3M 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

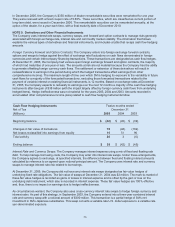

Net Investment Hedging: As circumstances warrant, the Company uses foreign currency debt and forwards to hedge

portions of the Company’s net investments in foreign operations. For hedges that meet the effectiveness

requirements, the net gains or losses are recorded in cumulative translation within other comprehensive income, with

any ineffectiveness recorded in cost of sales. The unrealized gain recorded in cumulative translation at December 31,

2005 was $47 million and the unrealized gain at December 31, 2004 was $5 million. At December 31, 2003, this

amount was not material. Hedge ineffectiveness was not material in 2005, 2004 and 2003.

Commodity Price Management: The Company manages commodity price risks through negotiated supply contracts,

price protection agreements and forward physical contracts. The Company uses commodity price swaps as cash flow

hedges of forecasted transactions to manage price volatility. The related mark-to-market gain or loss on qualifying

hedges is included in other comprehensive income to the extent effective (typically 100% effective), and reclassified

into cost of sales in the period during which the hedged transaction affects earnings. 3M has hedged its exposure to

the variability of future cash flows for certain forecasted transactions through 2008. No significant commodity cash

flow hedges were discontinued during the years 2005, 2004 and 2003.

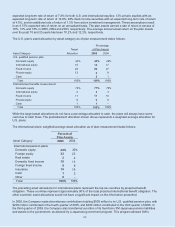

Currency Effects: 3M estimates that year-on-year currency effects, including hedging impacts, increased net

income by $115 million in 2005, $181 million in 2004, and $73 million in 2003. This estimate includes the effect of

translating profits from local currencies into U.S. dollars; the impact of currency fluctuations on the transfer of

goods between 3M operations in the United States and abroad; and transaction gains and losses, including

derivative instruments designed to reduce foreign currency exchange rate risks. 3M estimates that year-on-year

derivative and other transaction gains and losses increased net income by $50 million in 2005 and $48 million in

2004. 3M estimates that year-on-year derivative and other transaction gains and losses decreased net income by

$73 million in 2003.

Credit risk: The Company is exposed to credit loss in the event of nonperformance by counterparties in interest rate

swaps, currency swaps, and option and foreign exchange contracts. However, the Company’s risk is limited to the fair

value of the instruments. The Company actively monitors its exposure to credit risk through the use of credit approvals

and credit limits, and by selecting major international banks and financial institutions as counterparties. The Company

does not anticipate nonperformance by any of these counterparties.

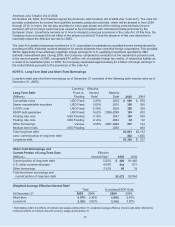

Fair value of financial instruments: At December 31, 2005 and 2004, the Company’s financial instruments included

cash and cash equivalents, accounts receivable, investments, accounts payable, borrowings, and derivative

contracts. The fair values of cash and cash equivalents, accounts receivable, accounts payable, and short-term

borrowings and current portion of long-term debt (except the $350 million dealer remarketable security) approximated

carrying values because of the short-term nature of these instruments. Available-for-sale investments and derivative

contracts are reported at fair values. Fair values for investments held at cost are not readily available, but are

estimated to approximate fair value. The carrying amounts and estimated fair values of other financial instruments

based on third-party quotes as of December 31 follow:

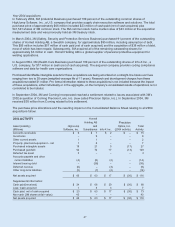

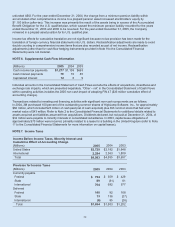

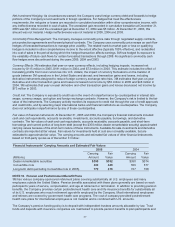

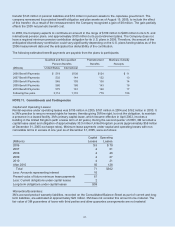

Financial Instruments’ Carrying Amounts and Estimated Fair Values

2005 2004

Carrying Fair Carrying Fair

(Millions) Amount Value Amount Value

Dealer remarketable securities $350 $352 $350 $374

Convertible note 539 549 556 577

Long-term debt (excluding Convertible note in 2005) 770 816 727 768

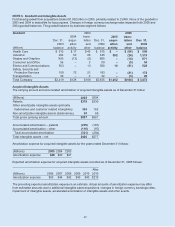

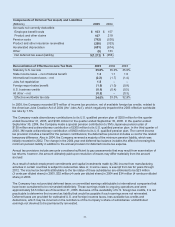

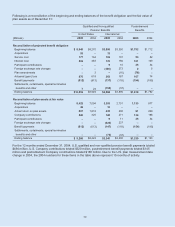

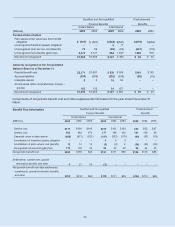

NOTE 10. Pension and Postretirement Benefit Plans

3M has various company-sponsored retirement plans covering substantially all U.S. employees and many

employees outside the United States. Pension benefits associated with these plans generally are based on each

participant’s years of service, compensation, and age at retirement or termination. In addition to providing pension

benefits, the Company provides certain postretirement health care and life insurance benefits for substantially all

of its U.S. employees who reach retirement age while employed by the Company. Most international employees

and retirees are covered by government health care programs. The cost of company-provided postretirement

health care plans for international employees is not material and is combined with U.S. amounts.

The Company’s pension funding policy is to deposit with independent trustees amounts allowable by law. Trust

funds and deposits with insurance companies are maintained to provide pension benefits to plan participants and