eTrade 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

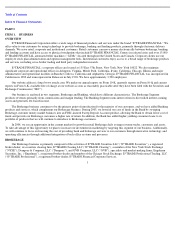

The following table shows our loan purchase, sale and repayment activity, including loans acquired through business combinations (in

thousands):

We primarily purchase pools of loans on the secondary market using our correspondent network. The following table shows the number

of pools and the associated number of loans that we purchased:

Delinquent, Nonperforming and Other Problem Assets

Year Ended December 31,

2003

2002

2001

Loans receivable

—

net, beginning of year

$

7,365,720

$

8,010,457

$

5,039,602

Loan purchases and originations:

One

-

to four

-

family variable

-

rate

4,035,699

3,565,449

4,451,489

One

-

to four

-

family fixed

-

rate

10,582,799

8,921,213

6,988,688

Consumer and other loans

4,528,864

2,756,830

2,017,950

Total loan purchases and originations

19,147,362

15,243,492

13,458,127

Loans sold

(13,515,811

)

(12,011,864

)

(7,899,991

)

Loans repurchased

1,418

—

1,189

Loans repaid

(3,885,916

)

(3,948,424

)

(2,653,385

)

Total loans sold, repurchased and repaid

(17,400,309

)

(15,960,288

)

(10,552,187

)

Net change in deferred discounts and loan fees

54,846

105,715

74,010

Net transfers to real estate owned and repossessed assets

(26,045

)

(25,864

)

(1,786

)

Net change in allowance for loan losses

(10,181

)

(7,792

)

(7,309

)

Increase (decrease) in total loans receivable

1,765,673

(644,737

)

2,970,855

Loans receivable

—

net, end of year

$

9,131,393

$

7,365,720

$

8,010,457

Year Ended December 31,

2003

2002

2001

Number of pools

5,686

4,448

1,649

Number of loans

18,767

10,527

15,346

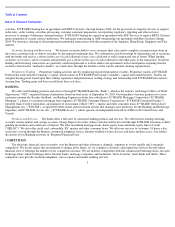

We continually monitor our loan portfolio to anticipate and address potential and actual delinquencies. Based on the length of the

delinquency period, we reclassify these assets as nonperforming and, if necessary, take possession of the underlying collateral. Once we take

possession of the underlying collateral, we classify the property as other assets on our consolidated balance sheets.

Nonperforming Assets . We classify loans as nonperforming whenever principal or interest payments are more than 90 days past due or

when we have reason to believe the loan is uncollectible. When a loan is classified as nonperforming, we: 1) stop recognizing interest income

on the loan; 2) reverse any interest we accrued during the initial 90-day period; and 3) discontinue the accretion of deferred loan fees.

Whenever we receive a payment from a nonperforming loan, we apply the full payment to principal if we continue to doubt that both principal

and interest will be collected in full. We only recognize payments as interest income when the principal and interest on the loan is expected to

be collected in full or when the principal has been fully repaid.

Repossessed Assets and Nonperforming Loans. When we acquire the collateral underlying uncollectible loans, we record this Real

Estate Owned (“REO”) and other repossessed assets at estimated fair value, less estimated selling costs. We use appraisals and other

appropriate valuation methods to estimate the fair value of these assets. If the net estimated fair value of the collateral is less than the loan

balance, the difference is charged to the allowance for loan losses. We perform periodic valuations and establish a valuation allowance for REO

and repossessed assets through a charge to income, if the carrying value of a property exceeds its estimated fair

9