3M 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Year 2003 acquisitions:

In January 2003, 3M purchased an additional 25% interest in Sumitomo 3M Limited from NEC Corporation for

$377 million in cash. Prior to this purchase, 3M controlled and owned 50% of Sumitomo 3M Limited and fully

consolidated both Sumitomo 3M Limited’s balance sheet and results of operations, with a provision for the minority

interest that did not have participating rights. As a result of this acquisition, 3M now owns 75% of Sumitomo 3M

Limited. Sumitomo Electric Industries, Ltd., a Japanese corporation, owns the remaining 25% of Sumitomo 3M

Limited. Because all business segments benefit from this combination, goodwill acquired in this acquisition was

allocated to 3M’s seven business segments.

During the first quarter of 2003, 3M (Display and Graphics Business) finalized the purchase of Corning Precision

Lens, Inc. (Precision Optics, Inc.), which was acquired in December 2002, exclusive of the settlement described

previously under “Year 2004 acquisitions”. The impacts of finalizing the purchase price allocation, including a

working capital adjustment and payment of direct acquisition expenses, are shown in the business combination

activity table that follows.

During the year ended December 31, 2003, 3M entered into six additional business combinations for a total

purchase price of $49 million, net of cash acquired.

1) 3M (Industrial Business) purchased 100% of the outstanding shares of Solvay Fluoropolymers, Inc. (SFI),

previously a wholly owned subsidiary of Solvay America, Inc. SFI is a manufacturer of fluoroplastic products.

2) 3M (Display and Graphics Business) purchased Corning Shanghai Logistics Company Limited, previously a

wholly owned subsidiary of Corning Incorporated. This business is involved in the distribution of lens systems for

projection televisions.

3) 3M (Safety, Security and Protection Services Business) purchased 100% of the outstanding shares of

GuardiaNet Systems, Inc., a software company.

4) 3M (Electro and Communications Business) purchased the outstanding minority interest of Pouyet

Communications, Inc. (PCI), an Indian company. PCI is a telecommunications supplier.

5) 3M (Health Care Business) purchased 100% of the outstanding shares of Vantage Health Limited, a British

company. Vantage Health Limited develops health information systems software.

6) 3M (Health Care Business) purchased certain tangible and intangible assets from AstraZeneca S.p.A., an

Italian company. AstraZeneca S.p.A. is a research-based pharmaceuticals company.

Purchased identifiable intangible assets for these acquisitions are being amortized on a straight-line basis over lives

ranging from 5 to 15 years (weighted-average life of 11.3 years). There were no in-process research and development

charges associated with these acquisitions. Pro forma information related to these acquisitions is not included because

the impact of these acquisitions, either individually or in the aggregate, on the Company’s consolidated results of

operations is not considered to be material.

The purchase price allocations and the resulting impact on the Consolidated Balance Sheet relating to all 2003

acquisitions follow:

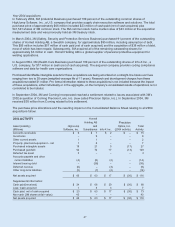

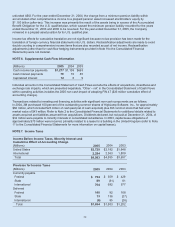

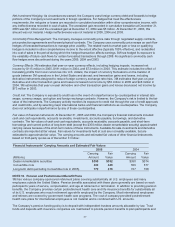

2003 ACTIVITY

Asset (Liability) Sumitomo Precision Optics, Inc. Aggregation of Total

(Millions) 3M Limited (2003 activity) Remaining Acquisitions Activity

Accounts receivable $ – $ – $ 4 $ 4

Inventory 9 – 14 23

Other current assets – – 1 1

Investments – – (15) (15)

Property, plant, and

equipment – net – (3) 29 26

Purchased intangible assets – 4 8 12

Purchased goodwill 289 8 11 308

Deferred tax asset 37 – – 37

Accounts payable and other

current liabilities – 4 (6) (2)

Minority interest liability 139 – 1 140

Other long-term liabilities (97) – 2 (95)

Net assets acquired $ 377 $ 13 $ 49 $ 439