eTrade 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

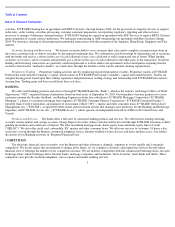

Lending Activities

The following table presents the balance and associated percentage of each major loan category in our portfolio (dollars in thousands):

7

December 31,

September 30,

2003

2002

2001

2000

1999

Real estate loans:

One-to four-family:

Fixed-rate

$

1,345,369

14.97

%

$

1,877,265

26.05

%

$

3,672,512

45.95

%

$

1,583,129

37.45

%

$

1,391,254

63.69

%

Adjustable-rate

1,910,161

21.26

1,502,224

20.86

2,645,952

33.11

2,635,955

62.36

785,821

35.98

Home equity lines of credit and

second mortgage

1,511,767

16.83

354,768

4.93

23,059

0.29

4,042

0.10

1,024

0.05

Multi-family

97

—

106

—

183

—

203

0.01

1,330

0.06

Commercial

12,279

0.14

13,397

0.19

1,981

0.03

2,717

0.06

3,050

0.14

Mixed-use and land

72

—

121

—

635

0.01

503

0.01

1,224

0.05

Total real estate loans(1)(2)

4,779,745

53.20

3,747,881

52.03

6,344,322

79.39

4,226,549

99.99

2,183,703

99.97

Consumer and other loans:

Recreational vehicle

2,285,451

25.43

1,366,876

18.98

198,643

2.49

—

—

—

—

Automobile

1,162,339

12.94

1,481,695

20.57

1,436,407

17.97

224

0.01

430

0.02

Marine

627,975

6.99

453,783

6.30

—

—

—

—

—

—

Credit card

113,434

1.26

—

—

—

—

—

—

—

—

Lease financing

2,651

0.03

3,621

0.05

—

—

—

—

—

—

Other

13,567

0.15

149,024

2.07

12,237

0.15

82

—

255

0.01

Total consumer and other loans

4,205,417

46.80

3,454,999

47.97

1,647,287

20.61

306

0.01

685

0.03

Total loans(1)

8,985,162

100.00

%

7,202,880

100.00

%

7,991,609

100.00

%

4,226,855

100.00

%

2,184,388

100.00

%

Add (deduct):

Premiums (discounts) and

deferred fees on loans

184,078

190,506

38,722

(43,171

)

(22,718

)

Allowance for loan losses

(37,847

)

(27,666

)

(19,874

)

(10,930

)

(7,161

)

Total

146,231

162,840

18,848

(54,101

)

(29,879

)

Loans receivable, net(1)(2)

$

9,131,393

$

7,365,720

$

8,010,457

$

4,172,754

$

2,154,509

(1) Includes loans held-for-sale, principally one- to four-family real estate loans. These loans were $1.0 billion at December 31, 2003, $1.8 billion at December 31, 2002, $1.6 billion at

December 31, 2001, $0.1 billion at September 30, 2000 and $0.1 billion at September 30, 1999.

(2) The geographic concentrations of mortgage loans are described in Note 7 to the Consolidated Financial Statements.