Xcel Energy 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

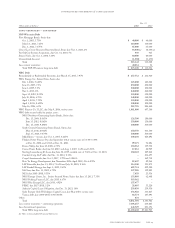

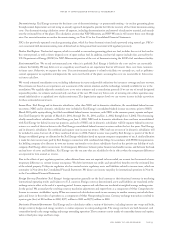

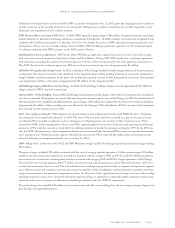

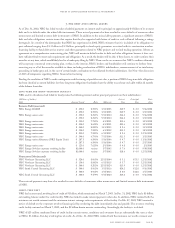

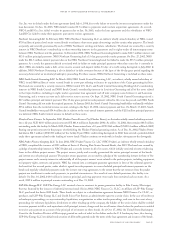

Year Ended Year Ended Year Ended

Dec. 31 Dec. 31 Dec. 31

(Thousands of dollars) 2002 2001 2000

Operating revenue $ 729,408 $597,181 $347,848

Operating and other expenses 1,300,131 544,837 310,007

Pretax (loss)/income from operations of discontinued components (570,723) 52,344 37,841

Income tax (benefit)/expense (8,296) 5,352 5,835

(Loss)/income from operations of discontinued components (562,427) 46,992 32,006

Estimated pretax gain on disposal of discontinued components 2,814 ––

Income tax (benefit)/expense (2,992) ––

Gain on disposal of discontinued components 5,806 ––

Net (loss)/income on discontinued operations $(556,621) $ 46,992 $ 32,006

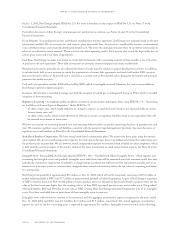

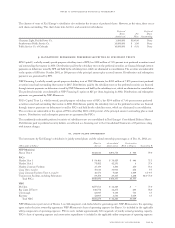

Special charges from discontinued operations included in Operating and Other Expenses previously include the following:

(Thousands of dollars) 2002 2001 2000

Asset impairments

Killingholme $ 477,868 $ – $ –

Hsin Yu 121,864 ––

599,732 ––

Severance and other charges 7,389 ––

Total special charges $ 607,121 $ – $ –

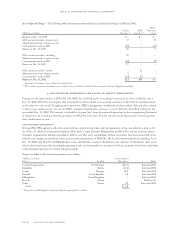

These impairment charges relate to assets considered held for sale under SFAS No. 144, as of Dec. 31, 2002. In January 2003, Killingholme

was transferred to the project lenders. Hsin Yu has historically operated at a loss and its funding has been discontinued as of Dec. 31, 2002.

The fair values represent discounted cash flows over the remaining life of each project and reflect project-specific assumptions for long-term

power pool prices, escalated future project operating costs and expected plant operation given assumed market conditions.

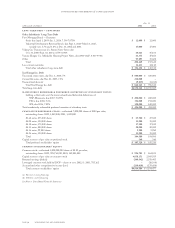

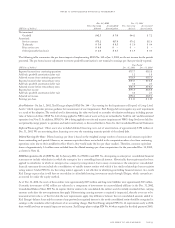

The major classes of assets and liabilities held for sale are as follows as of Dec. 31:

(Thousands of dollars) 2002 2001

Cash $23,911 $ 99,171

Receivables, net 28,220 129,220

Derivative instruments valuation – at market 29,795 38,996

Other current assets 26,609 49,234

Current assets held for sale 108,535 316,621

Property, plant and equipment, net 274,544 1,383,690

Derivative instruments valuation – at market 87,803 83,588

Other noncurrent assets 17,425 62,900

Noncurrent assets held for sale 379,772 1,530,178

Current portion of long-term debt 445,656 289,269

Accounts payable – trade 55,707 97,654

Other current liabilities 18,738 42,510

Current liabilities held for sale 520,101 429,433

Long-term debt 73 561,927

Deferred income tax 129,640 154,573

Derivative instruments valuation – at market 12,302 15,131

Other noncurrent liabilities 13,947 51,666

Noncurrent liabilities held for sale $155,962 $783,297

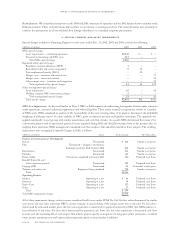

Included in other noncurrent assets held for sale is approximately $27 million, net of $3.6 million of amortization, of goodwill and

$11 million, net of $1.9 million of amortization, of intangible assets as of Dec. 31, 2002. There are no amounts of goodwill or intangible

assets included in noncurrent assets held for sale.

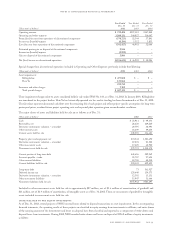

losses related to nrg equity investments

As of Dec. 31, 2002, several projects of NRG incurred losses related to disposal transactions or asset impairments. In the accompanying

financial statements, the operating results of these projects are classified in equity earnings from investments in affiliates, and write-downs

of the carrying amount of the investments and losses on disposal have been classified and reported as a component of write-downs and

disposal losses from investments. During 2002, NRG recorded write-downs and losses on disposal of $196.2 million of equity investments

as follows:

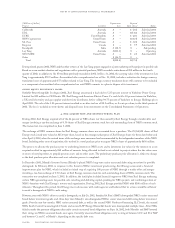

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 59