Westjet 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

292006 | WestJet Annual Report

ACCOUNTING POLICIES AND

CRITICAL ACCOUNTING ESTIMATES

Critical accounting estimates are defi ned as those that require

us to make assumptions about matters that are highly uncertain

at the time the accounting estimates are made, and could

potentially result in materially different results under different

assumptions and conditions. For further discussion of these

and other accounting policies we follow, see Note 1 to our

consolidated fi nancial statements.

We have identifi ed the following areas that contain critical

accounting estimates utilized in the preparation of our fi nancial

statements:

PROPERTY AND EQUIPMENT

We make estimates about the expected useful lives, projected

residual values, lease-return conditions and the potential for

impairment of our property and equipment. In estimating the

lives and expected residual values of our fl eet, we rely upon

annual independent appraisals, recommendations from Boeing

and actual experience with the same aircraft types. Revisions

to the estimates for our fl eet can be caused by changes in the

utilization of the aircraft or changing market prices of used

aircraft of the same type. We evaluate our estimates and

potential impairment on all property and equipment annually

and when events and circumstances indicate that the assets

may be impaired.

NON-REFUNDABLE GUEST CREDITS

We also make estimates in accounting for our liability related

to certain types of non-refundable guest credits. We may issue

future travel credits related to guest compensation for fl ight

delays, missing baggage and other inconveniences as a gesture

of good faith. These types of credits are non-refundable and

expire one year from the date of issue. We record a liability

based on the estimated incremental cost of a one-way fl ight in

the period the credit is issued. The utilization of guest credits is

recorded as revenue when the guest has fl own or upon expiry.

DEFERRED SALES AND MARKETING COSTS

We defer sales and marketing costs related to advanced ticket

sales, we estimate the amount to defer based on the proportion

of advanced ticket sales to total bookings on an annualized

basis. This amount is included on our balance sheet in prepaid

expenses.

RIAZ VERJEE

Customer Service Agent

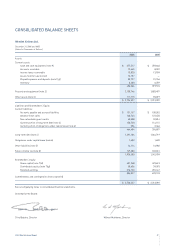

Through our cautious fi nancial

management, we have maintained

one of the most favourable balance

sheets in the airline industry.