ADT 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

employees globally and our Six Sigma teams

completed nearly 1,100 projects. These efforts gen-

erated approximately $270 million of net savings.

STRATEGIC SOURCING

Our business segments continue to work together to

develop and implement “One Tyco” sourcing strate-

gies to reduce our spending and to make purchases

more efficiently. At year-end, we had cross-functional

teams addressing more than 100 purchase categories

ranging from telecommunications and personal

computers to commercial printing and office sup-

plies. Despite a difficult year for commodity pricing,

we delivered more than $300 million of net savings.

REAL ESTATE

We accelerated our efforts to optimize our real

estate footprint in 2004. Over the past two years we

have closed more than 600 facilities, reducing our

overall real estate portfolio by more than 12 million

square feet. Beyond the savings, we achieved

increased efficiencies as multiple segments and busi-

ness units began co-locating to share services

and infrastructure.

WORKING CAPITAL

In 2004, we improved our working capital velocity

by eight days. All five of our segments showed progress

in inventory turns as we collectively improved by

10 days across the Company. In addition, better

accounts receivable performance resulted in a five-day

improvement. In total, our working capital pro-

grams freed up more than $900 million of cash.

GROWTH FOCUS

Organically, Tyco’s revenue increased 5 percent,

2

or about $2 billion, in 2004. This performance

reflects the success of our new product and service

offerings, our efforts to expand globally, and the

continued loyalty of our customers.

To maintain and extend our market leader-

ship, we are strategically investing to deliver even

greater value for our customers. For example,

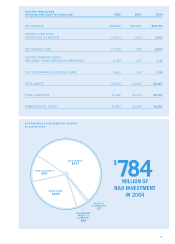

we increased research and development investment

across the company by 18 percent, including a

39 percent increase at Tyco Healthcare. We also

expanded our efforts to hire and train new sales-

people for many of our growing operations,

including ADT and Tyco Healthcare.

We are equally focused on improving processes

to better leverage our existing resources. For instance,

Tyco Electronics’ Global Account Management pro-

gram applies an integrated team approach to better

serve our major customers. This best practice is now

being used by other Tyco businesses.

BALANCE SHEET FOCUS

During 2004, we remained focused on actions to

continuously strengthen our balance sheet. We used

our strong cash flow to pay down $4.2 billion of debt,

including the repurchase of $517 million of convert-

ible debt securities. This action reduced the number

of Tyco’s diluted shares outstanding by nearly 23 mil-

lion. We also voluntarily contributed approximately

$575 million to our pension plans. The major rating

agencies recognized these actions and upgraded Tyco’s

debt rating to full investment-grade status in 2004.

“ABOVE ALL, 2004 WAS A YEAR TO

DEMONSTRATE OUR ABILITY TO MEET

OUR COMMITMENTS TO YOU.”

2 Organic revenue growth is a non-GAAP financial measure.

See GAAP reconciliation on inside back cover.

16