ADT 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NON-GAAP MEASURES

“Free cash flow” (FCF) and “organic revenue growth” are

non-GAAP measures and should not be considered replace-

ments for financial GAAP results. These measures should

be used in conjunction with the most comparable GAAP

financial measures. Investors are urged to read the

Company’s financial statements as filed with the Securities

and Exchange Commission for more information about the

most comparable GAAP measures.

The difference between Cash Flows from Operating

Activities (the most comparable GAAP measure) and FCF

(the non-GAAP measure) consists mainly of significant cash

outflows that the Company believes are useful to identify.

FCF permits management and investors to gain insight into

the number that management employs to measure cash

that is free from any significant existing obligation. It is

also a significant component in the Company’s incentive

compensation plans. The difference reflects the impact

from: the sale of accounts receivable programs, net capital

expenditures, acquisition of customer accounts (ADT dealer

program), cash paid for purchase accounting and hold-

back/earn-out liabilities, and dividends paid.

The impact from the sale of accounts receivable

programs is added or subtracted from the GAAP measure

because this activity is driven by economic financing

decisions rather than operating activity. Capital expendi-

tures, the ADT dealer program, and dividends are subtracted

because they represent long-term commitments. Cash

paid for purchase accounting and holdback/earn-out lia-

bilities is subtracted from Cash Flow from Operating

Activities because these cash outflows are not available

for general corporate uses.

The limitation associated with using FCF is that it

subtracts cash items that are ultimately within manage-

ment and the Board of Directors’ discretion to direct and

that therefore may imply that there is less or more cash

that is available for the Company’s programs than the

most comparable GAAP measure.

“Organic revenue growth” is an important measure

used by the Company to measure the underlying results and

trends in the business. The difference between reported net

revenue growth (the most comparable GAAP measure) and

organic revenue growth (the non-GAAP measure) consists of

the impact from foreign currency, acquisitions and divesti-

tures, and revenue reclassifications.

Organic revenue growth is an important measure of

the Company’s performance because it excludes items that:

i) are not completely under management’s control, such

as the impact of foreign currency exchange; or ii) do not

reflect the underlying growth of the Company, such as

acquisition and divestiture activity, or revenue reclassifica-

tion. It is also a component of the Company’s compensation

programs. The limitation of this measure is that it excludes

items that have an impact on the Company’s revenue.

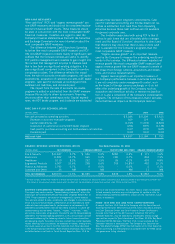

FREE CASH FLOW RECONCILIATION

(IN MILLIONS) 2004 2003 2002

Net cash provided by operating activities $ 5,384 $ 5,309 $ 5,423

Decrease in accounts receivable programs 929 119 56

Capital expenditures, net (1,015) (1,274) (2,823)

Acquisition of customer accounts (ADT dealer program) (254) (597) (1,138)

Cash paid for purchase accounting and holdback/earn-out liabilities (107) (272) (625)

Dividends paid (100) (101) (100)

FREE CASH FLOW $ 4,837 $ 3,184 $ 793

ORGANIC REVENUE GROWTH RECONCILIATION Year Ended September 30, 2004

(IN MILLIONS) NET REVENUES FOREIGN CURRENCY DIVESTITURES AND OTHER ORGANIC REVENUE GROWTH

Fire & Security $11,447 5.7% $ 526 5.0% $(82) -0.9% $ 171 1.6%

Electronics 11,822 12.7% 560 5.5% (34) -0.7% 804 7.9%

Healthcare 9,110 8.2% 292 3.5% (5) -0.1% 403 4.8%

Engineered Products 6,007 33.6% 298 6.6% 759 16.8%(1) 452 10.1%

Plastics & Adhesives 1,742 0.7% 9 0.5% – 0.0% 2 0.1%

Corporate and Other 25 NM – NM – NM 11 NM

TOTAL NET REVENUES $40,153 11.6% $1,685 4.8% $638 1.6% $1,843 5.2%

(1) Amount includes $739 million related to a revenue reclassification at Infrastructure Services for certain subcontract costs previously treated as pass-through to customers and

$18 million of Infrastructure Services revenue which resulted from the consolidation of several joint ventures under FIN 46 during fiscal 2004.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This report may contain certain “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform Act of

1995. These statements are based on management’s current expecta-

tions and are subject to risks, uncertainty, and changes in circumstances,

which may cause actual results, performance, or achievements to differ

materially from anticipated results, performance, or achievements. All

statements contained herein that are not clearly historical in nature are

forward-looking and the words “believe,” “expect,” “estimate,” “plan,”

and similar expressions are generally intended to identify forward-looking

statements. The forward-looking statements in this annual report include

statements addressing the following subjects: future financial condition

and operating results. Economic, business, competitive, and/or regulatory

factors affecting Tyco’s businesses are examples of factors, among others,

that could cause actual results to differ materially from those described

in the forward-looking statements. More detailed information about these

and other factors is set forth in Tyco’s Annual Report on Form 10-K for

the fiscal year ended September 30, 2004. Tyco is under no obligation

to (and expressly disclaims any such obligations to) update or alter its

forward-looking statements whether as a result of new information, future

events, or otherwise.

FORM 10-K AND SEC AND NYSE CERTIFICATIONS

A copy of the Form 10-K filed by the Company with the Securities and

Exchange Commission (SEC) for fiscal 2004, which includes as Exhibits

the Chief Executive Officer and Chief Financial Officer Certifications

required to be filed with the SEC pursuant to Section 302 of the

Sarbanes-Oxley Act, may be obtained by shareholders without charge

upon written request to Tyco International, 2nd Floor, 90 Pitts Bay Road,

Pembroke HM 08, Bermuda. The Form 10-K is also available on the

Company's website at www.tyco.com. The Company has filed with the

New York Stock Exchange (NYSE) the Certification of its Chief Executive

Officer confirming that the Company has complied with the NYSE corpo-

rate governance listing standards.