3M 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

their beneficiaries. There are no plan assets in the non-qualified plan due to its nature. For its U.S. postretirement

plan, the Company has set aside amounts at least equal to annual benefit payments with an independent trustee.

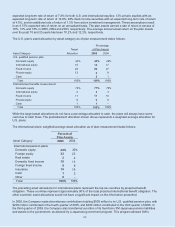

On December 8, 2003, the Medicare Prescription Drug Improvement and Modernization Act of 2003 (the Medicare

Act) was signed into law. The Act expands Medicare to include coverage for prescription drugs. 3M sponsors

medical programs, including prescription drug coverage for U.S. retirees. On May 19, 2004, the FASB issued FSP

No. 106-2, “Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement

and Modernization Act of 2003”, which requires current recognition of the federal subsidy that employers may

receive for providing drug coverage to retirees. FSP No. 106-2 was effective for the Company July 1, 2004. The

Company remeasured its plans’ assets and accumulated postretirement benefit obligation (APBO) as of June 30,

2004 to include the effects of the Medicare Act. The Medicare Act reduced the APBO by $240 million, which was

partially offset by an increase to the APBO of $170 million as a result of the plan remeasurement. The net impact

to the APBO was a reduction of $70 million.

In 2004, the Company’s U.S. plan measurement date was changed from September 30 to December 31.

Information presented in the tables for U.S. plans for 2005 and 2004 reflects a measurement date of December

31, and for 2003 a measurement date of September 30. The primary reasons for this change include consistency

between the U.S. and international measurement dates, the increased clarity that results from having the same

measurement and balance sheet dates, and administrative simplification. This change did not have a material

impact on the determination of periodic pension cost or pension obligations.

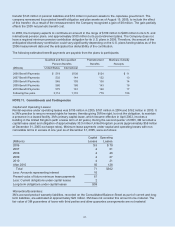

The Company completed the acquisition of CUNO during the third quarter of 2005. CUNO has several U.S. plans

and an international pension plan. The U.S. plans had a combined projected benefit obligation of $53 million and

plan assets of $42 million as of August 1, 2005. The international pension plan had a projected benefit obligation

of $13 million and plan assets of $10 million as of August 1, 2005. These plans are included in the balances of the

appropriate U.S. and International categories in the tables that follow.

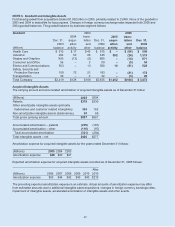

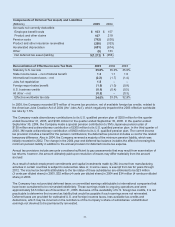

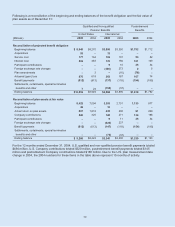

The following is a summary of the funded status of the plans as of December 31:

Qualified and Non-qualified Pension Benefits

United States International

(Millions) 2005 2004 2005 2004

Projected benefit obligation $10,052 $8,949 $3,884 $3,896

Accumulated benefit obligation 9,410 8,331 3,306 3,375

Plan assets 9,285 8,422 3,340 3,305

Funded status (767) (527) (544) (591)

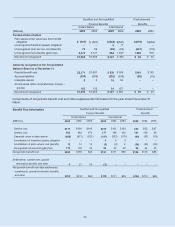

Certain international pension plans were underfunded as of December 31, 2005 and 2004. The accumulated

benefit obligations of these plans were $807 million in 2005 and $1.378 billion in 2004. The assets of these plans

were $544 million in 2005 and $1.073 billion in 2004. The net underfunded amounts are included in current and

other liabilities on the Consolidated Balance Sheet.