Xcel Energy 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

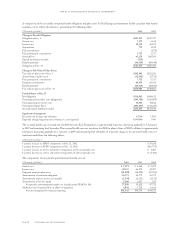

Xcel Energy evaluates all of its contracts within the regulated and nonregulated operations when such contracts are entered to determine

if they are derivatives and if so, if they qualify and meet the normal designation requirements under SFAS No. 133. None of the contracts

entered into within the trading operation are considered normal.

Normal purchases and normal sales contracts are accounted for as executory contracts as required under other generally accepted

accounting principles.

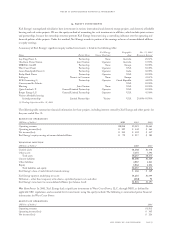

18.commitments and contingencies

commitments

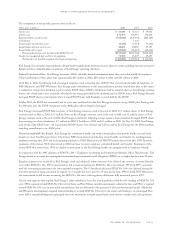

Legislative Resource Commitments In 1994, NSP-Minnesota received Minnesota legislative approval for additional on-site temporary

spent fuel storage facilities at its Prairie Island nuclear power plant, provided NSP-Minnesota satisfies certain requirements. Seventeen

dry cask containers were approved. As of Dec. 31, 2002, NSP-Minnesota had loaded 17 of the containers. The Minnesota Legislature

established several energy resource and other commitments for NSP-Minnesota to obtain the Prairie Island temporary nuclear fuel storage

facility approval. These commitments can be met by building, purchasing or, in the case of biomass, converting generation resources.

Other commitments established by the Legislature included a discount for low-income electric customers, required conservation

improvement expenditures and various study and reporting requirements to a legislative electric energy task force. NSP-Minnesota

has implemented programs to meet the legislative commitments. NSP-Minnesota’s capital commitments include the known effects

of the Prairie Island legislation. The impact of the legislation on future power purchase commitments and other operating expenses

is not yet determinable.

See additional discussion of the current operating contingency related to the spent fuel storage facilities under Operating Contingency.

Capital Commitments As discussed in Liquidity and Capital Resources under Management’s Discussion and Analysis, the estimated

cost, as of Dec. 31, 2002, of the capital expenditure programs of Xcel Energy and its subsidiaries and other capital requirements is

approximately $1.5 billion in 2003, $1.2 billion in 2004 and $1.3 billion in 2005.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, the desired reserve margin

and the availability of purchased power, as well as alternative plans for meeting Xcel Energy’s long-term energy needs. In addition,

Xcel Energy’s ongoing evaluation of merger, acquisition and divestiture opportunities to support corporate strategies, address restructuring

requirements and comply with future requirements to install emission-control equipment may impact actual capital requirements.

Support and Capital Subscription Agreement In May 2002, Xcel Energy and NRG entered into a support and capital subscription

agreement pursuant to which Xcel Energy agreed under certain circumstances to provide up to $300 million to NRG. Xcel Energy

has not to date provided funds to NRG under this agreement. However, Xcel Energy is willing to make a contribution of $300 million

if the restructuring plan discussed earlier is approved by the creditors. See additional discussion of NRG restructuring at Note 4.

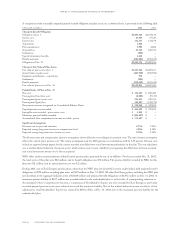

Leases Our subsidiaries lease a variety of equipment and facilities used in the normal course of business. Some of these leases qualify as

capital leases and are accounted for accordingly. The capital leases expire between 2002 and 2025. The net book value of property under

capital leases was approximately $624 million and $605 million at Dec. 31, 2002 and 2001, respectively. Assets acquired under capital

leases are recorded as property at the lower of fair-market value or the present value of future lease payments and are amortized over their

actual contract term in accordance with practices allowed by regulators. The related obligation is classified as long-term debt. Executory

costs are excluded from the minimum lease payments.

The remainder of the leases, primarily real estate leases and leases of coal-hauling railcars, trucks, cars and power-operated equipment,

are accounted for as operating leases. Rental expense under operating lease obligations was approximately $86 million, $58 million and

$56 million for 2002, 2001 and 2000, respectively.

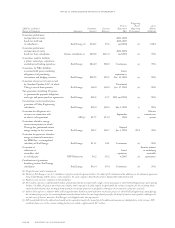

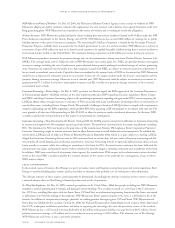

Future commitments under operating and capital leases are:

Operating Capital

(Millions of dollars) Leases Leases

2003 $ 66 $ 83

2004 64 80

2005 61 78

2006 58 75

2007 51 73

Thereafter 86 1,030

Total minimum obligation $1,419

Interest (795)

Present value of minimum obligation $ 624

page 84 xcel energy inc. and subsidiaries

notes to consolidated financial statements