3M 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

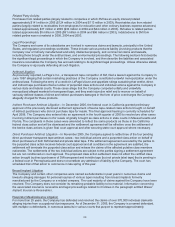

Company supports such legislation in principle, although enactment of the proposed legislation could cause the

Company to record substantial additional liabilities.

As a result of the costs of aggressively defending itself, the Company increased its reserves in the second quarter of

2005 for respirator mask/asbestos liabilities by $30 million. As of December 31, 2005, the Company had reserves

for respirator mask/asbestos liabilities of $210 million.

As of December 31, 2005, the Company had receivables for insurance recoveries related to the respirator

mask/asbestos litigation of $447 million. The Company increased its receivables in the second quarter of 2005 for

insurance recoveries related to respirator mask/asbestos litigation by $15 million and received payments under the

Company’s insurance program of $5 million in the fourth quarter of 2005 (bringing the total recoveries in 2005 to

$32 million). While the Company has substantial remaining claims-made and occurrence (pre-1986) insurance

coverage, as previously disclosed this additional receivable represents a lower percentage of the additional liability

than was the case with receivables recorded prior to 2004 primarily because of varying degrees of prior settlements

with the Company’s insurers, insolvencies of certain insurers, uncertainties concerning the precise manner of

assigning particular costs to specific policies, potential exhaustion of policies, and the types of claims asserted.

Various factors could affect the timing and amount of recovery of this receivable, including (i) delays in or avoidance

of payment by insurers; (ii) the extent to which insurers may become insolvent in the future, and (iii) the outcome of

negotiations with insurers and possible legal proceedings, if necessary, with respect to respirator mask/asbestos

liability insurance coverage.

The difference between the accrued liability and insurance receivable represents in part the time delay between

payment of claims and recording of liability (including with respect to projected future claims) on the one hand and

receipt of insurance reimbursements on the other hand. Because of the lag time between settlement and payment of

a claim, no meaningful conclusions may be drawn from quarterly changes in the amount of receivables for expected

insurance recoveries and the quarterly changes in the number of claimants at the end of each quarter.

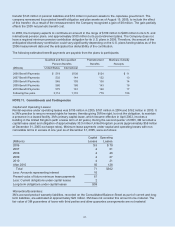

Environmental Liabilities and Insurance Receivables: As of December 31, 2005, the Company had recorded

liabilities of $30 million for estimated environmental remediation costs based upon an evaluation of currently available

facts with respect to each individual site and also recorded related insurance receivables of $15 million. The

Company records liabilities for remediation costs on an undiscounted basis when they are probable and reasonably

estimable, generally no later than the completion of feasibility studies or the Company’s commitment to a plan of

action. Liabilities for estimated costs of environmental remediation, depending on the site, are based primarily upon

internal or third-party environmental studies, and estimates as to the number, participation level and financial viability

of any other potentially responsible parties, the extent of the contamination and the nature of required remedial

actions. The Company adjusts recorded liabilities as further information develops or circumstances change. The

Company expects that it will pay the amounts recorded over the periods of remediation for the applicable sites,

currently ranging up to 30 years.

It is difficult to estimate the cost of environmental compliance and remediation given the uncertainties regarding the

interpretation and enforcement of applicable environmental laws and regulations, the extent of environmental

contamination and the existence of alternate cleanup methods. Developments may occur that could affect the

Company’s current assessment, including, but not limited to: (i) changes in the information available regarding the

environmental impact of the Company’s operations and products; (ii) changes in environmental regulations or

enforcement policies, including efforts to recover natural resource damages; (iii) new and evolving analytical and

remediation techniques; (iv) success in allocating liability to other potentially responsible parties; and (v) the financial

viability of other potentially responsible parties and third-party indemnitors.

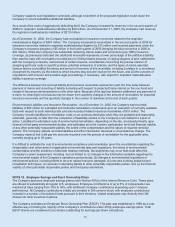

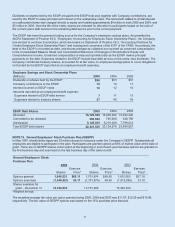

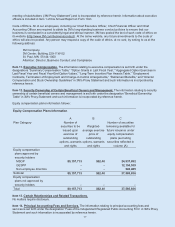

NOTE 12. Employee Savings and Stock Ownership Plans

The Company sponsors employee savings plans under Section 401(k) of the Internal Revenue Code. These plans

are offered to substantially all regular U.S. employees. Employee contributions of up to 6% of compensation are

matched at rates ranging from 35% to 50%, with additional Company contributions depending upon Company

performance. All Company contributions initially are invested in 3M common stock, with employee contributions

invested in a number of investment funds pursuant to their elections. Vested employees may diversify their 3M

shares into other investment options.

The Company maintains an Employee Stock Ownership Plan (ESOP). This plan was established in 1989 as a cost-

effective way of funding the majority of the Company’s contributions under 401(k) employee savings plans. Total

ESOP shares are considered to be shares outstanding for earnings per share calculations.