Abercrombie & Fitch 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2120

Ab e r cr omb i e&Fitch Ab e rcrombi e &Fitch

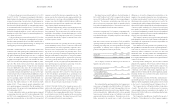

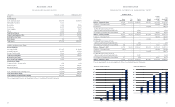

(Thousands) February 2, 2002 February 3, 2001

Assets

Current Assets

Cash and Equivalents $167,664 $137,581

Marketable Securities 71,220 –

Receivables 20,456 15,829

Inventories 108,876 120,997

Store Supplies 21,524 17,817

Other 15,455 11,338

Total Current Assets 405,195 303,562

Property and Equipment, Net 365,112 278,785

Deferred Income Taxes –6,849

Other Assets 239 381

Total Assets $770,546 $589,577

Liabilities and Shareholders’ Equity

Current Liabilities

Accounts Payable $031,897 $033,942

Accrued Expenses 109,586 101,302

Income Taxes Payable 22,096 21,379

Total Current Liabilities 163,579 156,623

Deferred Income Taxes 1,165 –

Other Long-Term Liabilities 10,368 10,254

Shareholders’ Equity

Common Stock – $.01 par value 1,033 1,033

Paid-In Capital 141,394 136,490

Retained Earnings (Deficit) 519,540 350,868

661,967 488,391

Less: Treasury Stock, at Average Cost (66,533) (65,691)

Total Shareholders’ Equity 595,434 422,700

Total Liabilities and Shareholders’ Equity $770,546 $589,577

The accompanying Notes are an integral part of these Consolidated Financial Statements.

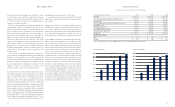

C O N SO L I D AT ED B A L A N CE S H E E T S

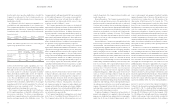

Shareholders’ Equity ($ in Millions)

1997 1998 1999 2000 2001

$59

$311

$423

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

$600

Earnings Per Diluted Share

1997 1998 1999 2000 2001

$0.47

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

$0.96

$1.39

$1.55

$1.65

$186

$595

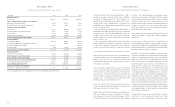

C O N SO L I D AT ED S TAT E M E N T S OF SH AREH OLDERS’ EQUITY

Common Stock

Treasury

Stock, Total

Shares Par Paid-In Retained at Average Shareholders’

(Thousands)Outstanding Value Capital Earnings Cost Equity

Balance, January 30,1999 102,814 $1,033 $143,626 $ 43,131)$ (1,685) $ 1 8 6,105

Purchase of Treasury Stock (1,510) – – – (50,856) (50,856)

Net Income – – – 149,604 – 149,604

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 9,389 – – 9,389

Stock Options, Restricted Stock and Other 700 – (5,710) – 22,562 16,852

Balance, January 29,2000 102,004 $1,033 $147,305 $192,735 $(29,979) $311,094

Purchase of Treasury Stock (3,550) – – – (43,929) (43,929)

Net Income – – – 158,133 – 158,133

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 462 – – 462

Stock Options, Restricted Stock and Other 342 – (11,277) – 8,217 (3,060)

Balance, February 3, 2001 98,796 $1,033 $136,490 $350,868 $(65,691) $422,700

Purchase of Treasury Stock (600) – – – (11,069) (11,069)

Net Income – – – 168,672 – 168,672

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 5,056 – – 5,056

Stock Options, Restricted Stock and Other 677 – (152) – 10,227 10,075

Balance, February 2, 2002 98,873 $1,033 $141,394 $519,540 $(66,533) $595,434

The accompanying Notes are an integral part of these Consolidated Financial Statements.