eTrade 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

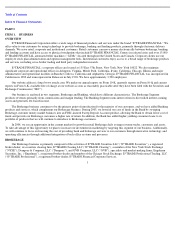

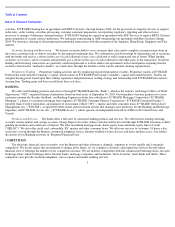

REQUIRED FINANCIAL DATA

This section presents information required by the SEC’s Industry Guide 3, “ Statistical Disclosure by Bank Holding Companies .”

Prior to

its acquisition by E*TRADE FINANCIAL in January 2000, the Bank reported its results of operations on a calendar year basis. Prior to 2001,

E*TRADE FINANCIAL reported on a year ending September 30. The financial information that follows for 1999 includes the results of the

Bank for the twelve-month period ended December 31.

Distribution of Assets, Liabilities and Shareholder’s Equity; Interest Rates and Interest Differential

The following table presents average balance data and income and expense data for our banking operations, as well as the related interest

yields and rates and interest spread (dollars in thousands):

Year Ended December 31,

2003

2002

2001

Average

Balance

Interest

Inc./Exp.

Average

Yield/Cost

Average

Balance

Interest

Inc./Exp.

Average

Yield/Cost

Average

Balance

Interest

Inc./Exp.

Average

Yield/Cost

Interest-earning banking assets:

Loans receivable, net(1)

$

7,659,793

$

384,005

5.01

%

$

7,520,665

$

477,955

6.36

%

$

6,701,905

$

495,768

7.40

%

Interest

-

bearing deposits

203,356

4,560

2.24

%

196,419

5,042

2.57

%

145,077

4,263

2.94

%

Mortgage-backed and related available-for-

sale

securities

6,707,070

255,802

3.81

%

4,730,552

226,785

4.79

%

4,164,081

273,690

6.57

%

Available

-

for

-

sale investment securities

2,026,646

87,340

4.31

%

951,789

46,639

4.90

%

1,175,669

77,116

6.60

%

Investment in FHLB stock

79,642

3,047

3.83

%

75,713

4,304

5.69

%

65,988

4,224

6.40

%

Trading securities

488,372

16,159

3.31

%

228,848

7,128

3.11

%

84,759

3,981

4.70

%

Total interest

-

earning banking assets(2)

17,164,879

$

750,913

4.37

%

13,703,986

$

767,853

5.60

%

12,337,479

$

859,042

6.96

%

Non

-interest-earning banking assets

833,296

629,341

529,233

Total banking assets

$

17,998,175

$

14,333,327

$

12,866,712

Interest

-

bearing banking liabilities:

Retail deposits

$

9,263,881

$

263,017

2.84

%

$

8,243,543

$

335,730

4.07

%

$

7,166,789

$

421,064

5.88

%

Brokered certificates of deposit

365,162

10,147

2.78

%

205,239

5,975

2.91

%

29,236

1,810

6.19

%

FHLB advances

935,043

42,579

4.55

%

970,226

56,952

5.87

%

1,223,724

78,439

6.41

%

Other borrowings

5,976,730

160,081

2.68

%

3,835,442

150,002

3.91

%

3,180,272

190,493

5.99

%

Total interest

-

bearing banking liabilities

16,540,816

$

475,824

2.87

%

13,254,450

$

548,659

4.14

%

11,600,021

$

691,806

5.96

%

Non

-interest-bearing banking liabilities

562,357

310,086

552,513

Total banking liabilities

17,103,173

13,564,536

12,152,534

Total banking shareholder’s equity

895,002

768,791

714,178

Total banking liabilities and shareholder’s

equity

$

17,998,175

$

14,333,327

$

12,866,712

Excess of interest-earning banking assets over

interest-bearing banking liabilities/net interest

income

$

624,063

$

275,089

$

449,536

$

219,194

$

737,458

$

167,236

Net interest:

Spread

1.50

%

1.46

%

1.00

%

Margin (net yield on interest-earning banking

assets)

1.60

%

1.60

%

1.36

%

Ratio of interest-earning banking assets to interest-

bearing banking liabilities

103.77

%

103.39

%

106.36

%

Return by Bank on average:

Total banking assets

0.74

%

0.79

%

0.43

%

Total banking assets, as adjusted(3)

0.74

%

0.79

%

0.53

%

Equity

14.93

%

14.77

%

7.82

%