3M 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

quantities of all raw materials to meet its reasonably foreseeable production requirements, but it is impossible to

predict future shortages of raw materials or the impact any such shortages would have. 3M manages commodity price

risks through negotiated supply contracts, price protection agreements and forward physical contracts. Fluctuations in

foreign currency exchange rates also impact results, although the Company minimizes this effect through hedging

about half of this impact. 3M continued, as it has for many years, to incur expenses (insured and uninsured) in

managing its litigation and environmental contingencies.

The sale of the pharmaceuticals business is not presented as a discontinued operation due to the extent of the

projected continuing cash flows from our contractual supply relationship with the buyers in relation to those of the

business that was sold. Therefore, it will create both a sales and profitability comparability issue beginning with first

quarter 2007 results. Annual sales in 2006 for pharmaceuticals were $774 million, and reported operating income was

$1.039 billion, including net gains of $783 million as discussHGLQWKH³3KDUPDFHXWLFDOV%XVLQHVV´GLVFXVVLRQWKDW

follows. Sales growth in 2007 will be negatively impacted as these pharmaceutical sales are in the base 2006 period.

0¶V'UXJ'HOLYHU\6\VWHPV'LYLVLRQZLOOEHDVRXUFHRI supply to the acquiring companies, with expected annual

revenues of approximately $100 million from the various arrangements with the three buyers. Such outsourcing

arrangements involve a lower profitability than the other product and service offerings of most of our existing Health

Care businesses.

3M restructured many areas in parallel with divesting the global branded pharmaceuticals business. The great

majority of those costs will not be eliminated until late in the first quarter or early in the second quarter of 2007.

Earnings growth is expected to be slowest in the first quarter of 2007 due to these continued expenses and the strong

comparable first quarter in 2006. 3M expects earnings to improve somewhat in the second quarter of 2007, and

accelerate more into the second half of the year.

%HJLQQLQJLQWKH&RPSDQ\LVPRGLI\LQJLWVORQJWHUPDQGVKRUWWHUPLQFHQWLYHFRPSHQVDWLRQSURJUDPVWRDOLJQ

employee and shareholder interests more closely. The ComSDQ\VVKRUWWHUPLQFHQWLYHcompensation plan is moving

DZD\IURPLWVTXDUWHUO\\HDURYHU\HDUIRFXVHGSURILW sharing plan toward an annual bonus plan with payouts tied

principally to performance measured by the operating plan. The Company is also reducing the number of traditional

VWRFNRSWLRQVJUDQWHGXQGHULWVORQJWHUPincentive compensation plan by reducing the number of employees eligible

to receive annual grants and by shifting a portion of the annual grant away from traditional stock options primarily to

restricted stock units. These changes will reduce the annual dilution impact from 1.5% of total outstanding common

stock to about 1%. However, associated with the reduction in the number of eligible employees, the Company decided

WRSURYLGHDRQHWLPH³EX\RXW´JUDQWWRWKHLPSDFWHGHPSOR\HHVZKLFKZLOOUHVXOWLQLQFUHDVHGVWRFNEDVHG

FRPSHQVDWLRQH[SHQVHLQ,QDGGLWLRQ0¶VFKDQJHLQWhe vesting period for stock options from one to three

years starting with the May 2005 grant also results LQKLJKHUH[SHQVHLQFRPSDUHGZLWK6WRFNEDVHG

compensation expense is expected to total $0.21 per diluted share in 2007, compared with $0.17 per diluted share in

2006.

7KHSUHFHGLQJIRUZDUGORRNLQJVWDWHPHQWVinvolve risks and uncertainties that could cause results to differ materially

IURPWKRVHSURMHFWHGUHIHUWRWKHIRUZDUGORRNLQJVWDWHPHQWs section in Item 7 and the risk factors provided in Item 1A

for discussion of these risks and uncertainties).

As discussed in Note 1, effective January 1, 2006, 3M adopted Statement of Financial Accounting Standards No. 123

UHYLVHG³6KDUH%DVHG3D\PHQW´6)$61R5ZKLFKUHTXLUHG0WRH[SHQVHVWRFNEDVHGFRPSHQVDWLRQ7KH

&RPSDQ\DGRSWHG6)$61R5XVLQJWKHPRGLILHGUHWURVSHFWLYH method. Effective January 1, 2006, all prior periods

ZHUHUHYLVHGWRJLYHHIIHFWWRWKHIDLUYDOXHEDVHGPHWKRGof accounting for awards granted in fiscal years beginning on or

DIWHU-DQXDU\6WRFNEDVHGFRPpensation expense for the years ended 'HFHPEHUDQGLV

summarized by business segment in the table that follows.

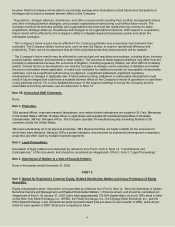

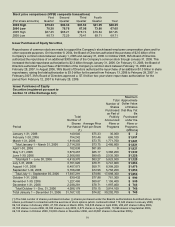

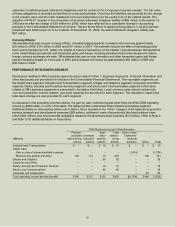

Stock-based compensation expense

'ROODUVLQPLOOLRQV 2006

Industrial and Transportation $ 51

Health Care 42 58

'LVSOD\DQG*UDSKLFV 27 19 34

Consumer and Office 24 21 34

6DIHW\6HFXULW\DQG3URWHFWLRQ6HUYLFHV 21 16 26

Electro and Communications 20 17 26

Corporate and Unallocated 15 ±±

Total Company

2005 2004

$ 47

35

$200 $155 $252

$ 74

December 31

Years ended