3M 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

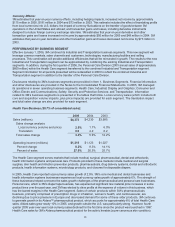

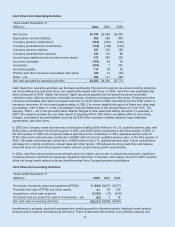

Cash Flows from Operating Activities:

Years ended December 31

(Millions) 2005 2004 2003

Net income $3,199 $2,990 $2,403

Depreciation and amortization 986 999 964

Company pension contributions (654) (591) (749)

Company postretirement contributions (134) (168) (194)

Company pension expense 331 325 168

Company postretirement expense 106 110 88

Income taxes (deferred and accrued income taxes) 417 396 539

Accounts receivable (184) 56 38

Inventories (294) 7 281

Accounts payable 113 35 62

Product and other insurance receivables and claims 122 12 (35)

Other – net 250 111 208

Net cash provided by operating activities $4,258 $4,282 $3,773

Cash flows from operating activities can fluctuate significantly from period to period, as pension funding decisions,

tax timing differences and other items can significantly impact cash flows. In 2005, cash flow was essentially flat

when compared to 2004. Higher net income, higher accounts payable and increased insurance receivable

collections were offset by accounts receivable increases, inventory increases and other items. Product and other

insurance receivables and claims increased cash flow by $122 million in 2005, benefiting from the $148 million in

insurance recoveries for the breast implant matter in 2005. For a more detailed discussion of these and other legal

proceedings, refer to Note 11 in the Consolidated Financial Statements of this Annual Report on Form 10-K. The

category “Other – net” in the preceding table reflects changes in other asset and liability accounts. For example, in

2005, this category includes the non-cash impact of adopting FIN 47 ($35 million cumulative effect of accounting

change), increases in accrued liabilities (such as the $30 million increase in liability related to legal settlement

agreements), and other items.

In 2005, the Company made discretionary contributions totaling $500 million to its U.S. qualified pension plan, with

$200 million contributed in the fourth quarter of 2005, and $300 million contributed in the third quarter of 2005. In

the third quarter of 2004, the Company made a special pension contribution to 3M’s Japanese pension plan of

$155 million and a discretionary contribution of $300 million to its U.S. qualified pension plan. In the third quarter of

2003, 3M made a discretionary contribution of $600 million to its U.S. qualified pension plan. Future contributions

will depend on market conditions, interest rates and other factors. 3M believes its strong cash flow and balance

sheet will allow it to fund future pension needs without compromising growth opportunities.

In 2004, cash flow improvements were primarily driven by higher net income. In all periods presented, significant

Company pension contributions negatively impacted cash flows. In all years, with a larger amount in 2003, a portion

of the tax timing benefit relates to the tax benefit received from Company pension contributions.

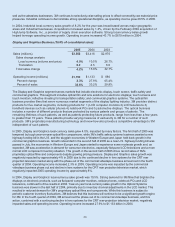

Cash Flows from Investing Activities:

Years ended December 31

(Millions) 2005 2004 2003

Purchases of property, plant and equipment (PP&E) $ (943) $(937) $(677)

Proceeds from sale of PP&E and other assets 41 69 129

Acquisitions, net of cash acquired (1,293) (73) (439)

Purchases and proceeds from sale of investments – net (46) 318

Net cash used in investing activities $(2,241) $(938) $(969)

Investments in property, plant and equipment are enabling growth in diverse markets, helping to meet product

demand and increasing manufacturing efficiency. These investments will continue to be primarily capacity and