Westjet 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192006 | WestJet Annual Report

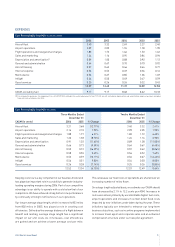

EXPENSES

Cost Per Available Seat Mile (CASM) (IN CENTS)

2006 2005 2004 2003 2002

Aircraft fuel 3.40 3.32 2.69 2.27 2.40

Airport operations 2.09 2.05 1.94 1.78 1.90

Flight operations and navigational charges 1.83 1.72 1.66 1.53 1.63

Sales and marketing 1.24 1.16 0.95 0.84 0.96

Depreciation and amortization(1) 0.89 1.00 0.88 0.92 1.13

General and administration 0.64 0.67 0.70 0.70 0.92

Aircraft leasing 0.57 0.62 0.46 0.64 0.77

Interest expense 0.56 0.52 0.49 0.36 0.16

Maintenance 0.56 0.67 0.85 1.06 1.69

Infl ight 0.54 0.50 0.49 0.47 0.59

Guest services 0.25 0.26 0.26 0.32 0.43

12.57 12.49 11.37 10.89 12.58

CASM, excluding fuel 9.17 9.17 8.68 8.62 10.18

(1) For comparative purposes, the impairment loss of $47,577,000, related to the early replacement of our 737-200 aircraft, included in depreciation and amortization expense has been excluded

from unit-cost calculations for 2004.

Cost Per Available Seat Mile (IN CENTS)

Three Months Ended Twelve Months Ended

December 31 December 31

CASM (in cents) 2006 2005 % Change 2006 2005 % Change

Aircraft fuel 3.21 3.68 (12.77%) 3.40 3.32 2.41%

Airport operations 2.14 2.10 1.90% 2.09 2.05 1.95%

Flight operations and navigational charges 1.88 1.77 6.21% 1.83 1.72 6.40%

Sales and marketing 1.26 1.38 (8.70%) 1.24 1.16 6.90%

Depreciation and amortization 0.91 1.03 (11.65%) 0.89 1.00 (11.00%)

General and administration 0.66 0.73 (9.59%) 0.64 0.67 (4.48%)

Aircraft leasing 0.53 0.72 (26.39%) 0.57 0.62 (8.06%)

Interest expense 0.58 0.55 5.45% 0.56 0.52 7.69%

Maintenance 0.53 0.59 (10.17%) 0.56 0.67 (16.42%)

Infl ight 0.56 0.51 9.80% 0.54 0.50 8.00%

Guest services 0.26 0.28 (7.14%) 0.25 0.26 (3.85%)

12.52 13.34 (6.15%) 12.57 12.49 0.64%

Keeping costs low is a key component of our business model and

has played an important role in our ability to generate industry-

leading operating margins during 2006. Part of our competitive

advantage is our ability to operate with costs below that of our

competitors. We have achieved strong bottom-line performance

by continually striving for effi ciencies in our operations.

Our longer average stage length, which increased to 833 miles

from 802 miles in 2005, has played a role in creating cost

effi ciencies. Defi ned as the average distance of a fl ight between

takeoff and landing, average stage length has a signifi cant

impact on our unit costs. As it increases, cost effi ciencies

are gained and we achieve a lower average cost per mile.

This is because our fi xed costs of operations are shared over an

increasing number of miles fl own.

On a stage length adjusted basis, we estimate our CASM should

have decreased by 2.1% to 12.2 cents per ASM. Increases in

costs were driven primarily by uncontrollable higher fuel costs,

airport operations and increases in certain direct fi xed costs

impacted by new initiatives undertaken during the year. These

initiatives typically are intended to enhance our long-term

business objectives, such as incentive programs implemented

to increase travel agent and corporate sales and an enhanced

compensation structure under our new pilot agreement.