Xcel Energy 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

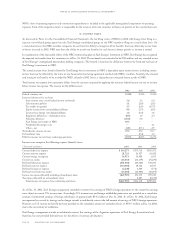

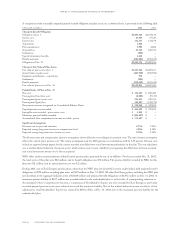

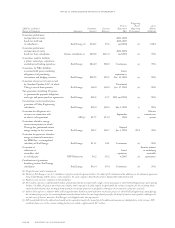

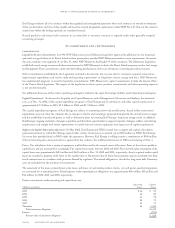

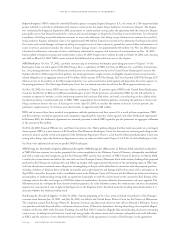

Triggering

Term or Event Assets

(Millions of dollars) Guarantee Current Expiration Requiring Held as

Nature of Guarantee Guarantor Amount Exposure Date Performance Collateral

Guarantee performance

and payment of surety 2003, 2004

bonds for itself and 2005, 2007

its subsidiaries Xcel Energy (d) $342.7 $5.6 and 2012 (b) $10.0

Guarantee performance

and payment of surety 2003, 2004

bonds for those subsidiaries Various subsidiaries (e) $493.8 $116.0 and 2005 (b) N/A

Guarantees made to facilitate

e prime’s natural gas acquisition,

marketing and trading operations Xcel Energy $264.0 $88.0 Continuous (a) N/A

Guarantees for NRG liabilities

associated with power marketing Latest

obligations, fuel purchasing expiration is

transactions and hedging activities Xcel Energy $219.5 $96.3 Dec. 31, 2003 (a) N/A

Guarantee of payment of notes issued

by Guardian Pipeline, LLC, of which Terminated

Viking is one of three partners Xcel Energy $60.0 $60.0 Jan. 17, 2003 (a) N/A

Two guarantees benefiting Cheyenne

to guarantee the payment obligations

under gas and power purchase agreements Xcel Energy $26.5 $1.7 2011 and 2013 (a) N/A

Construction contract performance

guarantee of Utility Engineering

subsidiaries Xcel Energy $25.0 $25.0 July 1, 2003 (c) N/A

Guarantee for obligations of a Electric

customer in connection with September transmission

an electric sale agreement SPS (f ) $17.7 $11.0 2003 (a) system

Guarantees related to energy

conservation projects in which

Planergy has guaranteed certain Expired

energy savings to the customer Xcel Energy $26.7 $26.7 Jan. 1, 2003 N/A N/A

Guarantee for payments related to

energy or financial transactions

for XERS Inc., a nonregulated

subsidiary of Xcel Energy Xcel Energy $11.1 $4.1 Continuous (a) N/A

Guarantee of Security interest

collection of Latest in underlying

receivables sold expiration receivable

to a third party NSP-Minnesota $6.2 $6.2 in 2007 (a) agreements

Combination of guarantees

benefiting various Xcel Energy

subsidiaries Xcel Energy $16.4 $5.4 Continuous (a) N/A

(a) Nonperformance and/or nonpayment

(b) Failure of Xcel Energy or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the indemnity agreement

between Xcel Energy and the various surety companies, the surety companies have the discretion to demand that collateral be posted.

(c) Failure to meet emission compliance at relevant facility

(d) $5.6-million exposure is related to $265 million of performance bonds associated with a single construction project in which Utility Engineering is participating.

On Dec. 31, 2002, this project was 93-percent complete, and is expected to be fully complete in April 2003. An estimate of exposure for the remaining bonds

cannot be determined as these are largely bonds posted for the benefit of various municipalities relating to the normal course ofbusiness activities.

(e) $116-million exposure is related to $491 million of performance bonds associated with three construction projects in which Utility Engineering is participating.

An estimate of exposure for the remaining bonds cannot be determined as these are largely bonds posted for the benefit of various municipalities relating to the

normal course of business activities. Xcel Energy is not obligated under these agreements.

(f ) SPS would hold title to the collateral and would not be required to transfer the ownership of the additional transmission related facilities to the customer. SPS

would also have access to the customer sinking fund account, which is approximately $6.7 million.

page 80 xcel energy inc. and subsidiaries

notes to consolidated financial statements