3M 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

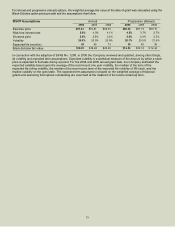

The Company recorded $40 million in the second quarter of 2006 with respect to the settlement in principle reached in

that quarter with respect to the antitrust class action brought on behalf of direct purchasers who did not purchase

private label tape. For those significant pending legal proceedings that do not appear in the table and that are not the

subject of pending settlement agreements, the Company has determined that liability is not probable or the amount of

the liability is not estimable, or both, and the Company is unable to estimate the possible loss or range of loss at this

time. The amounts in the preceding table with respect to breast implant and environmental remediation represent the

&RPSDQ\¶VEHVWHVWLPDWHRIWKHUHVSHFtive liabilities. The Company does not believe that there is any single best

estimate of the respirator/mask/asbestos liability or the other liabilities shown above, nor that it can reliably estimate

the amount or range of amounts by which those liabilities may exceed the reserves the Company has established.

Breast Implant Insurance Receivables: As of December 31, 2006, the Company had receivables for insurance

recoveries related to the breast implant matter of $93 million, representing amounts expected to be recovered pursuant to

WKH0LQQHVRWD6XSUHPH&RXUW¶VUXOLQJRI$XJXVWEXW\Ht to be received and other amounts that have been claimed

from various reinsurers, the Minnesota Insurance Guaranty Association, and the estates of certain insolvent insurance

carriers. The Company received about $1 million in the fourth quarter of 2006 (bringing total recoveries in 2006 to

$43 million), pursuant to settlements that were consistent with WKH&RPSDQ\¶VRYHUDOOH[SHFWDWLon of recovery as a result

of the Minnesota Supreme Court ruling. This recovery reduced the previously recorded receivable, which was separately

raised in the fourth quarter by $6 million reflecting a revised estimate of likely total remaining recoveries. With these

recent settlements and the previously disclosed settlements, 21 of the 29 insurers have withdrawn from the pending

SURFHHGLQJVDQGKDYHVHWWOHGWKH&RPSDQ\¶VFODLPVXQGHUWKH0Lnnesota Supreme Court decision. Various factors could

affect the timing and amount of recoveryRIWKHEDODQFHRIWKH&RPSDQ\¶VLQVXrance receivables, including (i) additional

delays in or avoidance of payment by insurers; (ii) the extent to which insurers may become insolvent in the future, and

(iii) the outcome of the pending legal proceedings involving the insurers. The Company expects the District Court in

Ramsey County Minnesota will enter in the first quarter of 2007 a comprehensive order and judgment setting forth the

amount (plus interest) that each of the insurers remaining in the case owe the Company.

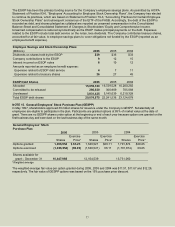

Respirator Mask/Asbestos Liabilities and Insurance Receivables: The Company estimates its respirator

mask/asbestos liabilities, including the cost to resolve the claim and defense costVE\H[DPLQLQJLWKH&RPSDQ\¶V

experience in resolving claims, (ii) apparent trends, (iii) the apparent quality of claims (e.g., whether the claim has

been asserted on behalf of asymptomatic claimants), (iv) changes in the nature and mix of claims (e.g., the proportion

RIFODLPVDVVHUWLQJXVDJHRIWKH&RPSDQ\¶VPDVNRUUHVSirator products and alleging exposure to each of asbestos,

silica, coal or other occupational dusts, and claims pleading use of asbestos-containing products allegedly

manufactured by the Company), (v) the number of current claims and a projection of the number of future asbestos

and other claims that may be filed against the Company, (vi) the cost to resolve recently settled claims, and (vii) an

estimate of the cost to resolve and defend against current and future claims. Because of the inherent difficulty in

projecting the number of claims that have not yet been asserted, particularly with respect to the Company's respiratory

products that themselves did not contain any harmful materials (which makes the various published studies that

purport to project future asbestos claims substantially removed from the Company's principal experience and which

themselves vary widely), the Company does not believe that there is any single best estimate of this liability, nor that it

can reliably estimate the amount or range of amounts by which the liability may exceed the reserve the Company has

established. No liability has been recorded regarding the pending action brought by the West Virginia Attorney General

previously described.

'HYHORSPHQWVPD\RFFXUWKDWFRXOGDIIHFWWKH&RPSDQ\¶VHVWimate of its liabilities. These developments include, but are

not limited to, significant changes in (i) the number of future claims, (ii) the average cost of resolving claims, (iii) the legal

costs of defending these claims and in maintaining trial readiness, (iv) changes in the mix and nature of claims received,

(v) trial and appellate outcomes, (vi) changes in the law and procedure applicable to these claims, and (vii) the financial

viability of other co-defendants and insurers.

$VRI'HFHPEHUWKH&RPSDQ\¶VUHFHLYDEOHIRULQVXrance recoveries related to the respirator mask/asbestos

litigation was $380 million. The Company collected $17 million in the fourth quarter and $75 million in 2006 from several

of its insurers, reducing this receivable by that amount. While the Company has substantial remaining claims-made and

occurrence (pre-1986) insurance coverage, as previously disclosed this additional receivable represents a lower

percentage of the additional liability than was the case with receivables recorded prior to 2004 primarily because of

YDU\LQJGHJUHHVRISULRUVHWWOHPHQWVZLWKWKH&RPSDQ\¶VLQsurers, insolvencies of certain insurers, uncertainties

concerning the precise manner of assigning particular costs to specific policies, potential exhaustion of policies, and the

types of claims asserted. Various factors could affect the timing and amount of recovery of this receivable, including (i)

delays in or avoidance of payment by insurers; (ii) the extent to which insurers may become insolvent in the future, and

(iii) the outcome of negotiations with insurers and possible legal proceedings, if necessary, with respect to respirator

mask/asbestos liability insurance coverage. On January 5, 2007 the Company was served with a declaratory judgment

action filed on behalf of two of its insurers (Continental Casualty and Continental Insurance Co.) disclaiming coverage for

respirator/mask claims. The action was filed in Hennepin County, Minnesota and names, in addition to the Company,