Xcel Energy 2002 Annual Report Download - page 40

Download and view the complete annual report

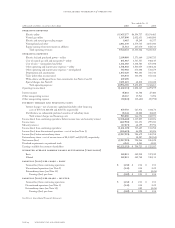

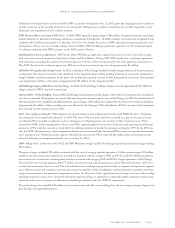

Please find page 40 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On Jan. 1, 2001, Xcel Energy adopted SFAS No. 133. For more information on the impact of SFAS No. 133, see Note 17 to the

Consolidated Financial Statements.

For further discussion of Xcel Energy’s risk management and derivative activities, see Notes 16 and 17 to the Consolidated

Financial Statements.

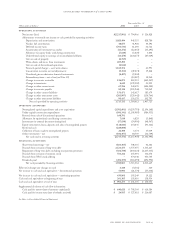

Use of Estimates In recording transactions and balances resulting from business operations, Xcel Energy uses estimates based on the best

information available. We use estimates for such items as plant depreciable lives, tax provisions, uncollectible amounts, environmental

costs, unbilled revenues and actuarially determined benefit costs. We revise the recorded estimates when we get better information or

when we can determine actual amounts. Those revisions can affect operating results. Each year we also review the depreciable lives of

certain plant assets and revise them if appropriate.

Cash Items Xcel Energy considers investments in certain debt instruments with a remaining maturity of three months or less at the time

of purchase to be cash equivalents. Those debt instruments are primarily commercial paper and money market funds.

Restricted cash consists primarily of cash collateral for letters of credit issued in relation to project development activities. In addition,

it includes funds held in trust accounts to satisfy the requirements of certain debt agreements and funds held within NRG’s projects

that are restricted in their use. Restricted cash is classified as a current asset as all restricted cash is designated for interest and principal

payments due within one year.

Cash and cash equivalents includes $385 million held by NRG, which is not legally restricted. However, this cash is not available for

Xcel Energy’s general corporate purposes.

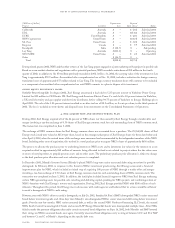

Inventory All inventory is recorded at average cost, with the exception of natural gas in underground storage at PSCo, which is recorded

using last-in-first-out pricing.

Regulatory Accounting Our regulated utility subsidiaries account for certain income and expense items using SFAS No. 71 – “Accounting

for the Effects of Certain Types of Regulation.” Under SFAS No. 71:

– we defer certain costs, which would otherwise be charged to expense, as regulatory assets based on our expected ability to recover

them in future rates; and

– we defer certain credits, which would otherwise be reflected as income, as regulatory liabilities based on our expectation they will

be returned to customers in future rates.

We base our estimates of recovering deferred costs and returning deferred credits on specific ratemaking decisions or precedent for each

item. We amortize regulatory assets and liabilities consistent with the period of expected regulatory treatment. See more discussion of

regulatory assets and liabilities at Note 20 to the Consolidated Financial Statements.

Stock-Based Employee Compensation We have several stock-based compensation plans. We account for those plans using the intrinsic

value method. We do not record compensation expense for stock options because there is no difference between the market price and

the purchase price at grant date. We do, however, record compensation expense for restricted stock awarded to certain employees, which

is held until the restriction lapses or the stock is forfeited. For more information on stock compensation impacts, see Note 12 to the

Consolidated Financial Statements.

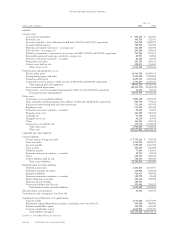

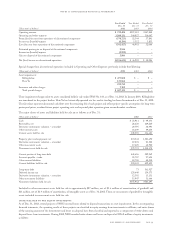

Intangible Assets During 2002, Xcel Energy adopted SFAS No. 142 – “Goodwill and Other Intangible Assets,” which requires new

accounting for intangible assets and goodwill. Intangible assets with finite lives will be amortized over their economic useful lives and

periodically reviewed for impairment. Goodwill is no longer being amortized, but will be tested for impairment annually and on an

interim basis if an event occurs or a circumstance changes between annual tests that may reduce the fair value of a reporting unit below

its carrying value.

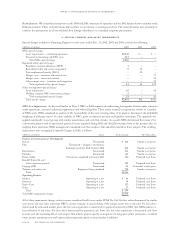

Xcel Energy had goodwill of approximately $35 million at Dec. 31, 2002, which will not be amortized, consisting of $27.8 million of

project-related goodwill at NRG and $7.7 million of project-related goodwill at Utility Engineering. As part of Xcel Energy’s acquisition

of NRG’s minority shares (see Note 4), $62 million of excess purchase price was allocated to fixed assets related to projects where the fair

value of the fixed assets was higher than the carrying value as of June 2002, to prepaid pension assets, and to other assets. Net goodwill

decreased between 2002 and 2001 due to asset sales at NRG. During 2002, Xcel Energy performed impairment tests of its intangible

assets. Tests have concluded that no write-down of these intangible assets is necessary.

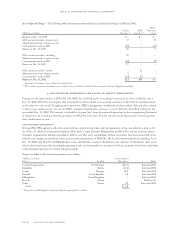

Intangible assets with finite lives continue to be amortized, and the aggregate amortization expense recognized in the years ended

Dec. 31, 2002, 2001 and 2000, were $4.3 million, $6.3 million and $3.9 million, respectively. The annual aggregate amortization

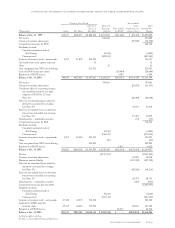

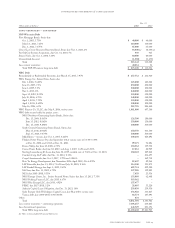

expense for each of the five succeeding years is expected to approximate $3.4 million. Intangible assets consisted of the following:

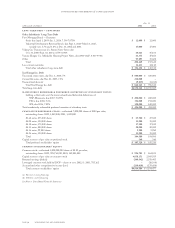

page 54 xcel energy inc. and subsidiaries

notes to consolidated financial statements