3M 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

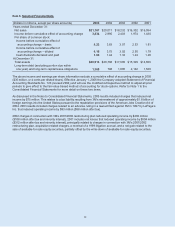

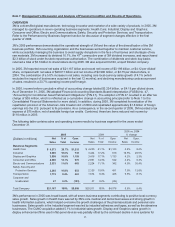

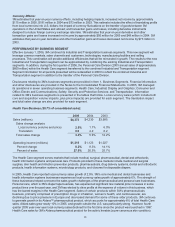

Operating Income:

3M uses operating income as one of its primary business segment performance measurement tools. Operating income

in 2005 was 23.7% of sales, up from 22.9% of sales in 2004 and 20.4% of sales in 2003. Operating income in 2005

grew by $431 million, or 9.4 percent, following 2004 operating income growth of $865 million, or 23.3 percent. The

LePage’s Inc. lawsuit negatively impacted operating income in 2003 by $93 million, or 0.5% of sales.

Interest Expense and Income:

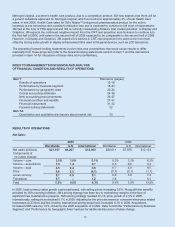

(Millions) 2005 2004 2003

Interest expense $ 82 $ 69 $ 84

Interest income (56) (46) (28)

Total $ 26 $ 23 $ 56

Interest Expense: Interest expense increased in 2005 compared to 2004, primarily due to higher interest rates.

The decrease in 2004 interest expense was primarily the result of lower average debt balances, partially offset by

higher interest rates in the United States.

Interest Income: Interest income was higher in 2005, benefiting primarily from higher interest rates. Interest income

increased in 2004 due to substantially higher cash balances.

Provision for Income Taxes:

(Percent of pretax income) 2005 2004 2003

Effective tax rate 34.0% 33.0% 32.9%

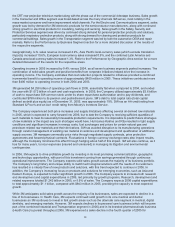

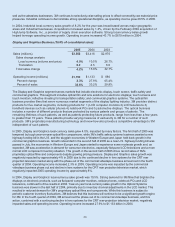

The tax rate for 2005 was 34.0%, compared with 33.0% in 2004. During 2005, 3M completed its evaluation of the

repatriation provision of the American Jobs Creation Act of 2004 (Jobs Act) and repatriated approximately $1.8 billion

of foreign earnings into the U.S. pursuant to its provisions. The Jobs Act provides 3M the opportunity to tax effectively

repatriate foreign earnings for U.S. qualifying investments specified by 3M’s domestic reinvestment plan. As a

consequence, in the second quarter of 2005, 3M recorded a tax expense of $75 million, net of available foreign tax

credits, which negatively impacted the 2005 effective worldwide tax rate by 1.5%. A half-point tax rate reduction

compared to the same periods last year is primarily attributable to the combination of the effects of the Medicare

Modernization Act and the domestic manufacturer’s deduction, which was a part of the Jobs Act.

The tax rate of 33.0% for 2004 was comparable to the 2003 rate of 32.9%. Income taxes associated with repatriating

certain cash from outside the United States negatively impacted the 2004 and 2003 income tax rates.

Minority Interest:

(Millions) 2005 2004 2003

Minority interest $55 $62 $52

Minority interest expense eliminates the income or loss attributable to non-3M ownership interests in 3M consolidated

entities. 3M’s most significant consolidated entity with non-3M ownership interests is Sumitomo 3M Limited in Japan

(3M owns 75% of Sumitomo 3M Limited). The decrease in 2005 related primarily to lower net income in Sumitomo

3M, while the increase in 2004 related primarily to higher net income in Sumitomo 3M.

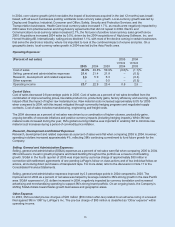

Cumulative Effect of Accounting Change:

As of December 31, 2005, the Company adopted FASB Interpretation No. 47, “Accounting for Conditional Asset

Retirement Obligations” (FIN 47). This accounting standard applies to the fair value of a liability for an asset

retirement obligation associated with the retirement of tangible long-lived assets and where the liability can be

reasonably estimated. Conditional asset retirement obligations exist for certain of the Company’s long-term assets.

The fair value of these obligations is recorded as liabilities on a discounted basis. Over time the liabilities are

accreted for the change in the present value and the initial capitalized costs are depreciated over the useful lives of

the related assets. The adoption of FIN 47 resulted in the recognition of an asset retirement obligation liability of

$59 million and an after tax charge of $35 million, which is reflected as a cumulative change in accounting principle

in the Consolidated Statement of Income. The pro forma effect of applying this guidance in all prior periods

presented was determined not to be material.