Xcel Energy 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

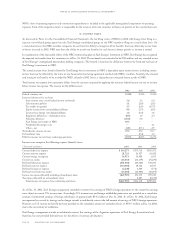

NRG’s share of operating expenses and construction expenditures is included in the applicable nonregulated components of operating

expenses. Each of the respective owners is responsible for the issuance of its own securities to finance its portion of the construction costs.

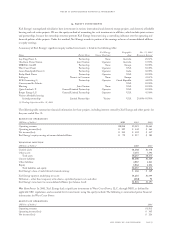

11. income taxes

As discussed in Note 1 to the Consolidated Financial Statements, the tax filing status of NRG for 2002 will change from filing as a

separate consolidated group, apart from the Xcel Energy consolidated group, to the NRG members filing on a stand-alone basis. On

a stand-alone basis, the NRG member companies do not have the ability to recognize all tax benefits that may ultimately accrue from

its losses incurred in 2002. NRG may have the ability to receive tax benefits for such losses in future periods as income is earned.

In consideration of the foreseeable effects of the NRG restructuring plan on Xcel Energy’s investment in NRG, Xcel Energy has recognized

the expected tax benefits from this investment as of Dec. 31, 2002. The tax benefit was estimated to be $706 million and was recorded at one

of Xcel Energy’s nonregulated intermediate holding companies. This benefit is based on the difference between the book and tax bases of

Xcel Energy’s investment in NRG.

The actual amount of tax benefit derived by Xcel Energy for its investment in NRG is dependent upon various factors, including certain

factors that may be affected by the terms of any financial restructuring agreement reached with NRG’s creditors. Similarly, the amount

and timing of tax benefits to be recorded by NRG, related to 2002 losses, is dependent on estimated future results of NRG.

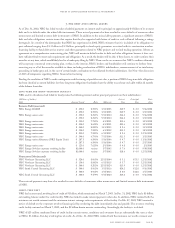

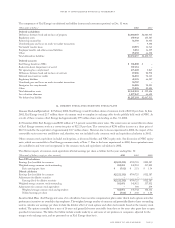

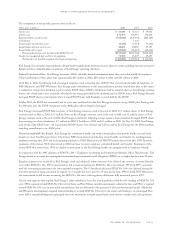

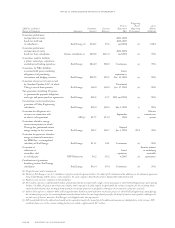

Total income tax expense from operations differs from the amount computed by applying the statutory federal income tax rate to income

before income tax expense. The reasons for the difference are:

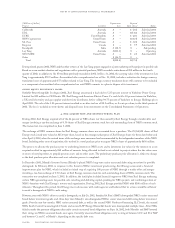

2002 2001 2000

Federal statutory rate 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit 5.6 3.6 6.0

Life insurance policies 1.1 (2.0) (2.5)

Tax credits recognized 1.5 (6.9) (10.7)

Equity income from unconsolidated affiliates 0.8 (1.7) (2.3)

Income from foreign consolidated affiliates 1.8 (6.0) 1.8

Regulatory differences – utility plant items (0.5) 1.9 2.4

Valuation allowance (46.8) 5.8 –

Xcel Energy tax benefit on NRG 30.7 ––

Nondeductible merger costs –– 3.1

Other – net (1.9) (0.5 ) 2.9

Total effective income tax rate 27.3 29.2 35.7

Extraordinary item –(0.4) 1.0

Effective income tax rate from continuing operations 27.3% 28.8% 36.7%

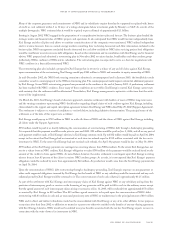

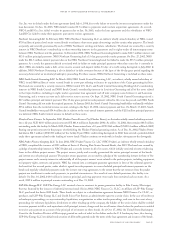

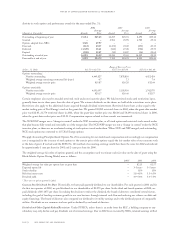

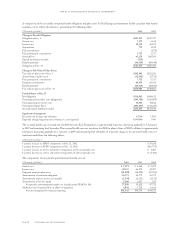

Income taxes comprise the following expense (benefit) items:

(Thousands of dollars) 2002 2001 2000

Current federal tax expense $ 114,273 $373,710 $205,472

Current state tax expense 21,724 26,927 63,428

Current foreign tax expense 18,973 10,988 1,693

Current tax credits (18,067) (66,179) (71,270)

Deferred federal tax expense (631,468) (24,323) 103,033

Deferred state tax expense (114,486) 18,702 12,547

Deferred foreign tax expense (2,248) 4,529 (578)

Deferred investment tax credits (16,686) (12,983) (15,295)

Income tax expense (benefit) excluding extraordinary items (627,985) 331,371 299,030

Tax expense (benefit) on extraordinary items –4,807 (8,549)

Total income tax expense from continuing operations $(627,985) $336,178 $290,481

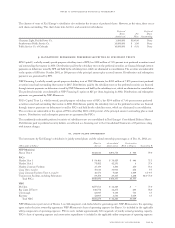

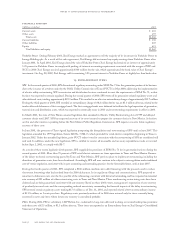

As of Dec. 31, 2001, Xcel Energy management intended to reinvest the earnings of NRG’s foreign operations to the extent the earnings

were subject to current U.S. income taxes. Accordingly, U.S. income taxes and foreign withholding taxes were not provided on a cumulative

amount of unremitted earnings of foreign subsidiaries of approximately $345 million at Dec. 31, 2001. As of Dec. 31, 2002, Xcel Energy

management has revised its strategy and no longer intends to indefinitely reinvest the full amount of earnings of NRG’s foreign operations.

However, no U.S. income tax benefit has been provided on the cumulative amount of unremitted losses of $339.7 million at Dec. 31, 2002,

due to the uncertainty of realization.

Xcel Energy management intends to indefinitely reinvest the earnings of the Argentina operations of Xcel Energy International and,

therefore, has not provided deferred taxes for the effects of currency devaluations.

page 70 xcel energy inc. and subsidiaries

notes to consolidated financial statements