ($ in Millions)

1997 1998 1999 2000 2001

$20

$40

$60

$80

$100

$120

$140

$160

$180

$48

$102

$150

$158

$169