Xcel Energy 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tax Matters PSCo’s wholly owned subsidiary PSR Investments, Inc. (PSRI) owns and manages permanent life insurance policies on

PSCo employees, known as corporate-owned life insurance (COLI). At various times, we have made borrowings against the cash values

of these COLI policies and deducted the interest expense on these borrowings. The IRS had issued a Notice of Proposed Adjustment

proposing to disallow interest expense deductions taken in tax years 1993 through 1997 related to COLI policy loans. A request for

technical advice from the IRS National Office with respect to the proposed adjustment had been pending. Late in 2001, Xcel Energy

received a technical advice memorandum from the IRS National Office, which communicated a position adverse to PSRI. Consequently,

we expect the IRS examination division to begin the process of disallowing the interest expense deductions for the tax years 1993

through 1997.

After consultation with tax counsel, it is Xcel Energy’s position that the IRS determination is not supported by the tax law. Based

upon this assessment, management continues to believe that the tax deduction of interest expense on the COLI policy loans is in full

compliance with the tax law. Therefore, Xcel Energy intends to challenge the IRS determination, which could require several years to

reach final resolution. Although the ultimate resolution of this matter is uncertain, management continues to believe the resolution

of this matter will not have a material adverse impact on Xcel Energy’s financial position, results of operations or cash flows. For

this reason, PSRI has not recorded any provision for income tax or interest expense related to this matter and has continued to take

deductions for interest expense related to policy loans on its income tax returns for subsequent years. However, defense of Xcel Energy’s

position may require significant cash outlays on a temporary basis, if refund litigation is pursued in United States District Court.

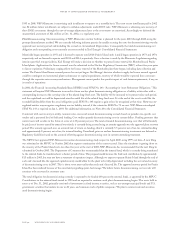

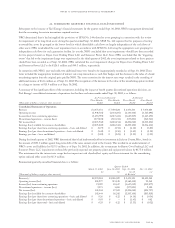

The total disallowance of interest expense deductions for the period of 1993 through 1997, as proposed by the IRS, is approximately

$175 million. Additional interest expense deductions for the period 1998 through 2002 are estimated to total approximately $317 million.

Should the IRS ultimately prevail on this issue, tax and interest payable through Dec. 31, 2002, would reduce earnings by an estimated

$214 million after tax.

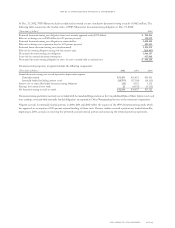

Seren At Dec. 31, 2002, Xcel Energy’s investment in Seren was approximately $255 million. Seren had capitalized $290 million for

plant in service and had incurred another $21 million for construction work in progress for these systems. The construction of its

broadband communications network in Minnesota and California has resulted in consistent losses. Management currently intends to

hold and operate Seren, and believes that no asset impairment exists. Xcel Energy projects improvements in Seren’s operating results,

with positive cash flows in 2005 and an earnings contribution anticipated in 2008.

Xcel Energy International At Dec. 31, 2002, Xcel Energy’s investment in Argentina, through Xcel Energy International, was approximately

$112 million. In December 2002, a subsidiary of Xcel Energy decided it would no longer fund one of its power projects in Argentina.

This decision resulted in the shutdown of the Argentina plant facility, pending financing of a necessary maintenance outage. Updated

cash flow projections for the plant were insufficient to provide full recovery of Xcel International’s investment. An impairment write-down

of approximately $13 million was recorded in the fourth quarter of 2002.

19. nuclear obligations

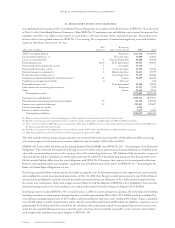

Fuel Disposal NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is

responsible for permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear plants. NSP-

Minnesota has funded its portion of the DOE’s permanent disposal program since 1981. The fuel disposal fees are based on a charge

of 0.1 cent per kilowatt-hour sold to customers from nuclear generation. Fuel expense includes DOE fuel disposal assessments of

approximately $13 million in 2002, $11 million in 2001 and $12 million in 2000. In total, NSP-Minnesota had paid approximately

$312 million to the DOE through Dec. 31, 2002. However, we cannot determine whether the amount and method of the DOE’s

assessments to all utilities will be sufficient to fully fund the DOE’s permanent storage or disposal facility.

The Nuclear Waste Policy Act required the DOE to begin accepting spent nuclear fuel no later than Jan. 31, 1998. In 1996, the DOE

notified commercial spent fuel owners of an anticipated delay in accepting spent nuclear fuel by the required date and conceded that a

permanent storage or disposal facility will not be available until at least 2010. NSP-Minnesota and other utilities have commenced

lawsuits against the DOE to recover damages caused by the DOE’s failure to meet its statutory and contractual obligations.

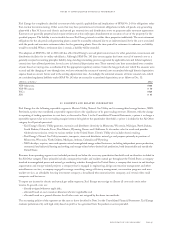

NSP-Minnesota has its own temporary, on-site storage facilities for spent fuel at its Monticello and Prairie Island nuclear plants. With

the dry cask storage facilities approved in 1994, management believes it has adequate storage capacity to continue operation of its Prairie

Island nuclear plant until at least 2007. The Monticello nuclear plant has storage capacity to continue operations until 2010. Storage

availability to permit operation beyond these dates is not assured at this time. We are investigating all of the alternatives for spent fuel

storage until a DOE facility is available, including pursuing the establishment of a private facility for interim storage of spent nuclear

fuel as part of a consortium of electric utilities. If on-site temporary storage at Prairie Island reaches approved capacity, we could seek

interim storage at this or another contracted private facility, if available.

Nuclear fuel expense includes payments to the DOE for the decommissioning and decontamination of the DOE’s uranium enrichment

facilities. In 1993, NSP-Minnesota recorded the DOE’s initial assessment of $46 million, which is payable in annual installments from

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 93